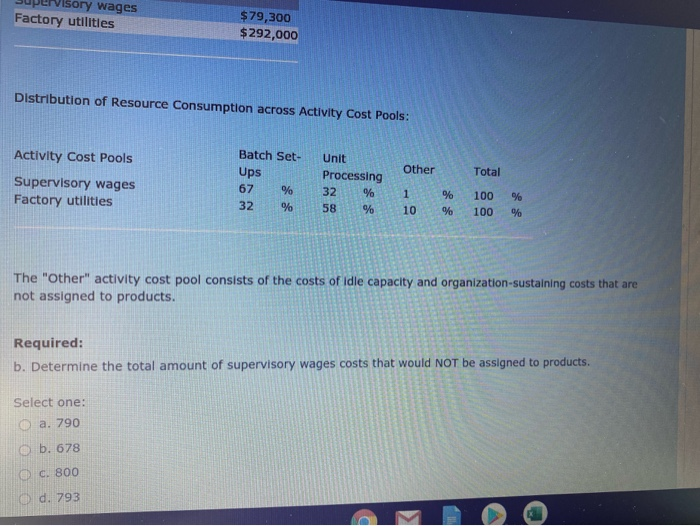

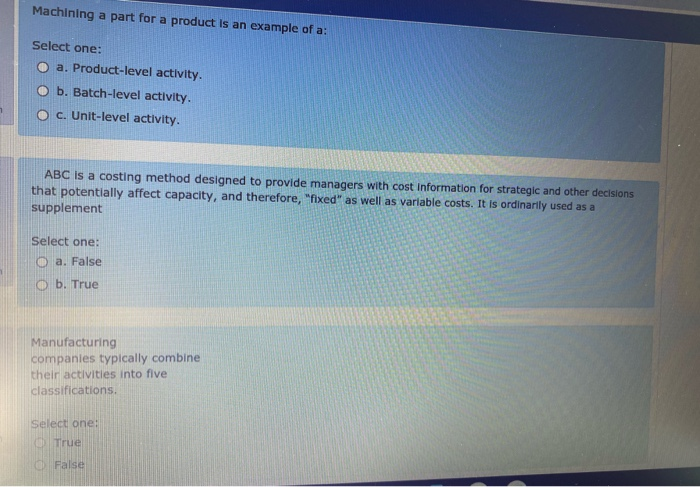

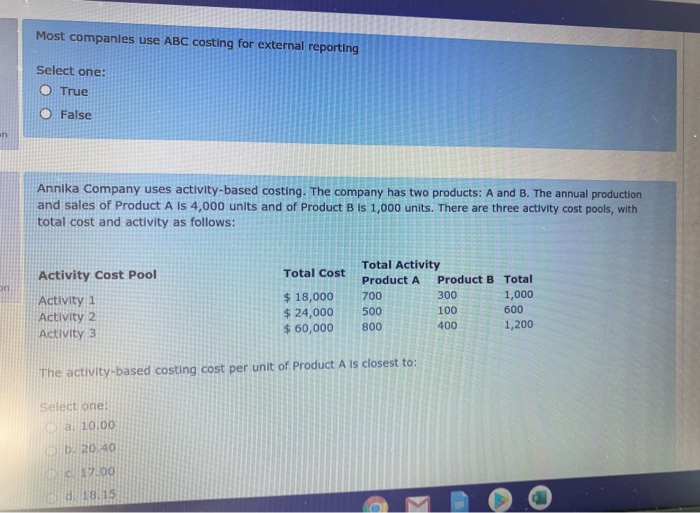

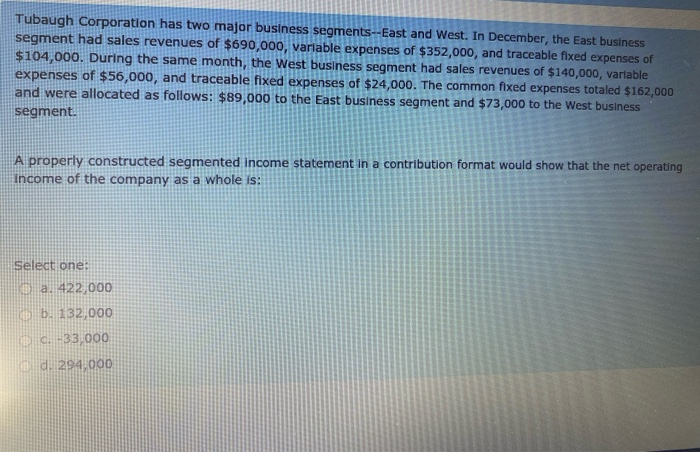

Visory wages Factory utilities $ 79,300 $ 292,000 Distribution of Resource Consumption across Activity Cost Pools: Other Activity Cost Pools Supervisory wages Factory utilities Total Batch Set- Ups 67 % 32 % Unit Processing 32 % 58 % 1 10 % % 100 100 % % The "other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs that are not assigned to products. Required: b. Determine the total amount of supervisory wages costs that would NOT be assigned to products. Select one: a. 790 b. 678 C. 800 O d. 793 Machining a part for a product is an example of a: Select one: O a. Product-level activity. b. Batch-level activity. O c. Unit-level activity. ABC is a costing method designed to provide managers with cost information for strategic and other decisions that potentially affect capacity, and therefore, "fixed" as well as variable costs. It is ordinarily used as a supplement Select one: a. False b. True Manufacturing companies typically combine their activities into five classifications, Select one: True O False Most companies use ABC costing for external reporting Select one: True O False en Annika Company uses activity-based costing. The company has two products: A and B. The annual production and sales of Product A ls 4,000 units and of Product B is 1,000 units. There are three activity cost pools, with total cost and activity as follows: Total Cost an Activity Cost Pool Activity 1 Activity 2 Activity 3 $ 18,000 $ 24,000 $ 60,000 Total Activity Product A Product B Total 700 300 1,000 500 100 600 800 400 1,200 The activity-based costing cost per unit of Product A is closest to: Select one: a 10.00 b20.40 17:00 d. 18.15 Tubaugh Corporation has two major business segments --East and West. In December, the East business segment had sales revenues of $690,000, variable expenses of $352,000, and traceable fixed expenses of $104,000. During the same month, the West business segment had sales revenues of $140,000, variable expenses of $56,000, and traceable fixed expenses of $24,000. The common fixed expenses totaled $162,000 and were allocated as follows: $89,000 to the East business segment and $73,000 to the West business segment. A properly constructed segmented income statement in a contribution format would show that the net operating income of the company as a whole is: select one: a. 422,000 b. 132,000 C. - 33,000 d. 294,000