Answered step by step

Verified Expert Solution

Question

1 Approved Answer

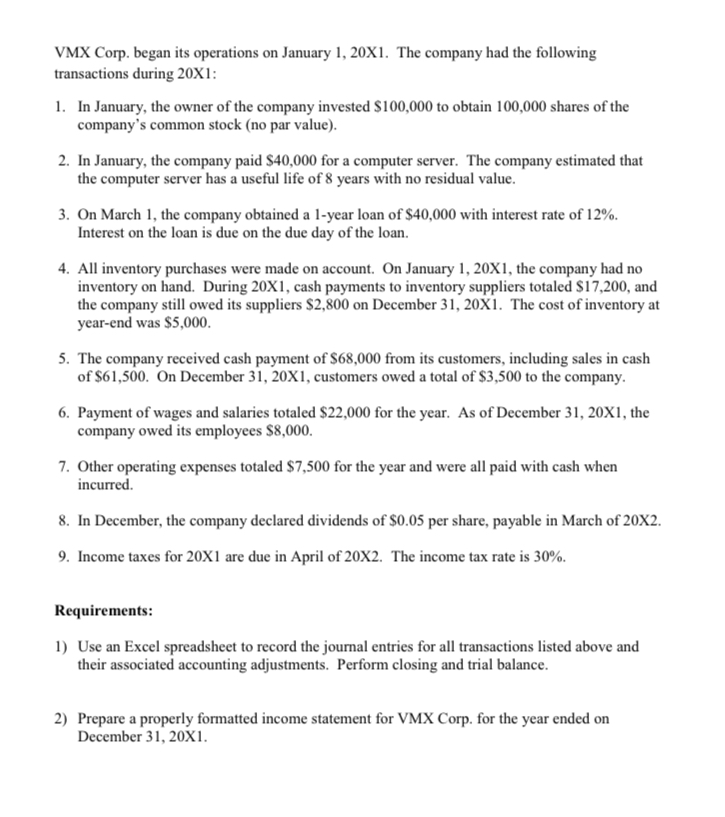

VMX Corp. began its operations on January 1 , 2 0 X 1 . The company had the following transactions during 2 0 X 1

VMX Corp. began its operations on January X The company had the following transactions during X:

In January, the owner of the company invested $ to obtain shares of the company's common stock no par value

In January, the company paid $ for a computer server. The company estimated that the computer server has a useful life of years with no residual value.

On March the company obtained a year loan of $ with interest rate of Interest on the loan is due on the due day of the loan.

All inventory purchases were made on account. On January X the company had no inventory on hand. During X cash payments to inventory suppliers totaled $ and the company still owed its suppliers $ on December X The cost of inventory at yearend was $

The company received cash payment of $ from its customers, including sales in cash of $ On December X customers owed a total of $ to the company.

Payment of wages and salaries totaled $ for the year. As of December X the company owed its employees $

Other operating expenses totaled $ for the year and were all paid with cash when incurred.

In December, the company declared dividends of $ per share, payable in March of X

Income taxes for X are due in April of X The income tax rate is

Requirements:

Use an Excel spreadsheet to record the journal entries for all transactions listed above and their associated accounting adjustments. Perform closing and trial balance.

Prepare a properly formatted income statement for VMX Corp. for the year ended on December X

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started