Answered step by step

Verified Expert Solution

Question

1 Approved Answer

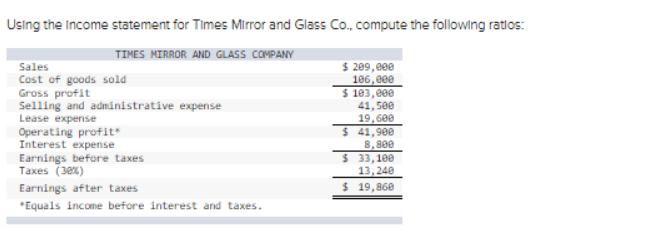

Using the income statement for Times Mirror and Glass Co., compute the following ratios: TIMES MIRROR AND GLASS COMPANY Sales Cost of goods sold

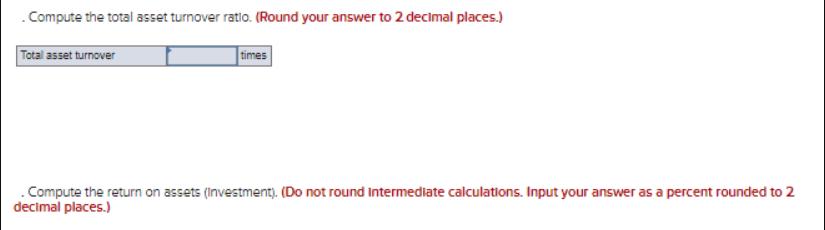

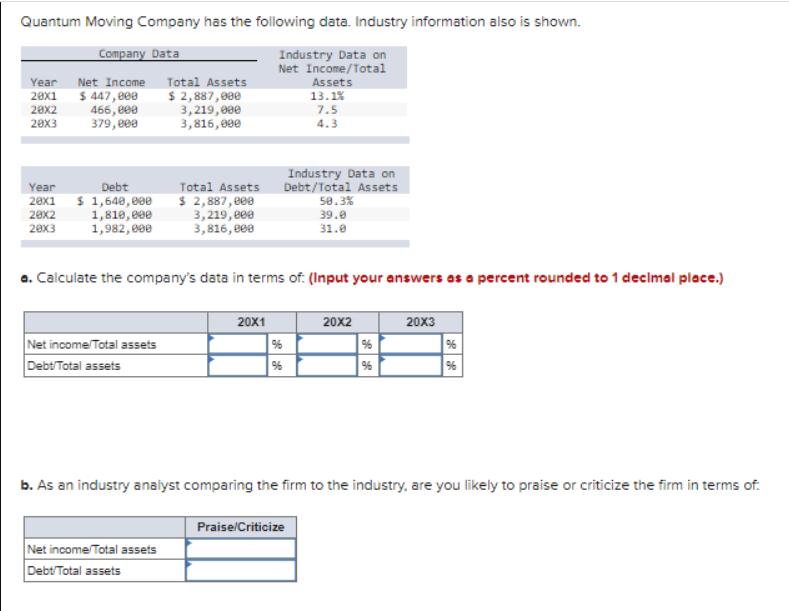

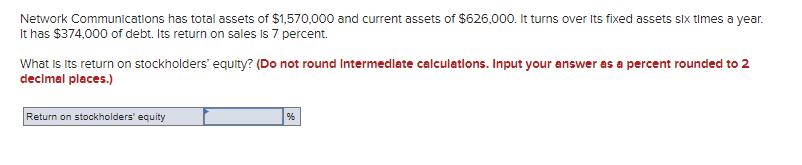

Using the income statement for Times Mirror and Glass Co., compute the following ratios: TIMES MIRROR AND GLASS COMPANY Sales Cost of goods sold Gross profit Selling and administrative expense Lease expense Operating profit" Interest expense Earnings before taxes Taxes (38%) Earnings after taxes *Equals income before interest and taxes. $ 209,000 106,000 $ 103,000 41,500 19,600 41,900 8,800 33,100 13,240 $ 19,868 $ $ . Compute the total asset turnover ratio. (Round your answer to 2 decimal places.) Total asset turnover times . Compute the return on assets (Investment). (Do not round Intermediate calculations. Input your answer as a percent rounded to 2 decimal places.) Quantum Moving Company has the following data. Industry information also is shown. Company Data Industry Data on Net Income/Total Year Net Income 20x1 $ 447,000 28x2 466,000 379,000 20x3 Year 20x1 20x2 20x3 Debt $ 1,640,000 1,810,000 1,982,000 Net income/Total assets Debt/Total assets Total Assets $ 2,887,000 3,219,000 3,816,000 Total Assets $ 2,887,000 3,219,000 3,816,000 Net income Total assets Debt/Total assets a. Calculate the company's data in terms of: (Input your answers as a percent rounded to 1 decimal place.) 20X1 Industry Data on Debt/Total Assets 58.3% 39.0 31.0 Assets 13.1% 7.5 4.3 %6 96 Praise/Criticize 20x2 %6 % 20x3 b. As an industry analyst comparing the firm to the industry, are you likely to praise or criticize the firm in terms of. % Network Communications has total assets of $1,570,000 and current assets of $626,000. It turns over Its fixed assets six times a year. It has $374,000 of debt. Its return on sales is 7 percent. What is its return on stockholders' equity? (Do not round Intermediate calculations. Input your answer as a percent rounded to 2 decimal places.) Return on stockholders' equity %

Step by Step Solution

★★★★★

3.36 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

a Times interest earned Income before interest and taxes Interest 419008800 4...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started