Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Vuyokazi Limited is an investment house. The following is a list of some of their investments: . Ordinary shares: The entity holds a portfolio of

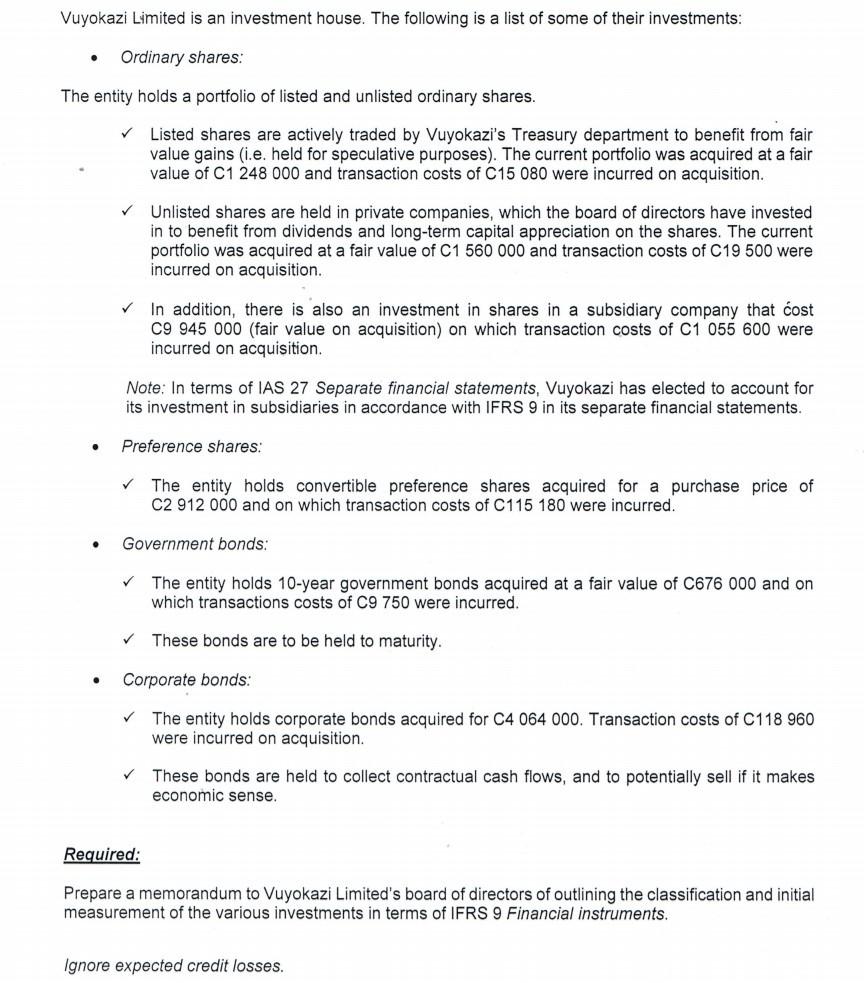

Vuyokazi Limited is an investment house. The following is a list of some of their investments: . Ordinary shares: The entity holds a portfolio of listed and unlisted ordinary shares. Listed shares are actively traded by Vuyokazi's Treasury department to benefit from fair value gains (i.e. held for speculative purposes). The current portfolio was acquired at a fair value of C1 248 000 and transaction costs of C15 080 were incurred on acquisition. Unlisted shares are held in private companies, which the board of directors have invested in to benefit from dividends and long-term capital appreciation on the shares. The current portfolio was acquired at a fair value of C1 560 000 and transaction costs of C19 500 were incurred on acquisition. In addition, there is also an investment in shares in a subsidiary company that cost C9 945 000 (fair value on acquisition) on which transaction costs of C1 055 600 were incurred on acquisition. Note: In terms of IAS 27 Separate financial statements, Vuyokazi has elected to account for its investment in subsidiaries in accordance with IFRS 9 in its separate financial statements. . Preference shares: The entity holds convertible preference shares acquired for a purchase price of C2 912 000 and on which transaction costs of C115 180 were incurred. Government bonds: The entity holds 10-year government bonds acquired at a fair value of C676 000 and on which transactions costs of C9 750 were incurred. These bonds are to be held to maturity. . Corporate bonds: The entity holds corporate bonds acquired for C4 064 000. Transaction costs of C118 960 were incurred on acquisition These bonds are held to collect contractual cash flows, and to potentially sell if it makes economic sense. Required: Prepare a memorandum to Vuyokazi Limited's board of directors of outlining the classification and initial measurement of the various investments in terms of IFRS 9 Financial instruments. Ignore expected credit losses. Vuyokazi Limited is an investment house. The following is a list of some of their investments: . Ordinary shares: The entity holds a portfolio of listed and unlisted ordinary shares. Listed shares are actively traded by Vuyokazi's Treasury department to benefit from fair value gains (i.e. held for speculative purposes). The current portfolio was acquired at a fair value of C1 248 000 and transaction costs of C15 080 were incurred on acquisition. Unlisted shares are held in private companies, which the board of directors have invested in to benefit from dividends and long-term capital appreciation on the shares. The current portfolio was acquired at a fair value of C1 560 000 and transaction costs of C19 500 were incurred on acquisition. In addition, there is also an investment in shares in a subsidiary company that cost C9 945 000 (fair value on acquisition) on which transaction costs of C1 055 600 were incurred on acquisition. Note: In terms of IAS 27 Separate financial statements, Vuyokazi has elected to account for its investment in subsidiaries in accordance with IFRS 9 in its separate financial statements. . Preference shares: The entity holds convertible preference shares acquired for a purchase price of C2 912 000 and on which transaction costs of C115 180 were incurred. Government bonds: The entity holds 10-year government bonds acquired at a fair value of C676 000 and on which transactions costs of C9 750 were incurred. These bonds are to be held to maturity. . Corporate bonds: The entity holds corporate bonds acquired for C4 064 000. Transaction costs of C118 960 were incurred on acquisition These bonds are held to collect contractual cash flows, and to potentially sell if it makes economic sense. Required: Prepare a memorandum to Vuyokazi Limited's board of directors of outlining the classification and initial measurement of the various investments in terms of IFRS 9 Financial instruments. Ignore expected credit losses

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started