Answered step by step

Verified Expert Solution

Question

1 Approved Answer

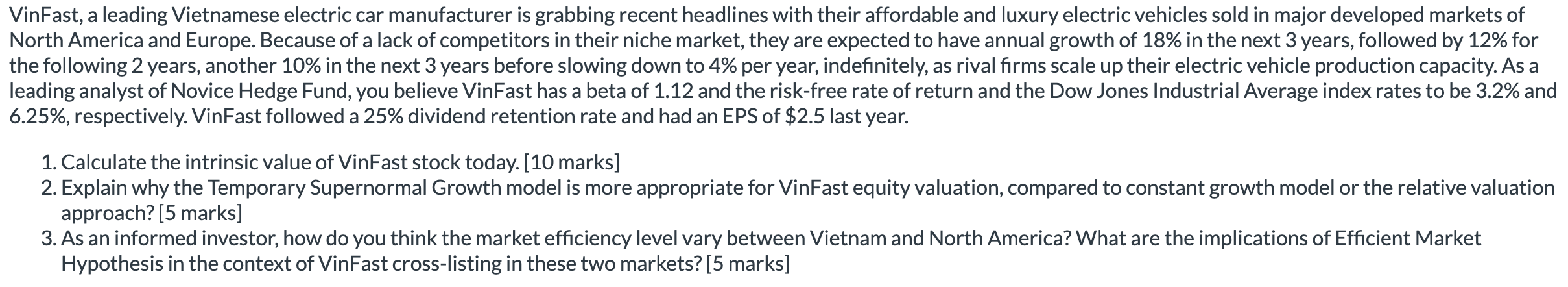

VinFast, a leading Vietnamese electric car manufacturer is grabbing recent headlines with their affordable and luxury electric vehicles sold in major developed markets of North

VinFast, a leading Vietnamese electric car manufacturer is grabbing recent headlines with their affordable and luxury electric vehicles sold in major developed markets of

North America and Europe. Because of a lack of competitors in their niche market, they are expected to have annual growth of in the next years, followed by for

the following years, another in the next years before slowing down to per year, indefinitely, as rival firms scale up their electric vehicle production capacity. As a

leading analyst of Novice Hedge Fund, you believe VinFast has a beta of and the riskfree rate of return and the Dow Jones Industrial Average index rates to be and

respectively. VinFast followed a dividend retention rate and had an EPS of $ last year.

Calculate the intrinsic value of VinFast stock today. marks

Explain why the Temporary Supernormal Growth model is more appropriate for VinFast equity valuation, compared to constant growth model or the relative valuation

approach? marks

As an informed investor, how do you think the market efficiency level vary between Vietnam and North America? What are the implications of Efficient Market

Hypothesis in the context of VinFast crosslisting in these two markets? marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started