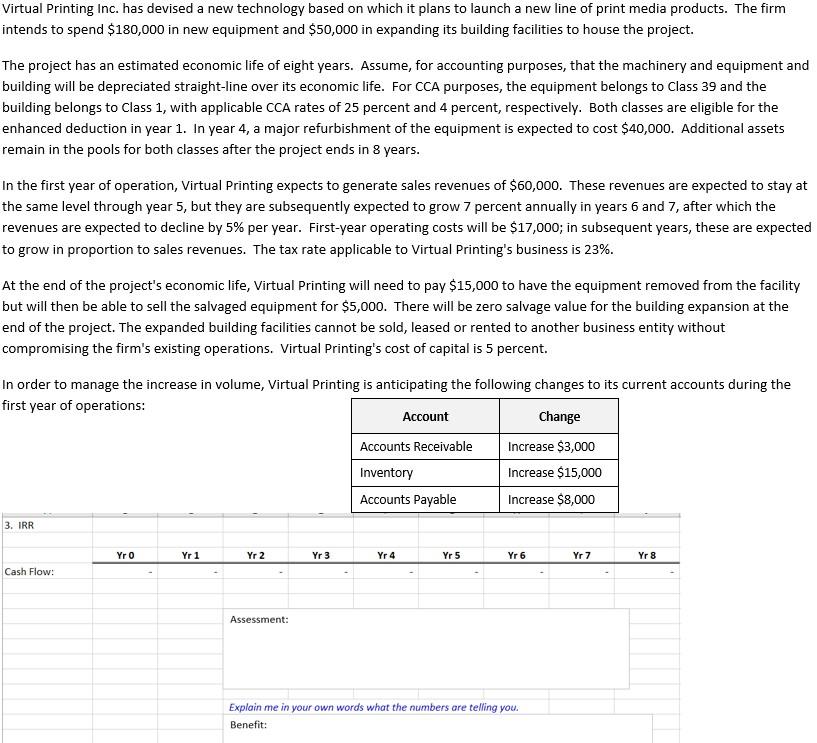

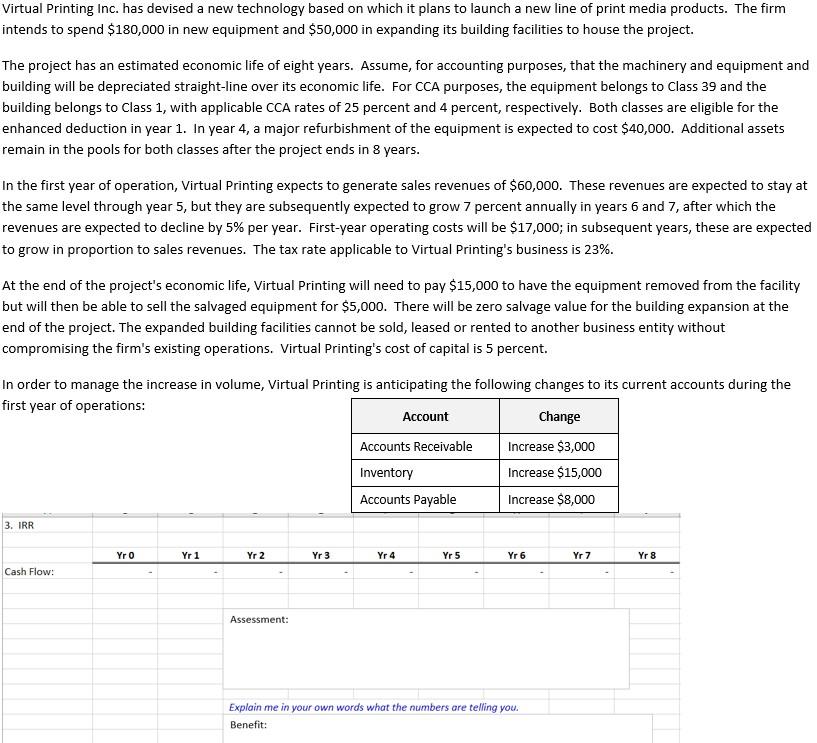

Virtual Printing Inc. has devised a new technology based on which it plans to launch a new line of print media products. The firm intends to spend $180,000 in new equipment and $50,000 in expanding its building facilities to house the project. The project has an estimated economic life of eight years. Assume, for accounting purposes, that the machinery and equipment and building will be depreciated straight-line over its economic life. For CCA purposes, the equipment belongs to Class 39 and the building belongs to Class 1, with applicable CCA rates of 25 percent and 4 percent, respectively. Both classes are eligible for the enhanced deduction in year 1. In year 4, a major refurbishment of the equipment is expected to cost $40,000. Additional assets remain in the pools for both classes after the project ends in 8 years. In the first year of operation, Virtual Printing expects to generate sales revenues of $60,000. These revenues are expected to stay at the same level through year 5, but they are subsequently expected to grow 7 percent annually in years 6 and 7, after which the revenues are expected to decline by 5% per year. First-year operating costs will be $17,000; in subsequent years, these are expected to grow in proportion to sales revenues. The tax rate applicable to Virtual Printing's business is 23%. At the end of the project's economic life, Virtual Printing will need to pay $15,000 to have the equipment removed from the facility but will then be able to sell the salvaged equipment for $5,000. There will be zero salvage value for the building expansion at the end of the project. The expanded building facilities cannot be sold, leased or rented to another business entity without compromising the firm's existing operations. Virtual Printing's cost of capital is 5 percent. In order to manage the increase in volume, Virtual Printing is anticipating the following changes to its current accounts during the first year of operations: Account Change Accounts Receivable Increase $3,000 Inventory Increase $15,000 Accounts Payable Increase $8,000 3. IRR Yr 0 Yr 1 Yr 2 Yr 3 Yr 4 Yr 5 Yr 6 Yr 7 Yr 8 Cash Flow: Assessment: Explain me in your own words