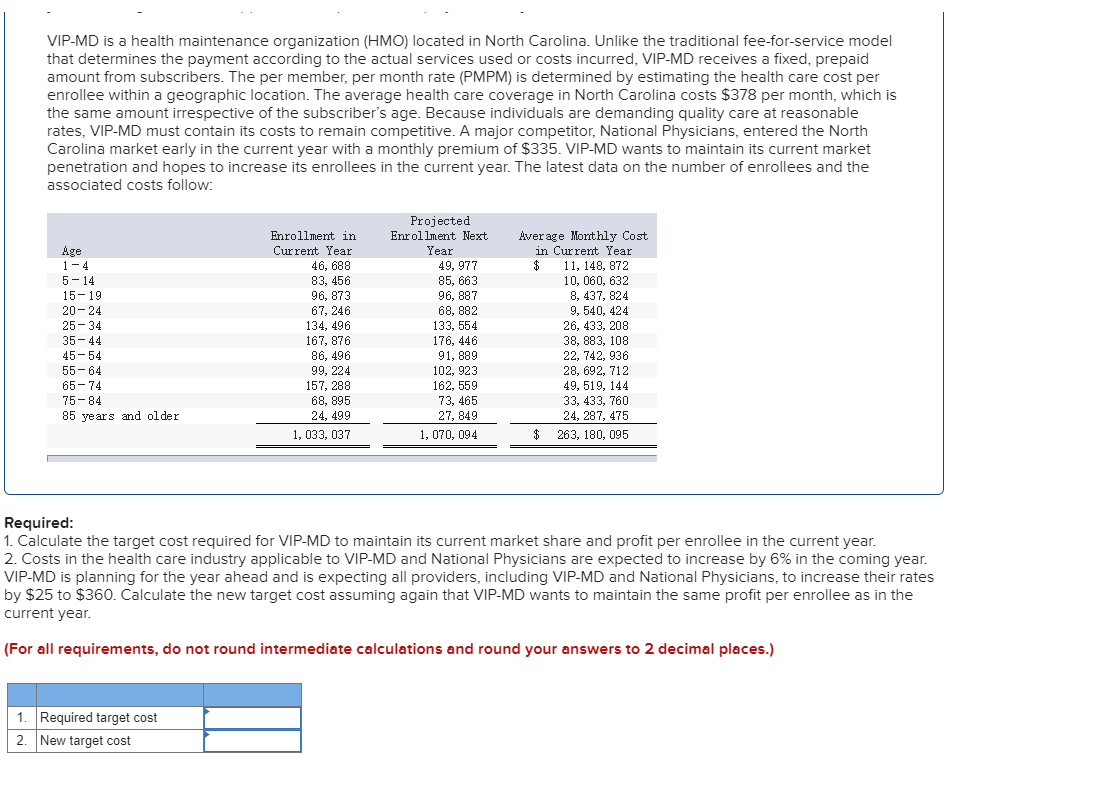

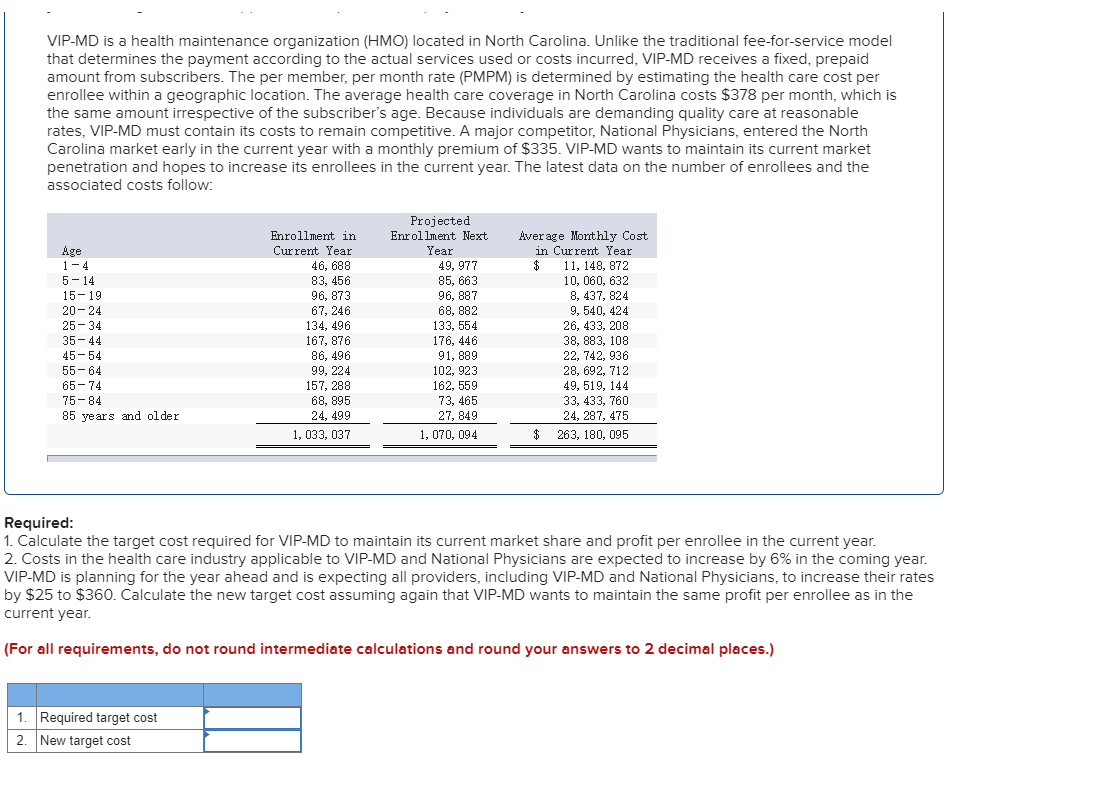

VIP-MD is a health maintenance organization (HMO) located in North Carolina. Unlike the traditional fee-for-service model that determines the payment according to the actual services used or costs incurred, VIP-MD receives a fixed, prepaid amount from subscribers. The per member, per month rate (PMPM) is determined by estimating the health care cost per enrollee within a geographic location. The average health care coverage in North Carolina costs $378 per month, which is the same amount irrespective of the subscribers age. Because individuals are demanding quality care at reasonable rates, VIP-MD must contain its costs to remain competitive. A major competitor, National Physicians, entered the North Carolina market early in the current year with a monthly premium of $335. VIP-MD wants to maintain its current market penetration and hopes to increase its enrollees in the current year. The latest data on the number of enrollees and the associated costs follow:

VIP-MD is a health maintenance organization (HMO) located in North Carolina. Unlike the traditional fee-for-service model that determines the payment according to the actual services used or costs incurred, VIP-MD receives a fixed, prepaid amount from subscribers. The per member, per month rate (PMPM) is determined by estimating the health care cost per enrollee within a geographic location. The average health care coverage in North Carolina costs $378 per month, which is the same amount irrespective of the subscriber's age. Because individuals are demanding quality care at reasonable rates, VIP-MD must contain its costs to remain competitive. A major competitor, National Physicians, entered the North Carolina market early in the current year with a monthly premium of $335. VIP-MD wants to maintain its current market penetration and hopes to increase its enrollees in the current year. The latest data on the number of enrollees and the associated costs follow Projected Enrollment in Current Year Enrollment Next Average Monthly Cost Age Year in Current Year 49, 977 11, 148, 872 10, 060, 632 8, 437, 824 9, 540, 424 26, 433, 208 1 4 46, 688 83, 456 96, 873 67, 246 5 14 15-19 20-24 25 34 35 44 45 54 85, 663 96, 887 68, 882 133, 554 176, 446 134, 496 167, 876 86, 496 99, 224 157, 288 68, 895 38, 883, 108 91, 889 22, 742, 936 28, 692, 712 49, 519, 144 33, 433, 760 24, 287, 475 102, 923 162, 559 73, 465 27, 849 55-64 65-74 75 84 85 years and older 24, 499 $ 1, 033, 037 1, 070, 094 263, 180, 095 Required: 1. Calculate the target cost required for VIP-MD to maintain its current market share and profit per enrollee in the current year. 2. Costs in the health care