Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Violet Company has sales of $452,000, net operating income of $244,000, average invested assets of $808,000, and a hurdle rate of 9.25 percent. Calculate Violet's

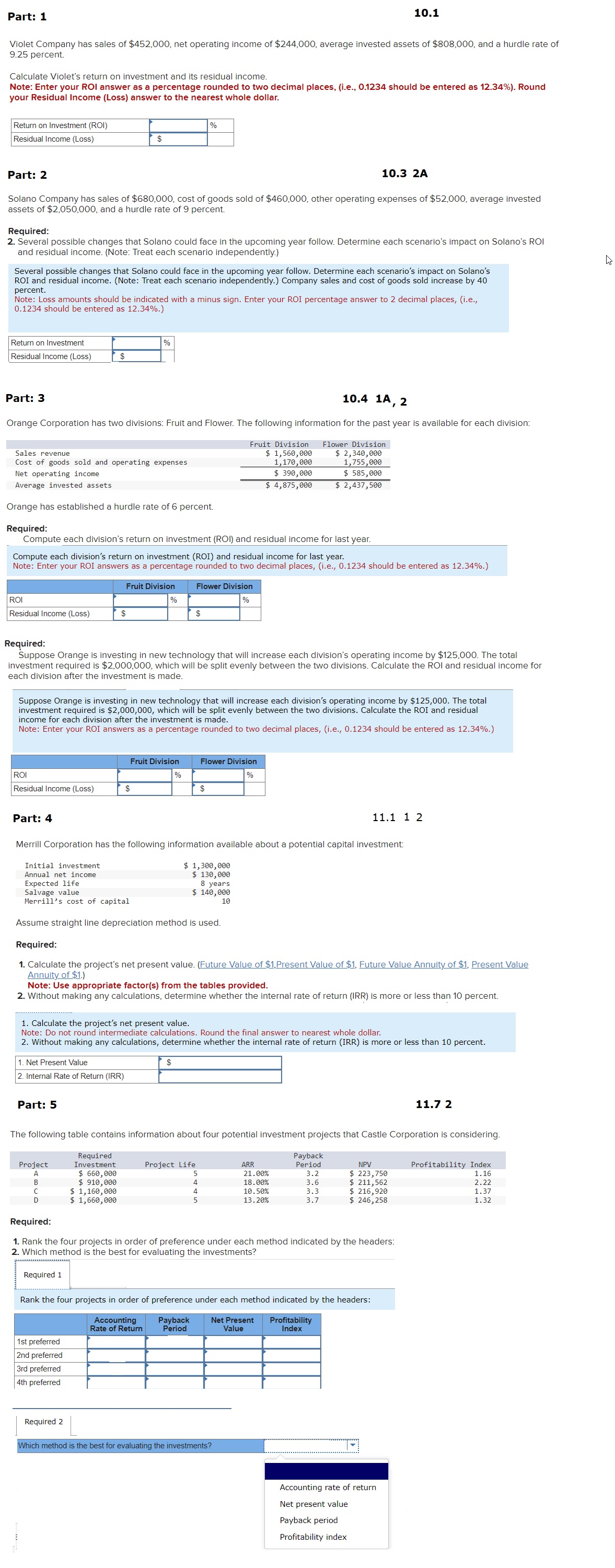

Violet Company has sales of $452,000, net operating income of $244,000, average invested assets of $808,000, and a hurdle rate of 9.25 percent. Calculate Violet's return on investment and its residual income. Note: Enter your ROI answer as a percentage rounded to two decimal places, (i.e., 0.1234 should be entered as 12.34% ). Round your Residual Income (Loss) answer to the nearest whole dollar. Part: 2 10.32A Solano Company has sales of $680,000, cost of goods sold of $460,000, other operating expenses of $52,000, average invested assets of $2,050,000, and a hurdle rate of 9 percent Required: 2. Several possible changes that Solano could face in the upcoming year follow. Determine each scenario's impact on Solano's ROI and residual income. (Note: Treat each scenario independently.) Several possible changes that Solano could face in the upcoming year follow. Determine each scenario's impact on Solano's ROI and residual income. (Note: Treat each scenario independently.) Company sales and cost of goods sold increase by 40 percent. Note: Loss amounts should be indicated with a minus sign. Enter your ROI percentage answer to 2 decimal places, (i.e., 0.1234 should be entered as 12.34%.) Return on Investment Residual Income (Loss) Part: 3 10.41A,2 Orange Corporation has two divisions: Fruit and Flower. The following information for the past year is available for each division: Urange has established a hurdle rate of 6 percent. Required: Compute each division's return on investment (ROI) and residual income for last year. Compute each division's return on investment (ROI) and residual income for last year. Note: Enter your ROI answers as a percentage rounded to two decimal places, (i.e., 0.1234 should be entered as 12.34%.) Required: Suppose Orange is investing in new technology that will increase each division's operating income by $125,000. The total investment required is $2,000,000, which will be split evenly between the two divisions. Calculate the ROI and residual income for each division after the investment is made. Suppose Orange is investing in new technology that will increase each division's operating income by $125,000. The total investment required is $2,000,000, which will be split evenly between the two divisions. Calculate the ROI and residual income for each division after the investment is made. Note: Enter your ROI answers as a percentage rounded to two decimal places, (i.e., 0.1234 should be entered as 12.34%.) Part: 4 11.112 Merrill Corporation has the following information available about a potential capital investment: Assume straight line depreciation method is used. Required: 1. Calculate the project's net present value. (Future Value of $1,Present Value of $1, Future Value Annuity of $1, Present Value Annuity of $1.) Note: Use appropriate factor(s) from the tables provided. 2. Without making any calculations, determine whether the internal rate of return (IRR) is more or less than 10 percent 1. Calculate the project's net present value. Note: Do not round intermediate calculations. Round the final answer to nearest whole dollar. 2. Without making any calculations, determine whether the internal rate of return (IRR) is more or less than 10 percent. Part: 5 11.72 The following table contains information about four potential investment projects that Castle Corporation is considering. Required: 1. Rank the four projects in order of preference under each method indicated by the headers: 2. Which method is the best for evaluating the investments? Rank the four projects in order of preference under each method indicated by the headers

