vv

vv

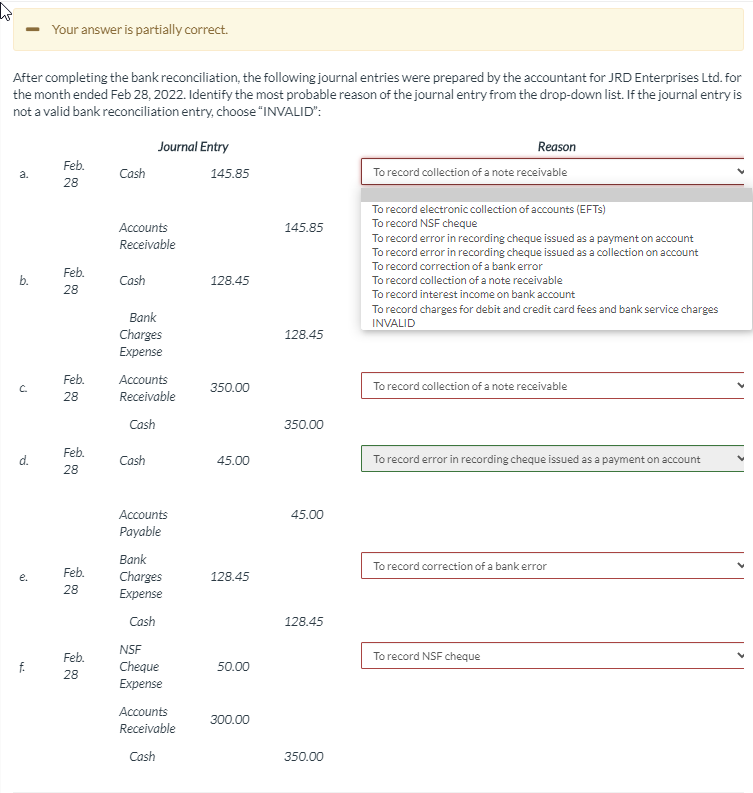

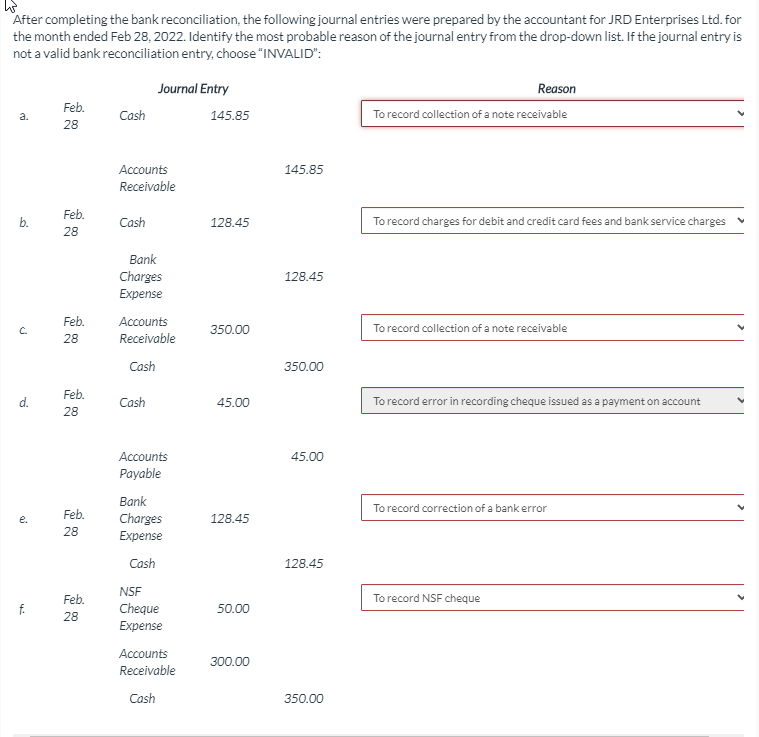

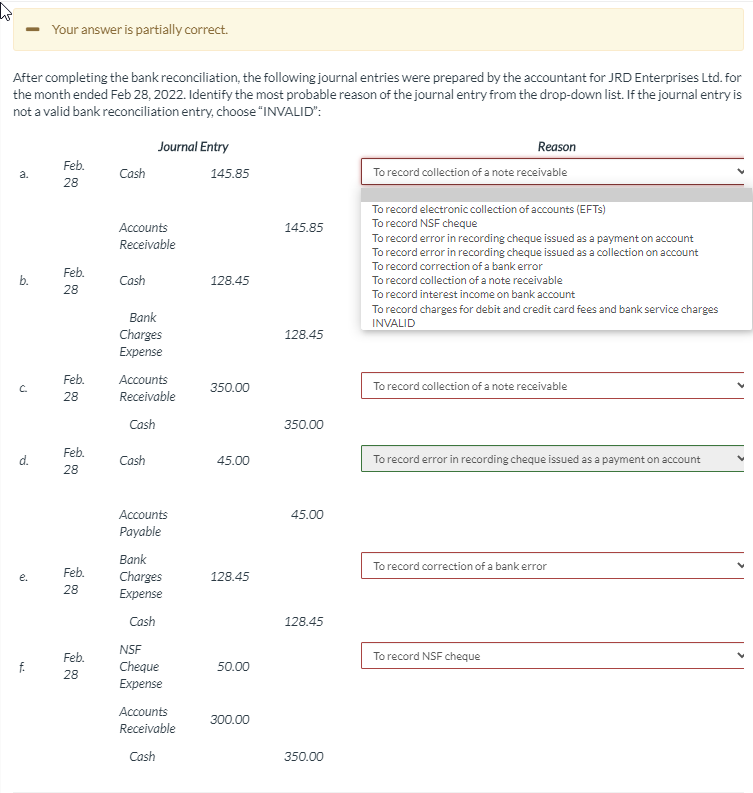

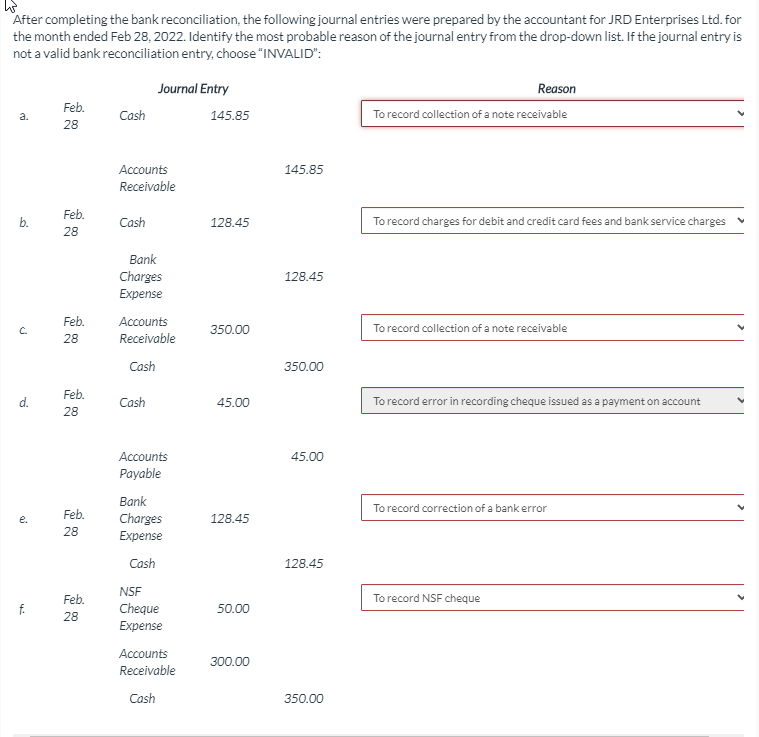

hs After completing the bank reconciliation, the following journal entries were prepared by the accountant for JRD Enterprises Ltd. for the month ended Feb 28, 2022. Identify the most probable reason of the journal entry from the drop-down list. If the journal entry is not a valid bank reconciliation entry, choose "INVALID": Journal Entry 145.85 Feb. 28 Reason To record collection of a note receivable a. Cash 145.85 Accounts Receivable b. Feb. 28 Cash 128.45 To record charges for debit and credit card fees and bank service charges 128.45 Bank Charges Expense Accounts Receivable Cash c. Feb. 28 350.00 To record collection of a note receivable 350.00 d. Feb. 28 Cash 45.00 To record error in recording cheque issued as a payment on account 45.00 Accounts Payable To record correction of a bank error e. Feb. 28 128.45 128.45 Bank Charges Expense Cash NSF Cheque Expense Accounts Receivable Cash To record NSF cheque Feb. 28 h 50.00 300.00 350.00 15 Your answer is partially correct. After completing the bank reconciliation, the following journal entries were prepared by the accountant for JRD Enterprises Ltd. for the month ended Feb 28, 2022. Identify the most probable reason of the journal entry from the drop-down list. If the journal entry is not a valid bank reconciliation entry, choose "INVALID": Journal Entry 145.85 Feb. 28 Reason To record collection of a note receivable a Cash 145.85 Accounts Receivable To record electronic collection of accounts (EFT) To record NSF cheque To record error in recording cheque issued as a payment on account To record error in recording cheque issued as a collection on account To record correction of a bank error To record collection of a note receivable To record interest income on bank account To record charges for debit and credit card fees and bank service charges INVALID b. Feb. 28 Cash 128.45 128.45 Bank Charges Expense Accounts Receivable c. Feb. 28 350.00 To record collection of a note receivable Cash 350.00 d. Feb. 28 Cash 45.00 To record error in recording cheque issued as a payment on account 45.00 Accounts Payable Bank Charges Expense Feb. To record correction of a bank error e. 128.45 28 Cash 128.45 To record NSF cheque f. Feb. 28 NSF Cheque Expense 50.00 Accounts Receivable 300.00 Cash 350.00

vv

vv