Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Vince Lupino works for Best Supplies Company, which pays its employees time and a half for all hours worked in excess of 40 hours

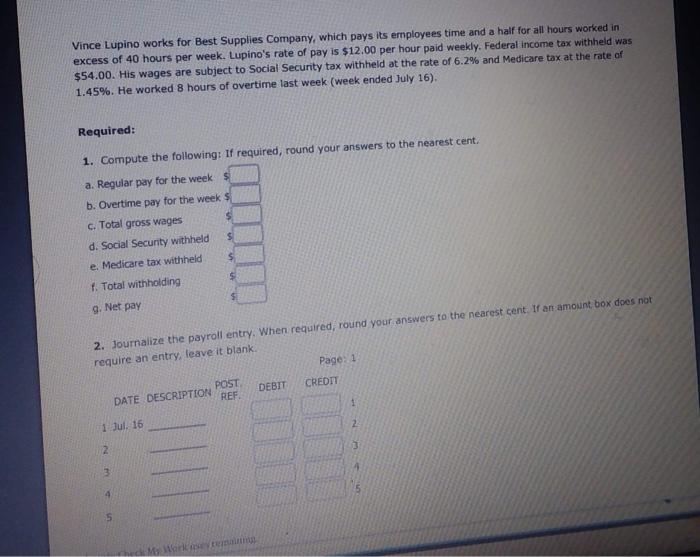

Vince Lupino works for Best Supplies Company, which pays its employees time and a half for all hours worked in excess of 40 hours per week. Lupino's rate of pay is $12.00 per hour paid weekly. Federal income tax withheld was $54.00. His wages are subject to Social Security tax withheld at the rate of 6.2% and Medicare tax at the rate of 1.45%. He worked 8 hours of overtime last week (week ended July 16). Required: 1. Compute the following: If required, round your answers to the nearest cent. a. Regular pay for the week S b. Overtime pay for the week $ c. Total gross wages d. Social Security withheld e. Medicare tax withheld f. Total withholding g. Net pay 2. Journalize the payroll entry. When required, round your answers to the nearest cent. If an amount box does not require an entry, leave it blank. 1 2 DATE DESCRIPTION Jul. 16 me in 3 $ $ 4 POST REF. DEBIT E II Check My Work sey remaining Page: 1 CREDIT 1 2 3 4

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Part 1 Solution Computation of Net Pay a Regular pay for ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started