Violet Company has sales of $452,000, net operating income of $244,000, average invested assets of $808,000, and a hurdle rate of 9.25 percent. Calculate Violet's return on investment and its residual income. Note: Enter your ROI answer as a percentage rounded to two decimal places, (i.e., 0.1234 should be entered as 12.34% ). Round your Residual Income (Loss) answer to the nearest whole dollar. Part: 2 10.32A Solano Company has sales of $680,000, cost of goods sold of $460,000, other operating expenses of $52,000, average invested assets of $2,050,000, and a hurdle rate of 9 percent Required: 2. Several possible changes that Solano could face in the upcoming year follow. Determine each scenario's impact on Solano's ROI and residual income. (Note: Treat each scenario independently.) Several possible changes that Solano could face in the upcoming year follow. Determine each scenario's impact on Solano's ROI and residual income. (Note: Treat each scenario independently.) Company sales and cost of goods sold increase by 40 percent. Note: Loss amounts should be indicated with a minus sign. Enter your ROI percentage answer to 2 decimal places, (i.e., 0.1234 should be entered as 12.34%.) Return on Investment Residual Income (Loss) Part: 3 10.41A,2 Orange Corporation has two divisions: Fruit and Flower. The following information for the past year is available for each division: Urange has established a hurdle rate of 6 percent. Required: Compute each division's return on investment (ROI) and residual income for last year. Compute each division's return on investment (ROI) and residual income for last year. Note: Enter your ROI answers as a percentage rounded to two decimal places, (i.e., 0.1234 should be entered as 12.34%.) Required: Suppose Orange is investing in new technology that will increase each division's operating income by $125,000. The total investment required is $2,000,000, which will be split evenly between the two divisions. Calculate the ROI and residual income for each division after the investment is made. Suppose Orange is investing in new technology that will increase each division's operating income by $125,000. The total investment required is $2,000,000, which will be split evenly between the two divisions. Calculate the ROI and residual income for each division after the investment is made. Note: Enter your ROI answers as a percentage rounded to two decimal places, (i.e., 0.1234 should be entered as 12.34%.) Part: 4 11.112 Merrill Corporation has the following information available about a potential capital investment: Assume straight line depreciation method is used. Required: 1. Calculate the project's net present value. (Future Value of $1,Present Value of $1, Future Value Annuity of $1, Present Value Annuity of $1.) Note: Use appropriate factor(s) from the tables provided. 2. Without making any calculations, determine whether the internal rate of return (IRR) is more or less than 10 percent 1. Calculate the project's net present value. Note: Do not round intermediate calculations. Round the final answer to nearest whole dollar. 2. Without making any calculations, determine whether the internal rate of return (IRR) is more or less than 10 percent. Part: 5 11.72 The following table contains information about four potential investment projects that Castle Corporation is considering. Required: 1. Rank the four projects in order of preference under each method indicated by the headers: 2. Which method is the best for evaluating the investments? Rank the four projects in order of preference under each method indicated by the headers Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started