Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Vineyard Ltd issued 100 share options to each of their 500 employees on 1 January 2020. The following conditions are applicable to the share

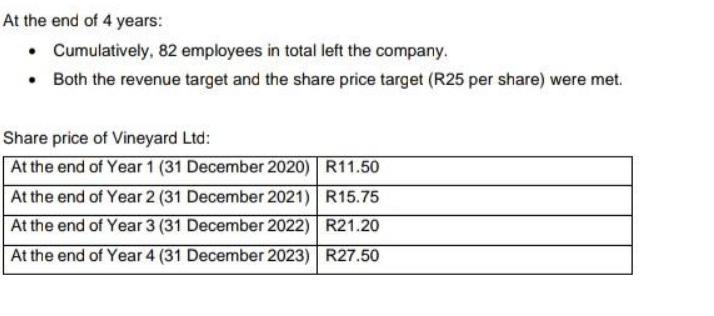

Vineyard Ltd issued 100 share options to each of their 500 employees on 1 January 2020. The following conditions are applicable to the share options: The employee receiving the share option must still be employed by the company after 4 years. At the end of the four years, the revenue of the company must have increased by at least 15% in each of the four years. The share price must reach R25 per share before the options can vest. The share options have a fair value of R12 on the grant date. The directors of Vineyard Ltd decided that they will settle all vested options in cash on the vesting date. The exercise price is R8 and the exercise date is 31 January 2024. At the end of 3 years: Cumulatively, 46 employees left the company and at that time, a further 32 employees were expected to leave in the 4th year of the vesting period. It was probable that the revenue target would be met. The share price, however, did not reach R25 and did not look probable to reach it by the end of the vesting period.

Step by Step Solution

★★★★★

3.47 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

1a A market performance condition is a type of condition attached to share options or other equitybased compensation plans It depends on the performan...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started