Visual Basic (VB) is a programming environment from Microsoft in which a programmer uses a graphical user interface (GUI) to choose and modify preselected sections of code written in the BASIC programming language.

PLEASE CODE in VISUAL BASICS. Please show an example of the running code.

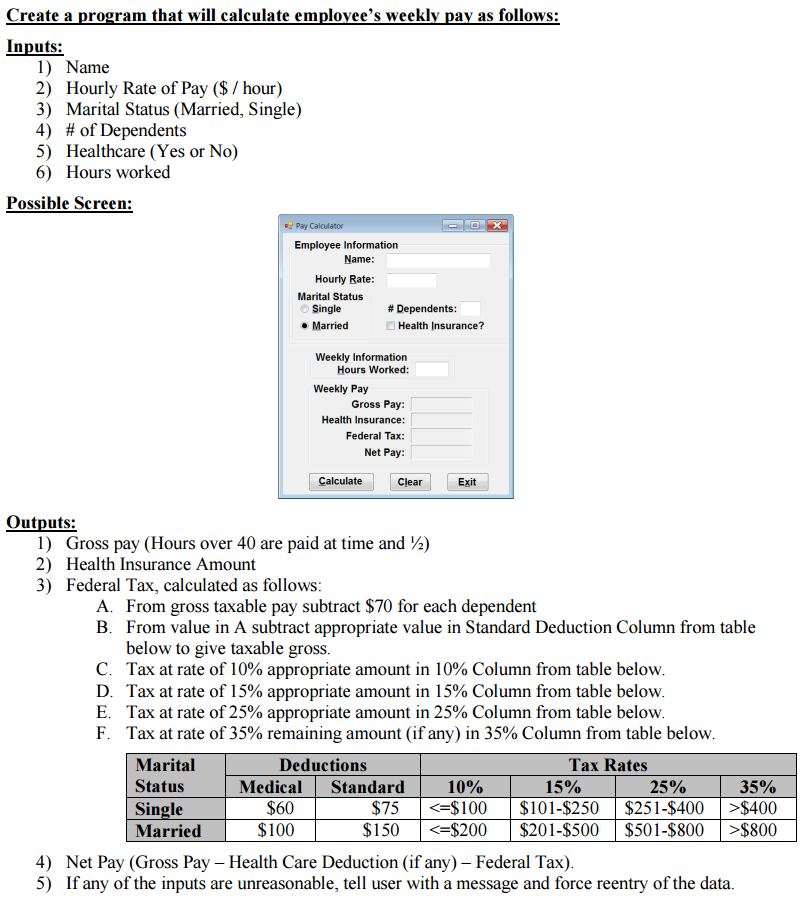

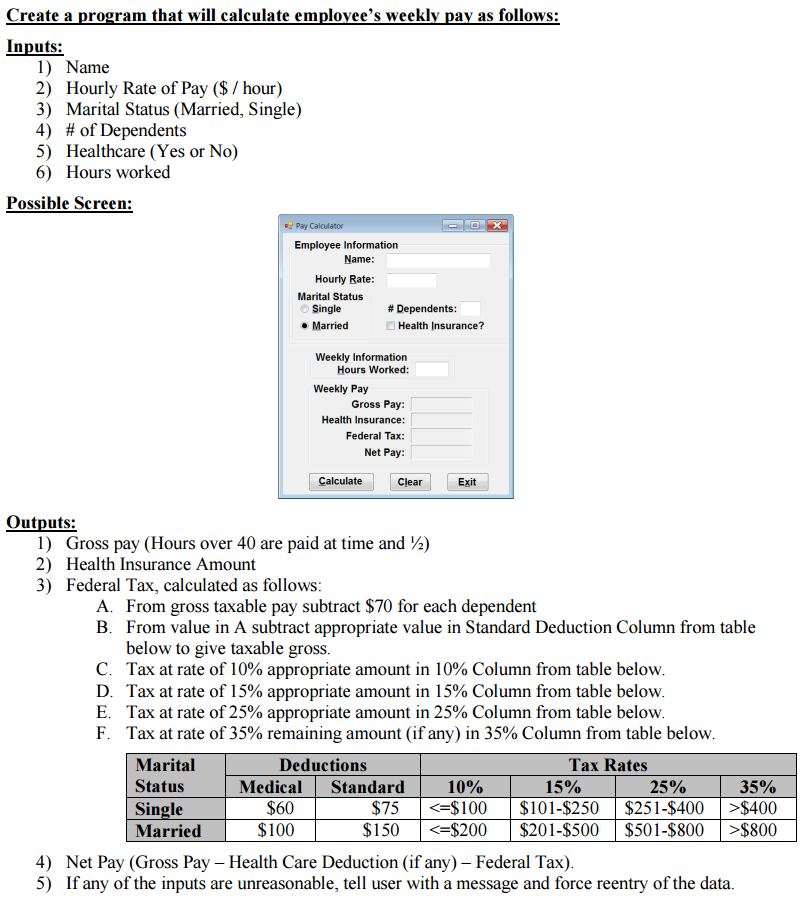

Create a program that will calculate employee's weekly pay as follows: Inputs: 1) Name 2) Hourly Rate of Pay ($/hour) 3) Marital Status (Married, Single) 4) of Dependents 5) Healthcare (Yes or No) 6) Hours worked Possible Screen Pay Calculator Employee Information Name: Hourly Rate: Marital Status Single #Dependents: Married Health Insurance? Weekly Information Hours Worked: Weekly Pay Gross Pay: Health Insurance Federal Tax: Net Pay: Clear Exit Calculate Outputs l) Gross pay (Hours over 40 are paid at time and 2) Health Insurance Amount 3) Federal Tax, calculated as follows: A. From gross taxable pay subtract $70 for each dependent B. From value in A subtract appropriate value in Standard Deduction Column from table below to give taxable gross. C. Tax at rate of 10% appropriate amount in 10% Column from table below. D. Tax at rate of 15% appropriate amount in 15% Column from table below. E. Tax at rate of 25% appropriate amount in 25% Column from table below. F. Tax at rate of 35% remaining amount (if any) in 35% Column from table below. Tax Rates Marital Deductions Medical Standard 10% 15% 25% 35% Status Single $150 $200 $201-$500 $501-$800 $800 $100 Married 4) Net Pay (Gross Pay-Health Care Deduction (if any)-Federal Tax) 5) If any of the inputs are unreasonable, tell user with a message and force reentry of the data. Create a program that will calculate employee's weekly pay as follows: Inputs: 1) Name 2) Hourly Rate of Pay ($/hour) 3) Marital Status (Married, Single) 4) of Dependents 5) Healthcare (Yes or No) 6) Hours worked Possible Screen Pay Calculator Employee Information Name: Hourly Rate: Marital Status Single #Dependents: Married Health Insurance? Weekly Information Hours Worked: Weekly Pay Gross Pay: Health Insurance Federal Tax: Net Pay: Clear Exit Calculate Outputs l) Gross pay (Hours over 40 are paid at time and 2) Health Insurance Amount 3) Federal Tax, calculated as follows: A. From gross taxable pay subtract $70 for each dependent B. From value in A subtract appropriate value in Standard Deduction Column from table below to give taxable gross. C. Tax at rate of 10% appropriate amount in 10% Column from table below. D. Tax at rate of 15% appropriate amount in 15% Column from table below. E. Tax at rate of 25% appropriate amount in 25% Column from table below. F. Tax at rate of 35% remaining amount (if any) in 35% Column from table below. Tax Rates Marital Deductions Medical Standard 10% 15% 25% 35% Status Single $150 $200 $201-$500 $501-$800 $800 $100 Married 4) Net Pay (Gross Pay-Health Care Deduction (if any)-Federal Tax) 5) If any of the inputs are unreasonable, tell user with a message and force reentry of the data