Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Voss Inc., an accounting firm, adjusts and closes its accounts each December 31. Below are two situations requiring adjusting entries. During the current year, supplies

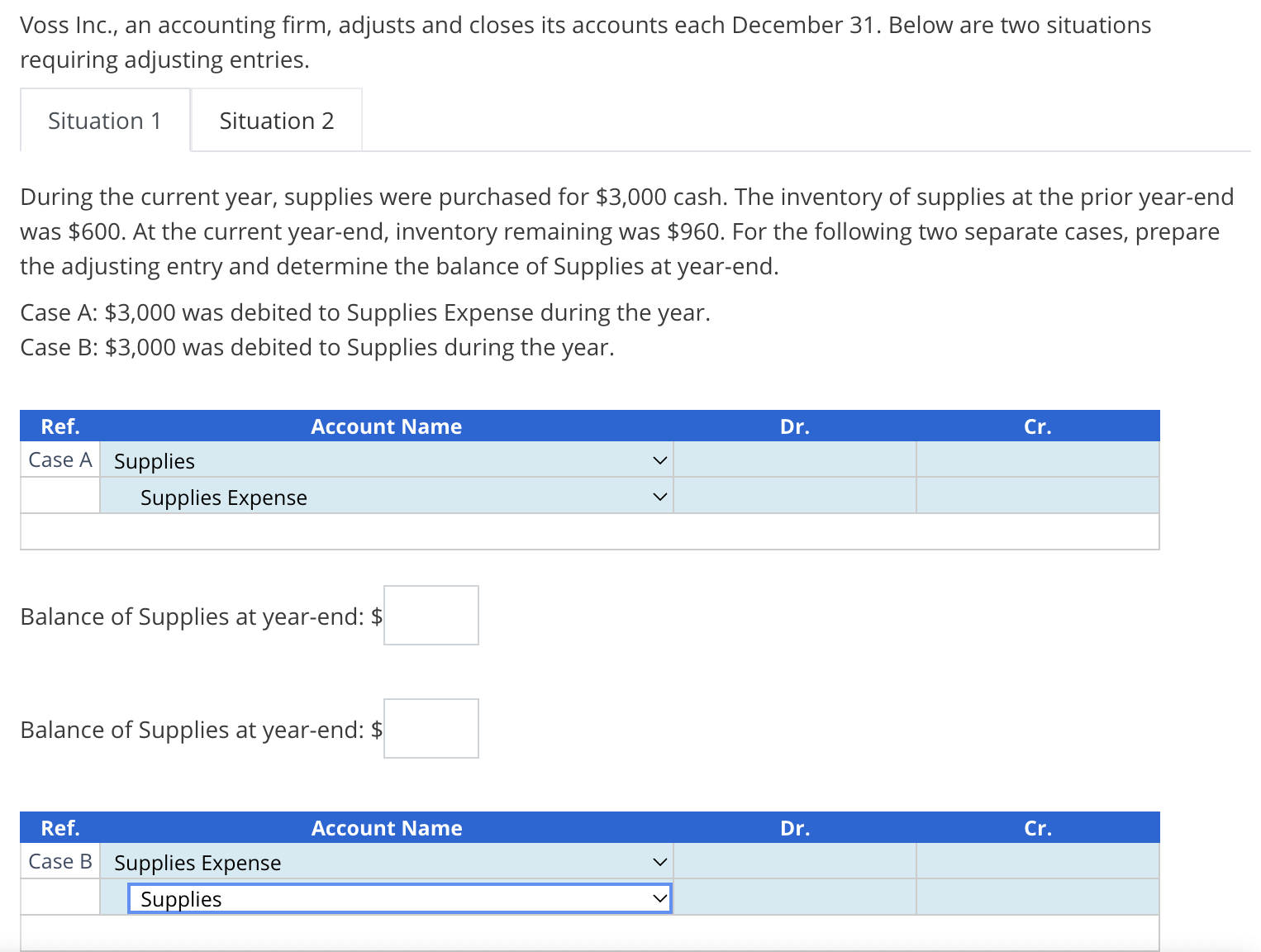

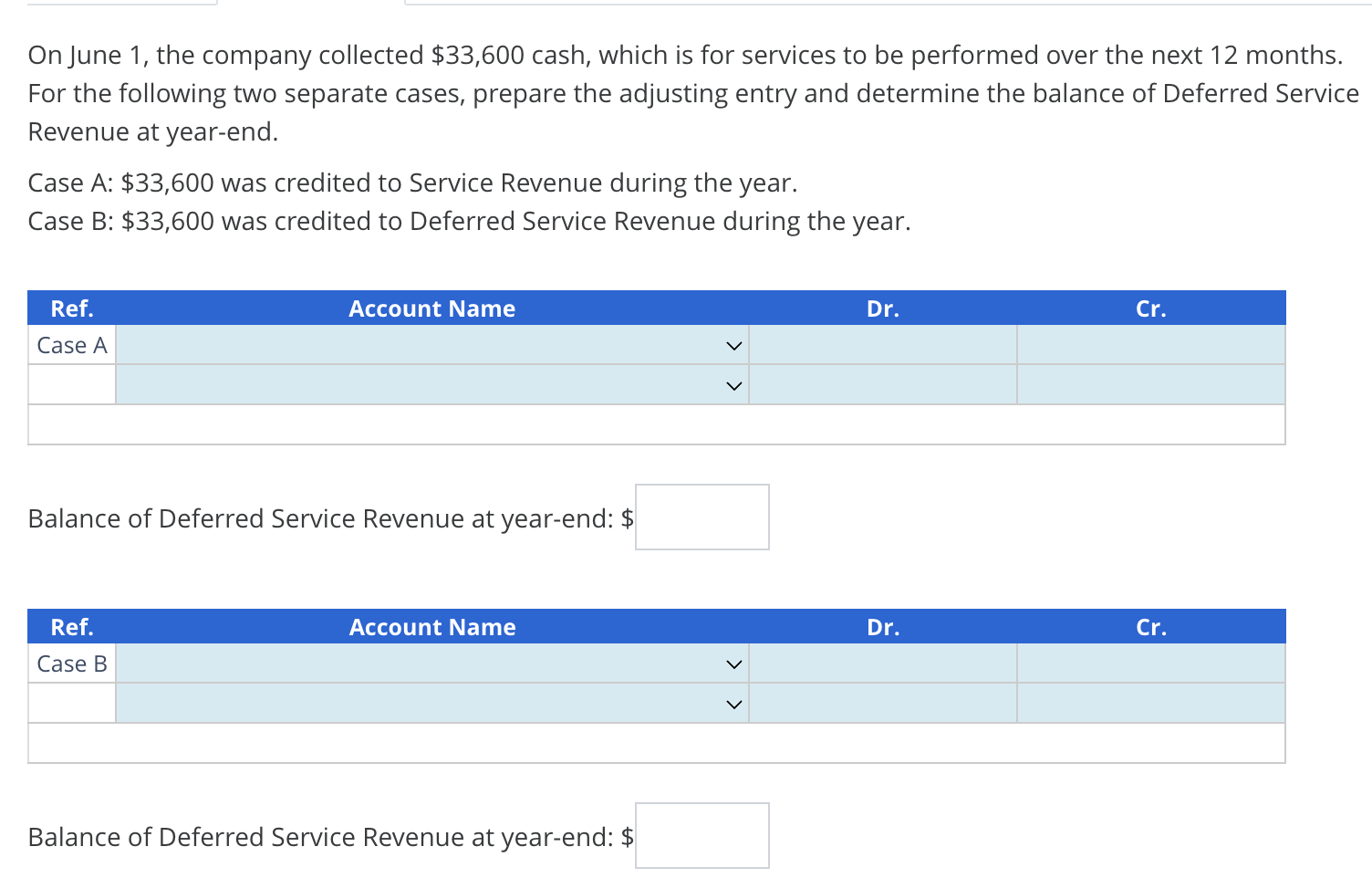

Voss Inc., an accounting firm, adjusts and closes its accounts each December 31. Below are two situations requiring adjusting entries. During the current year, supplies were purchased for $3,000 cash. The inventory of supplies at the prior year-er was $600. At the current year-end, inventory remaining was $960. For the following two separate cases, prepar the adjusting entry and determine the balance of Supplies at year-end. Case A: $3,000 was debited to Supplies Expense during the year. Case B: $3,000 was debited to Supplies during the year. Balance of Supplies at year-end: $ On June 1 , the company collected $33,600 cash, which is for services to be performed over the next 12 months. For the following two separate cases, prepare the adjusting entry and determine the balance of Deferred Service Revenue at year-end. Case A: $33,600 was credited to Service Revenue during the year. Case B: $33,600 was credited to Deferred Service Revenue during the year. Balance of Deferred Service Revenue at year-end: Balance of Deferred Service Revenue at year-end

Voss Inc., an accounting firm, adjusts and closes its accounts each December 31. Below are two situations requiring adjusting entries. During the current year, supplies were purchased for $3,000 cash. The inventory of supplies at the prior year-er was $600. At the current year-end, inventory remaining was $960. For the following two separate cases, prepar the adjusting entry and determine the balance of Supplies at year-end. Case A: $3,000 was debited to Supplies Expense during the year. Case B: $3,000 was debited to Supplies during the year. Balance of Supplies at year-end: $ On June 1 , the company collected $33,600 cash, which is for services to be performed over the next 12 months. For the following two separate cases, prepare the adjusting entry and determine the balance of Deferred Service Revenue at year-end. Case A: $33,600 was credited to Service Revenue during the year. Case B: $33,600 was credited to Deferred Service Revenue during the year. Balance of Deferred Service Revenue at year-end: Balance of Deferred Service Revenue at year-end Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started