Answered step by step

Verified Expert Solution

Question

1 Approved Answer

VolleyMasters ( Pty ) Ltd is a manufacturer of modern indoor and outdoor volleyball equipment. Over the last financial year, the company paid hefty fines

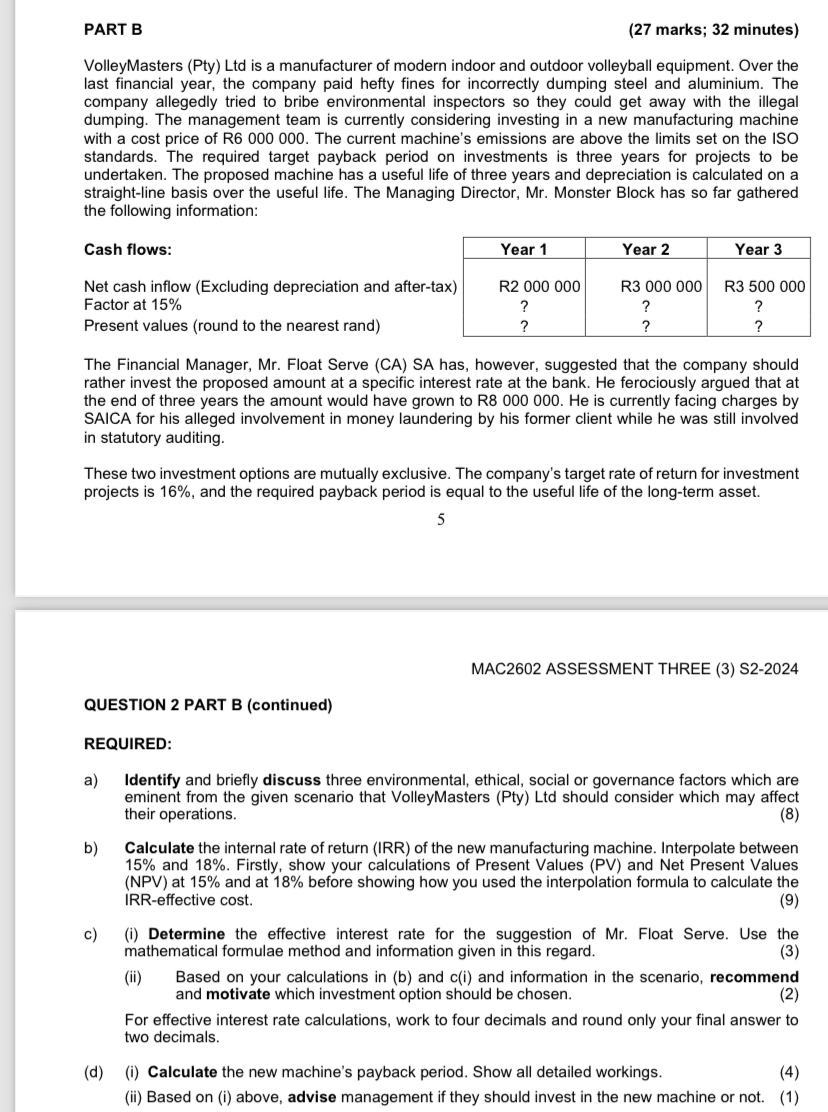

VolleyMasters Pty Ltd is a manufacturer of modern indoor and outdoor volleyball equipment. Over the

last financial year, the company paid hefty fines for incorrectly dumping steel and aluminium. The

company allegedly tried to bribe environmental inspectors so they could get away with the illegal

dumping. The management team is currently considering investing in a new manufacturing machine

with a cost price of R The current machine's emissions are above the limits set on the ISO

standards. The required target payback period on investments is three years for projects to be

undertaken. The proposed machine has a useful life of three years and depreciation is calculated on a

straightline basis over the useful life. The Managing Director, Mr Monster Block has so far gathered

the following information:

Cash flows:

Net cash inflow Excluding depreciation and aftertax

Factor at

Present values round to the nearest rand

The Financial Manager, Mr Float Serve CA SA has, however, suggested that the company should

rather invest the proposed amount at a specific interest rate at the bank. He ferociously argued that at

the end of three years the amount would have grown to R He is currently facing charges by

SAICA for his alleged involvement in money laundering by his former client while he was still involved

in statutory auditing.

These two investment options are mutually exclusive. The company's target rate of return for investment

projects is and the required payback period is equal to the useful life of the longterm asset.

QUESTION PART B continued

REQUIRED:

a Identify and briefly discuss three environmental, ethical, social or governance factors which are

eminent from the given scenario that VolleyMasters Pty Ltd should consider which may affect

their operations.

b Calculate the internal rate of return IRR of the new manufacturing machine. Interpolate between

and Firstly, show your calculations of Present Values PV and Net Present Values

NPV at and at before showing how you used the interpolation formula to calculate the

IRReffective cost.

ci Determine the effective interest rate for the suggestion of Mr Float Serve. Use the

mathematical formulae method and information given in this regard.

ii Based on your calculations in b and ci and information in the scenario, recommend

and motivate which investment option should be chosen.

For effective interest rate calculations, work to four decimals and round only your final answer to

two decimals.

di Calculate the new machine's payback period. Show all detailed workings.

ii Based on i above, advise management if they should invest in the new machine or not.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started