Answered step by step

Verified Expert Solution

Question

1 Approved Answer

viruses. Unless you need to edit, it's safer to stay in Protected View. Enable Editing BANK RECONCILIATION The Cash account of the Oakville Athletic Association

viruses. Unless you need to edit, it's safer to stay in Protected View. Enable Editing

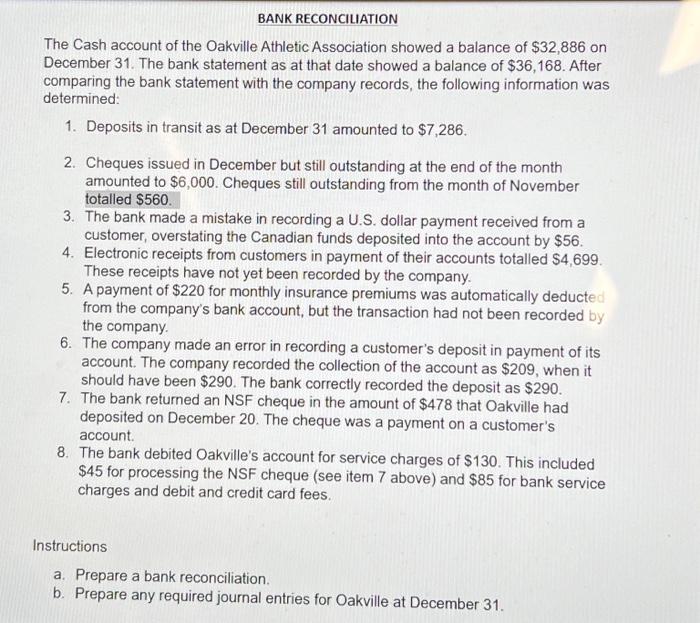

BANK RECONCILIATION

The Cash account of the Oakville Athletic Association showed a balance of $32,886 on December 31. The bank statement as at that date showed a balance of $36, 168. After comparing the bank statement with the company records, the following information was determined:

- Deposits in transit as at December 31 amounted to $7,286.

- Cheques issued in December but still outstanding at the end of the month amounted to $6,000. Cheques still outstanding from the month of November totalled $560.

- The bank made a mistake in recording a U.S. dollar payment received from a customer, overstating the Canadian funds deposited into the account by $56.

- Electronic receipts from customers in payment of their accounts totalled $4,699. These receipts have not yet been recorded by the company.

- A payment of $220 for monthly insurance premiums was automaticall deducted from the company's bank account, but the transaction had not been recorded by the company.

- The company made an error in recording a customer's deposit in payment of its account. The company recorded the collection of the account as $209, when it should have been $290. The bank correctly recorded the deposit as $290.

- The bank returned an NSF cheque in the amount of $478 that Oakville had deposited on December 20. The cheque was a payment on a customer's account.

- The bank debited Oakville's account for service charges of $130. This included

- $45 for processing the NSF cheque (see item 7 above) and $85 for bank service charges and debit and credit card fees

Instructions

- Prepare a bank reconciliation

- Prepare any required journal entries for Oakville at December 31.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started