what the numbers are telling you. Benefit: Virtual Printing Inc. has devised a new technology based on which it plans to launch a new line of print media products. The firm intends to spend $180,000 in new equipment and $50,000 in expanding its building facilities to house the project. The project has an estimated economic life of eight years. Assume, for accounting purposes, that the machinery and equipment and building will be depreciated straight-line over its economic life. For CCA purposes, the equipment belongs to Class 39 and the building belongs to Class 1, with applicable CCA rates of 25 percent and 4 percent, respectively. Both classes are eligible for the enhanced deduction in year 1. In year 4, a major refurbishment of the equipment is expected to cost $40,000. Additional assets remain in the pools for both classes after the project ends in 8 years. In the first year of operation, Virtual Printing expects to generate sales revenues of $60,000. These revenues are expected to stay at the same level through year 5, but they are subsequently expected to grow 7 percent annually in years 6 and 7, after which the revenues are expected to decline by 5% per year. First-year operating costs will be $17,000; in subsequent years, these are expected to grow in proportion to sales revenues. The tax rate applicable to Virtual Printing's business is 23%. At the end of the project's economic life, Virtual Printing will need to pay $15,000 to have the equipment removed from the facility but will then be able to sell the salvaged equipment for $5,000. There will be zero salvage value for the building expansion at the end of the project. The expanded building facilities cannot be sold, leased or rented to another business entity without compromising the firm's existing operations. Virtual Printing's cost of capital is 5 percent. In order to manage the increase in volume, Virtual Printing is anticipating the following changes to its current accounts during the first year of operations: Account Change Accounts Receivable Increase $3,000 Inventory Increase $15,000 Accounts Payable Increase $8,000 3. IRR Yr 0 Yr 1 Yr 2 Yr 3 Yr 4 Yr 5 Yr 6 Yr 7 Yr 8 Cash Flow: Assessment: Explain me in your own words what the numbers are telling you. Benefit