Answered step by step

Verified Expert Solution

Question

1 Approved Answer

VOn 1st April 20X1, Venus Itd acquired 100% of Saturn Itd for 4,00,000. The fair value of the net identifiable assets of Saturn Itd

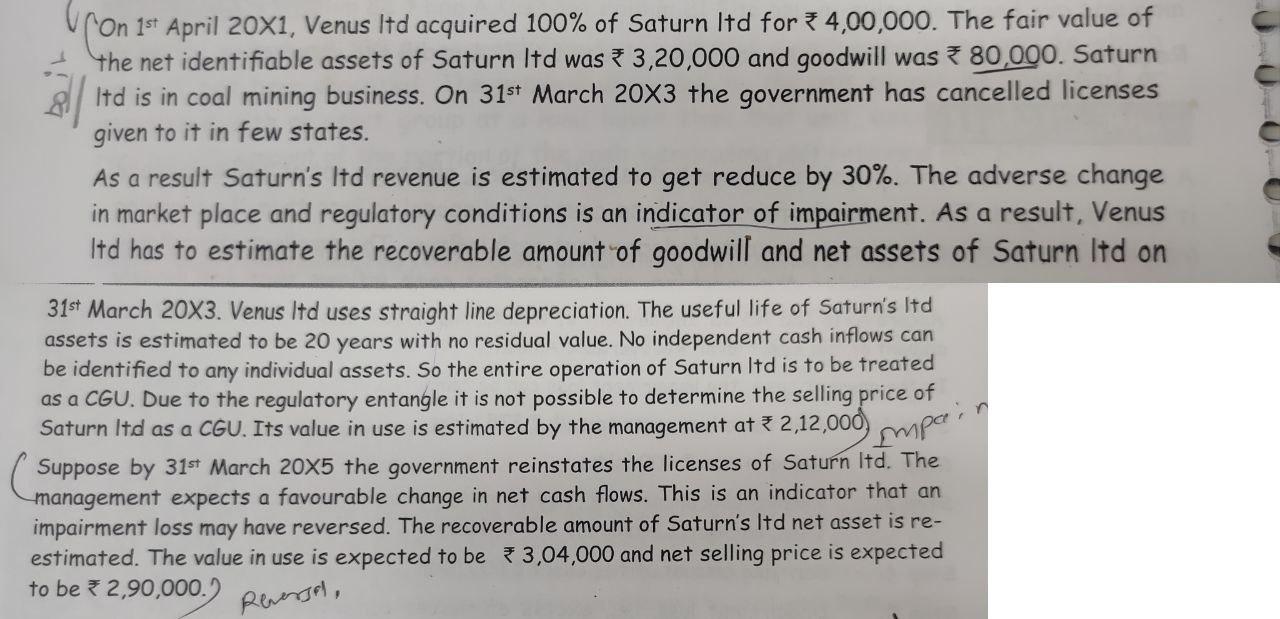

VOn 1st April 20X1, Venus Itd acquired 100% of Saturn Itd for 4,00,000. The fair value of the net identifiable assets of Saturn Itd was 3,20,000 and goodwill was 80,000. Saturn Itd is in coal mining business. On 31st March 20X3 the government has cancelled licenses given to it in few states. As a result Saturn's Itd revenue is estimated to get reduce by 30%. The adverse change in market place and regulatory conditions is an indicator of impairment. As a result, Venus Itd has to estimate the recoverable amount of goodwill and net assets of Saturn Itd on 31st March 20X3. Venus Itd uses straight line depreciation. The useful life of Saturn's Itd assets is estimated to be 20 years with no residual value. No independent cash inflows can be identified to any individual assets. So the entire operation of Saturn Itd is to be treated as a CGU. Due to the regulatory entangle it is not possible to determine the selling price of Saturn Itd as a CGU. Its value in use is estimated by the management at 2,12,00) Suppose by 31st March 20X5 the government reinstates the licenses of Saturn Itd. The management expects a favourable change in net cash flows. This is an indicator that an impairment loss may have reversed. The recoverable amount of Saturn's Itd net asset is re- estimated. The value in use is expected to be 3,04,000 and net selling price is expected to be 2,90,000.) Rensal,

Step by Step Solution

★★★★★

3.44 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Answer The answe...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started