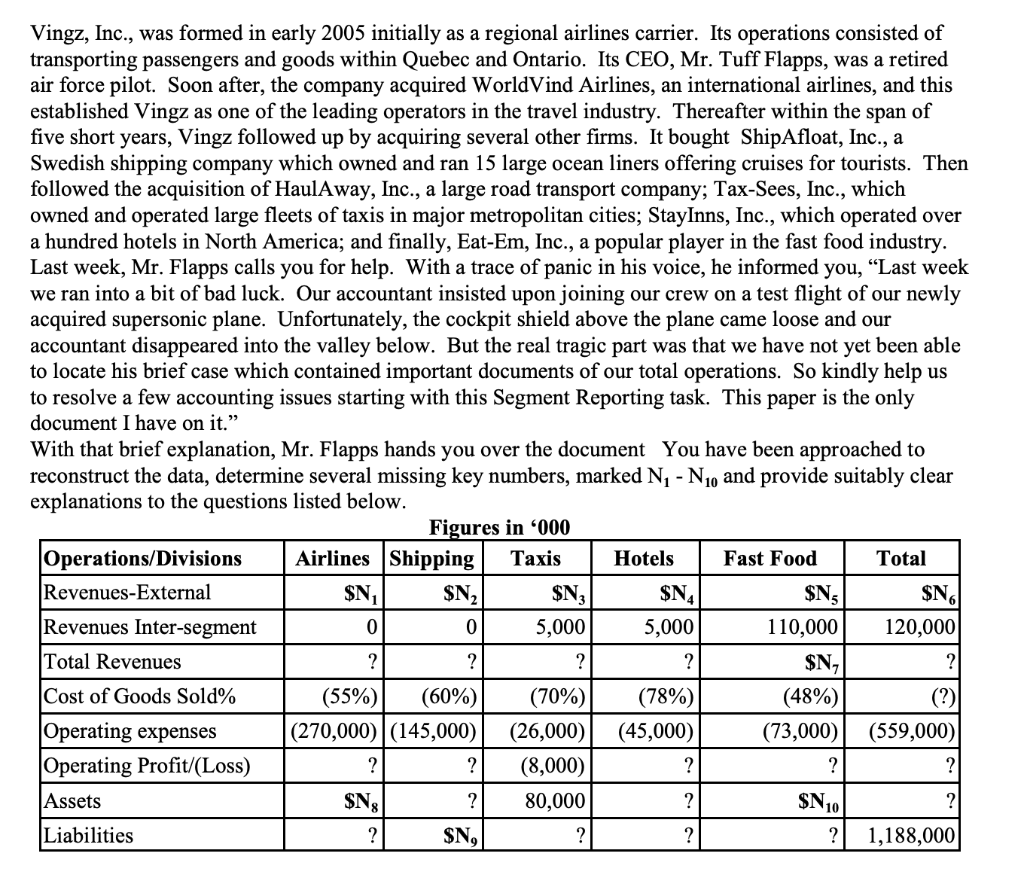

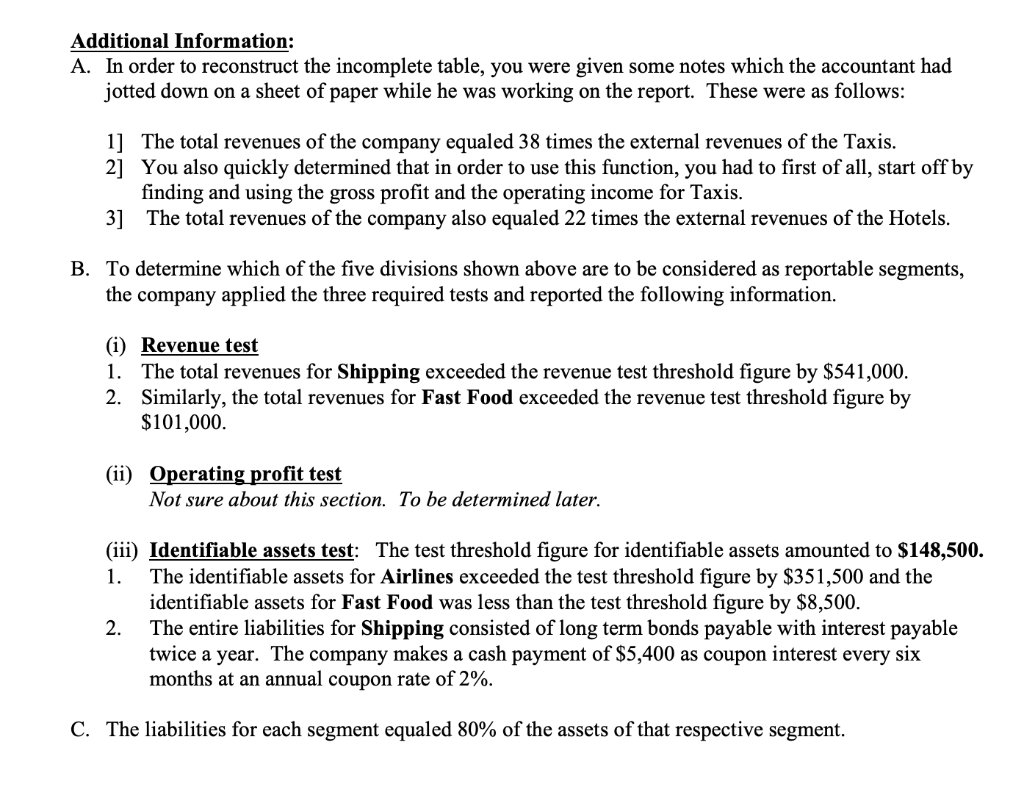

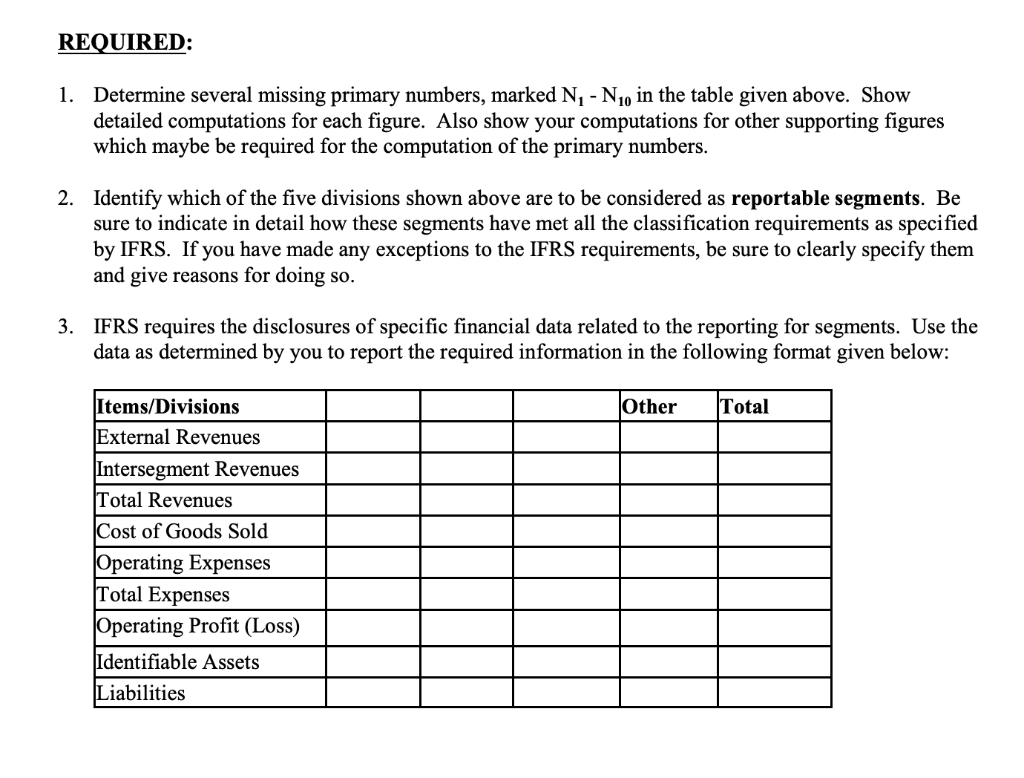

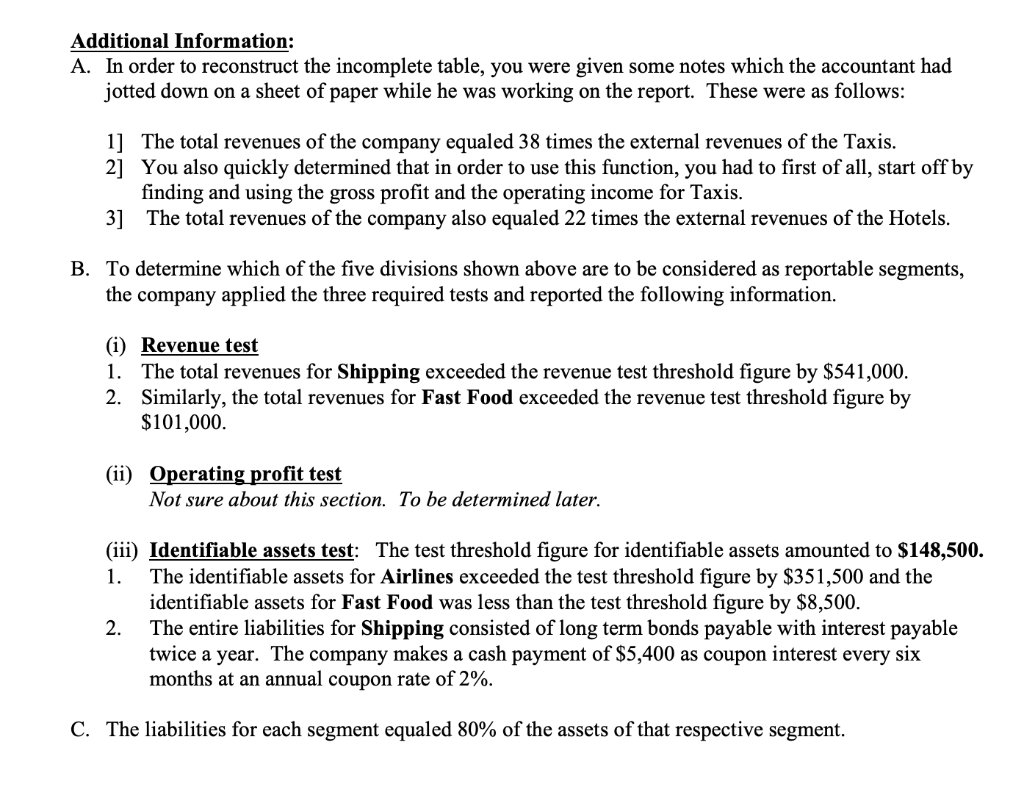

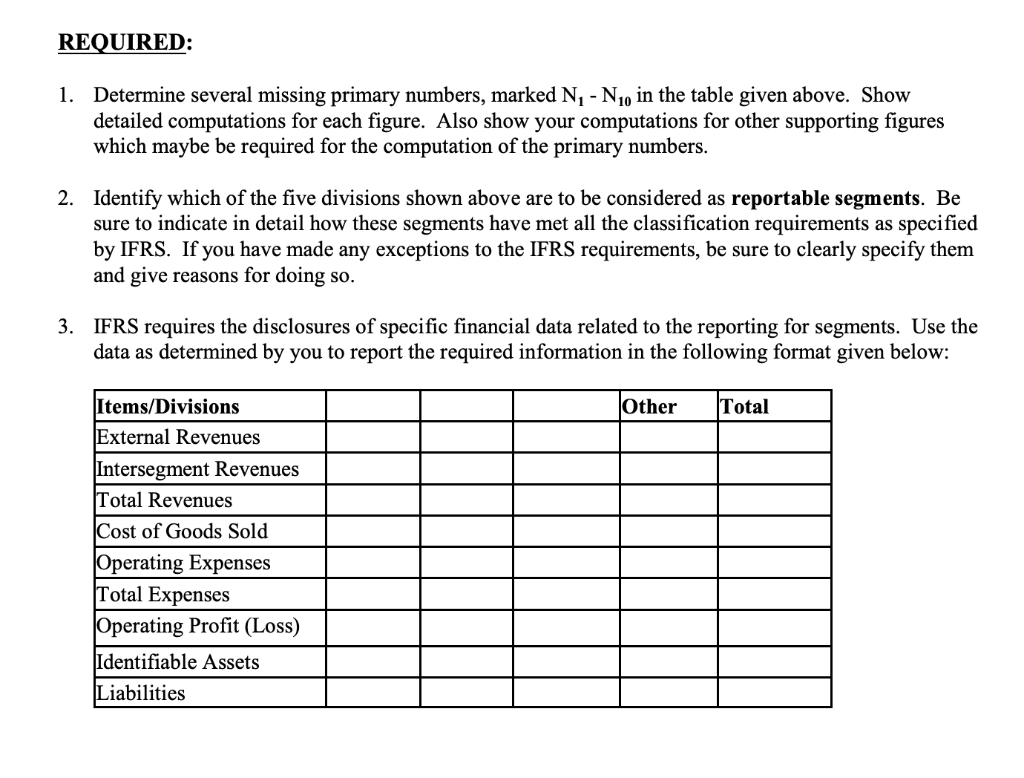

Vingz, Inc., was formed in early 2005 initially as a regional airlines carrier. Its operations consisted of transporting passengers and goods within Quebec and Ontario. Its CEO, Mr. Tuff Flapps, was a retired air force pilot. Soon after, the company acquired WorldVind Airlines, an international airlines, and this established Vingz as one of the leading operators in the travel industry. Thereafter within the span of five short years, Vingz followed up by acquiring several other firms. It bought ShipAfloat, Inc., a Swedish shipping company which owned and ran 15 large ocean liners offering cruises for tourists. Then followed the acquisition of HaulAway, Inc., a large road transport company; Tax-Sees, Inc., which owned and operated large fleets of taxis in major metropolitan cities; StayInns, Inc., which operated over a hundred hotels in North America; and finally, Eat-Em, Inc., a popular player in the fast food industry. Last week, Mr. Flapps calls you for help. With a trace of panic in his voice, he informed you, Last week we ran into a bit of bad