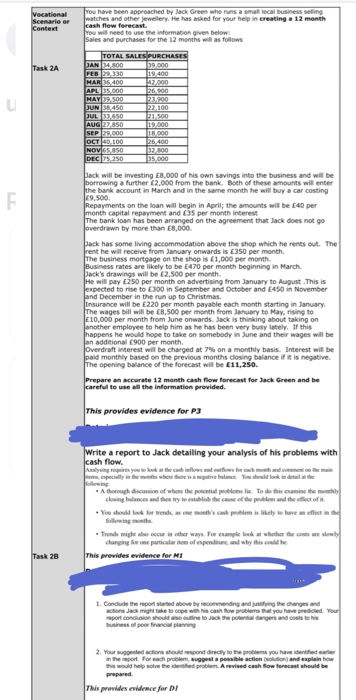

Vocational Scenario or Context You have been approached by Jack Green who runs a small local business seling watches and other jewellery. He has asked for your help in creating a 12 month cash flow forecast. You will need to use the information given below: Sales and purchases for the 12 months will as follows Task 2A u TOTAL SALES PURCHASES JAN 14.300 119.000 FEB 29,330 19,400 MAR 06 400 12000 APL 35.000 6,500 MAY 19.500 200 JUN38,450 22.100 JUL 11,650 1.500 AUG27,850 SEP-29.000 ITR000 OCT4,100 26,400 NOV 05,850 12.800 DEC 25.250 35.000 F pack will be investing 8,000 of his own savings into the business and will be borrowing a further 12,000 from the bank. Both of these amounts will enter the bank account in March and in the same month he will buy a car costing 49,500 Repayments on the loan will begin in April; the amounts will be E40 per month capital repayment and 35 per month interest The bank loan has been arranged on the agreement that Jack does not go overdrawn by more than 8,000 pack has some living accommodation above the shop which he rents out. The rent he will receive from January onwards is E350 per month. The business mortgage on the shop is 1,000 per month Business rates are likely to be 470 per month beginning in March. Jack's drawings will be 2,500 per month He will pay E250 per month on advertising from January to August. This is expected d to rise to 300 in September and October and E450 in November Insurance will be E220 per month payable each month starting in January and December in the run up to Christmas The wages bill will be 18.500 per month from January to May, rising to E10,000 per month from June onwards. Jack is thinking about taking on another employee to help him as he has been very busy lately. If this happens he would hope to take on somebody in June and their wages will be an additional 900 per month Overdraft interest will be charged at 7% on a monthly basis. Interest will be paid monthly based on the previous months dosing balance it is negative The opening balance of the forecast will be E11,250. Prepare an accurate 12 month cash flow forecast for Jack Green and be careful to use all the information provided. This provides evidence for P3 Write a report to Jack detailing your analysis of his problems with cash flow. Analysing requires you to look at the chiflows and flows for each month com.cpecially in the where there is a negative balonce should look in detail the A thorough discussion of where the potential problems lie. To do this examine the monthly showing balances and then try to establish the cause of the problem and the effect of You should look for trends, as one month's cash problem is likely to have an effect in the Trends might occur in other ways. For cumple look at whether the costs are slowly changing for one particular item of expendinand why this could be This provides evidence for MI Task 28 1. Conclude the report stand above by recommending and justifying the changes and action Jack might be to cope with his cash flow problems that you have predicted your raport conclusion should notline to Jack the potential dangers and costs to his business of poor financial planning 2. Your actions should respond directly to the problems you how dified in the report for each problem, suggest a possible action solution and explain how this would help solve the identified problem. A revised cash flow forecast should be prepared This provides evidence for DI Vocational Scenario or Context You have been approached by Jack Green who runs a small local business seling watches and other jewellery. He has asked for your help in creating a 12 month cash flow forecast. You will need to use the information given below: Sales and purchases for the 12 months will as follows Task 2A u TOTAL SALES PURCHASES JAN 14.300 119.000 FEB 29,330 19,400 MAR 06 400 12000 APL 35.000 6,500 MAY 19.500 200 JUN38,450 22.100 JUL 11,650 1.500 AUG27,850 SEP-29.000 ITR000 OCT4,100 26,400 NOV 05,850 12.800 DEC 25.250 35.000 F pack will be investing 8,000 of his own savings into the business and will be borrowing a further 12,000 from the bank. Both of these amounts will enter the bank account in March and in the same month he will buy a car costing 49,500 Repayments on the loan will begin in April; the amounts will be E40 per month capital repayment and 35 per month interest The bank loan has been arranged on the agreement that Jack does not go overdrawn by more than 8,000 pack has some living accommodation above the shop which he rents out. The rent he will receive from January onwards is E350 per month. The business mortgage on the shop is 1,000 per month Business rates are likely to be 470 per month beginning in March. Jack's drawings will be 2,500 per month He will pay E250 per month on advertising from January to August. This is expected d to rise to 300 in September and October and E450 in November Insurance will be E220 per month payable each month starting in January and December in the run up to Christmas The wages bill will be 18.500 per month from January to May, rising to E10,000 per month from June onwards. Jack is thinking about taking on another employee to help him as he has been very busy lately. If this happens he would hope to take on somebody in June and their wages will be an additional 900 per month Overdraft interest will be charged at 7% on a monthly basis. Interest will be paid monthly based on the previous months dosing balance it is negative The opening balance of the forecast will be E11,250. Prepare an accurate 12 month cash flow forecast for Jack Green and be careful to use all the information provided. This provides evidence for P3 Write a report to Jack detailing your analysis of his problems with cash flow. Analysing requires you to look at the chiflows and flows for each month com.cpecially in the where there is a negative balonce should look in detail the A thorough discussion of where the potential problems lie. To do this examine the monthly showing balances and then try to establish the cause of the problem and the effect of You should look for trends, as one month's cash problem is likely to have an effect in the Trends might occur in other ways. For cumple look at whether the costs are slowly changing for one particular item of expendinand why this could be This provides evidence for MI Task 28 1. Conclude the report stand above by recommending and justifying the changes and action Jack might be to cope with his cash flow problems that you have predicted your raport conclusion should notline to Jack the potential dangers and costs to his business of poor financial planning 2. Your actions should respond directly to the problems you how dified in the report for each problem, suggest a possible action solution and explain how this would help solve the identified problem. A revised cash flow forecast should be prepared This provides evidence for DI