industry applicable to VIP-MD and National Physicians are expected to increase by 6% in the coming year. VIP-MD is planning for the year ahead and is expecting all providers, including VIP-MD and National Physicians, to increase their rates by $25 to $360. Calculate the new target cost assuming again that VIP-MD wants to maintain the same profit per enrollee as in the current year (For all requirements, do not round intermediate calculations and round your answers to 2 decimal places.) 1 Required target cost 2 New target cost VIP-MD is a health maintenance organization (HMO) located in North Carolina. Unlike the traditional fee-for-service model that determines the payment according to the actual services used or costs incurred, VIP-MD receives a fixed, prepaid amount from subscribers. The per member, per month rate (PMPM) is determined by estimating the health care cost per enrollee within a geographic location. The average health care coverage in North Carolina costs $378 per month, which is the same amount irrespective of the subscriber's age. Because individuals are demanding quality care at reasonable rates, VIP-MD must contain its costs to remain competitive. A major competitor, National Physicians, entered the North Carolina market early in the current year with a monthly premium of $335. VIP-MD wants to maintain its current market penetration and hopes to increase its enrollees in the current year. The latest data on the number of enrollees and the associated costs follow Projected Enrollment in Current Year Enrollment Next Average Monthly Cost Age Year in Current Year 49, 977 11, 148, 872 10, 060, 632 8, 437, 824 9, 540, 424 26, 433, 208 1 4 46, 688 83, 456 96, 873 67, 246 5 14 15-19 20-24 25 34 35 44 45 54 85, 663 96, 887 68, 882 133, 554 176, 446 134, 496 167, 876 86, 496 99, 224 157, 288 68, 895 38, 883, 108 91, 889 22, 742, 936 28, 692, 712 49, 519, 144 33, 433, 760 24, 287, 475 102, 923 162, 559 73, 465 27, 849 55-64 65-74 75 84 85 years and older 24, 499 $ 1, 033, 037 1, 070, 094 263, 180, 095 Required: 1. Calculate the target cost required for VIP-MD to maintain its current market share and profit per enrollee in the current year. 2. Costs in the health care industry applicable to VIP-MD and National Physicians are expected to increase by 6% in the coming year. VIP-MD is planning for the year ahead and is expecting all providers, including VIP-MD and National Physicians, to increase their rates by $25 to $360. Calculate the new target cost assuming again that VIP-MD wants to maintain the same profit per enrollee as in the current year (For all requirements, do not round intermediate calculations and round your answers to 2 decimal places.) 1 Required target cost 2 New target cost