Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Viti Boutique imports designer clothing manufactured by subcontractors in New Zealand, Clothing is a seasonal product. The goods must be ready for sale prior to

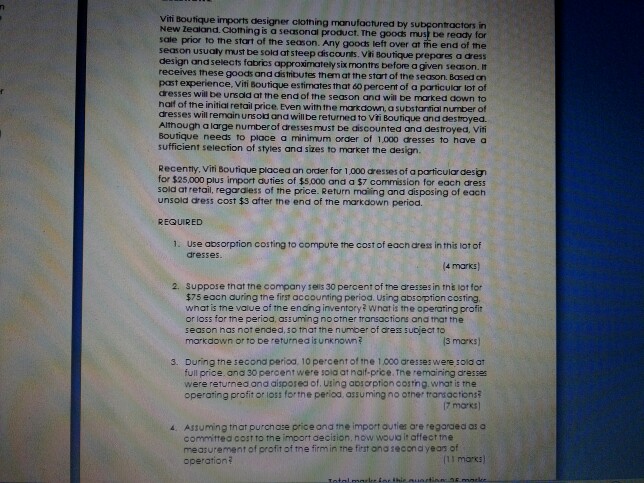

Viti Boutique imports designer clothing manufactured by subcontractors in New Zealand, Clothing is a seasonal product. The goods must be ready for sale prior to the start of the season. Any goods left over at me end of the season usually must be sold at steep discounts. Viti Boutique prepares a dress design and selects fabrics approximately six months before a given season. It receives these goods and distributes them at me start of the season. Based on past experience. Viti Boutique estimates that 60 percent of a particular lot of dresses will be unsold at the end of the season and will be marked down to half of the initial retail price. Even with the markdown, a substantial number of dresses will remain unsold and will be returned to Viti Boutique and destroyed. Although a large number of dresses must be discounted and destroyed, viti Boutique needs to place a minimum order of 1,000 dresses to have a sufficient selection of styles and sizes to market the design. Recently, viti Boutique placed an order for l,000 dresses of a particular for $25,000 plus import duties of $5,000 and a $7 commission for each dress sold at retail, regardless of the price. Return making and disposing of each unsold dress cost $3 after the end of the markdown period. use absorption costing to compute the cost of each dress in this lot of dresses. Suppose that the company setts 30 percent of the dresses in this lot for $75 each during the first accounting period. Using absorption costing, what is the value of the ending inventory? what is the operating profit or loss for the period assuming no other transactional and that the season has not ended, so that the number of dress subject to markdown or to be returned is unknown? During the second period, 10 percent of the dresses were sold or full price and 30 percent were sold at half-price. The remaining dresses were returned and disposed of Using absorption costing. what is the operating profit or loss for the period assuming no other transactions? Assuming that purchase price and the impact duties are regarded as a committed cost to the impact decision, now would it affect the measurement of profit of the firm in the first and second years of operation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started