luck. Our accountant insisted upon joining our crew on a test flight of our newly acquired supersonic plane. Unfortunately, the cockpit shield above the plane came loose and our accountant disappeared into the valley below. But the real tragic part was that we have not yet been able to locate his brief case which contained important documents of our total operations. So kindly help us to resolve a few accounting issues starting with this Segment Reporting task. This paper is the only document I have on it. With that brief explanation, Mr. Flapps hands you over the document You have been approached to reconstruct the data, determine several missing key numbers, marked N, -N and provide suitably clear explanations to the questions listed below. Figures in '000 Operations/Divisions Airlines Shipping Taxis Hotels Fast Food Total Revenues-External $N, $N2 N3 $N $NG| $NG Revenues Inter-segment 0 0 5,000 5,000 110,000 120,000 Total Revenues ? ? $N, Cost of Goods Sold% (55%) (60%) (70%) (78%) (48%) (?) Operating expenses (270,000)|(145,000) (26,000)| (45,000) (73,000) (559,000) Operating Profit/(Loss) ? (8,000) ? Assets $N ? 80,000 ? $N10 Liabilities ? $N, ? 1,188,000 ? ? Additional Information: A. In order to reconstruct the incomplete table, you were given some notes which the accountant had jotted down on a sheet of paper while he was working on the report. These were as follows: 1] The total revenues of the company equaled 38 times the external revenues of the Taxis. 2] You also quickly determined that in order to use this function, you had to first of all, start off by finding and using the gross profit and the operating income for Taxis. 3] The total revenues of the company also equaled 22 times the external revenues of the Hotels. B. To determine which of the five divisions shown above are to be considered as reportable segments, the company applied the three required tests and reported the following information. 1. (i) Revenue test The total revenues for Shipping exceeded the revenue test threshold figure by $541,000. 2. Similarly, the total revenues for Fast Food exceeded the revenue test threshold figure by $101,000. (ii) Operating profit test Not sure about this section. To be determined later. (iii) Identifiable assets test: The test threshold figure for identifiable assets amounted to $148,500. 1. The identifiable assets for Airlines exceeded the test threshold figure by $351,500 and the identifiable assets for Fast Food was less than the test threshold figure by $8,500. 2. The entire liabilities for Shipping consisted of long term bonds payable with interest payable twice a year. The company makes a cash payment of $5,400 as coupon interest every six months at an annual coupon rate of 2%. C. The liabilities for each segment equaled 80% of the assets of that respective segment. REQUIRED: 1. Determine several missing primary numbers, marked N-N10 in the table given above. Show detailed computations for each figure. Also show your computations for other supporting figures which maybe be required for the computation of the primary numbers. Identify which of the five divisions shown above are to be considered as reportable segments. Be sure to indicate in detail how these segments have met all the classification requirements as specified by IFRS. If you have made any exceptions to the IFRS requirements, be sure to clearly specify them and give reasons for doing so. 3. IFRS requires the disclosures of specific financial data related to the reporting for segments. Use the data as determined by you to report the required information in the following format given below: Other Total Items/Divisions External Revenues Intersegment Revenues Total Revenues Cost of Goods Sold Operating Expenses Total Expenses Operating Profit (Loss) Identifiable Assets Liabilities