Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Vinamilk has the following information at the end of the year 2019: Total dividends $21,460; beta 0.91; 6,500 shares outstanding; current market price is

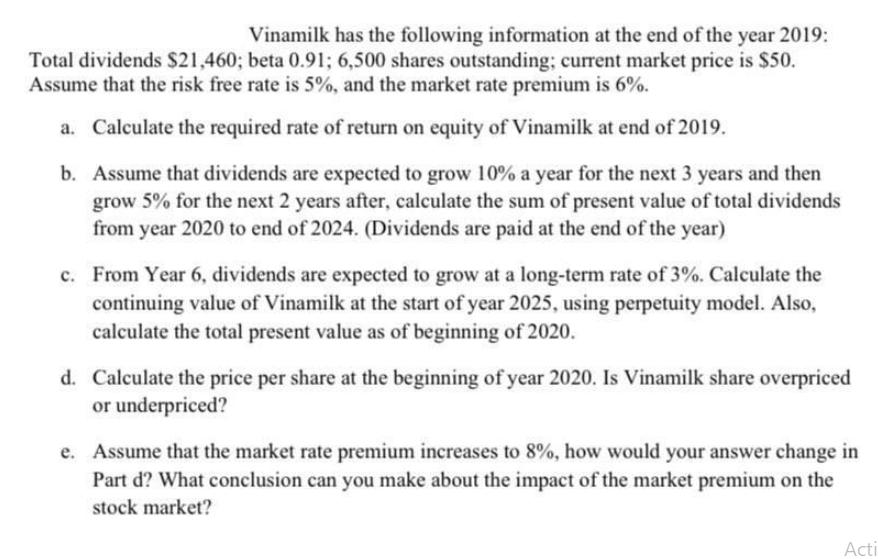

Vinamilk has the following information at the end of the year 2019: Total dividends $21,460; beta 0.91; 6,500 shares outstanding; current market price is $50. Assume that the risk free rate is 5%, and the market rate premium is 6%. a. Calculate the required rate of return on equity of Vinamilk at end of 2019. b. Assume that dividends are expected to grow 10% a year for the next 3 years and then grow 5% for the next 2 years after, calculate the sum of present value of total dividends from year 2020 to end of 2024. (Dividends are paid at the end of the year) c. From Year 6, dividends are expected to grow at a long-term rate of 3%. Calculate the continuing value of Vinamilk at the start of year 2025, using perpetuity model. Also, calculate the total present value as of beginning of 2020. d. Calculate the price per share at the beginning of year 2020. Is Vinamilk share overpriced or underpriced? e. Assume that the market rate premium increases to 8%, how would your answer change in Part d? What conclusion can you make about the impact of the market premium on the stock market? Acti

Step by Step Solution

★★★★★

3.34 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

To solve this problem we need to follow the steps and provide the answers for each part a Calculate the required rate of return on equity of Vinamilk ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started