Answered step by step

Verified Expert Solution

Question

1 Approved Answer

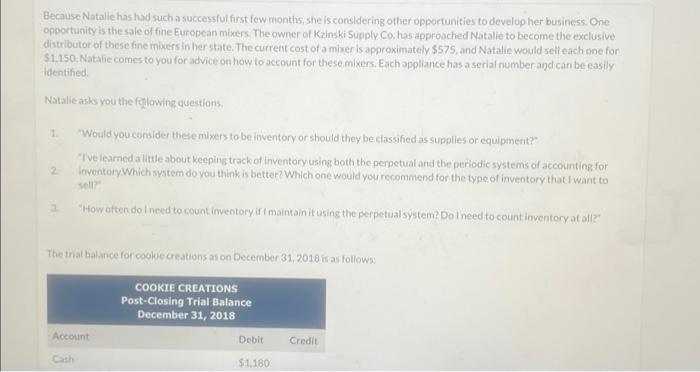

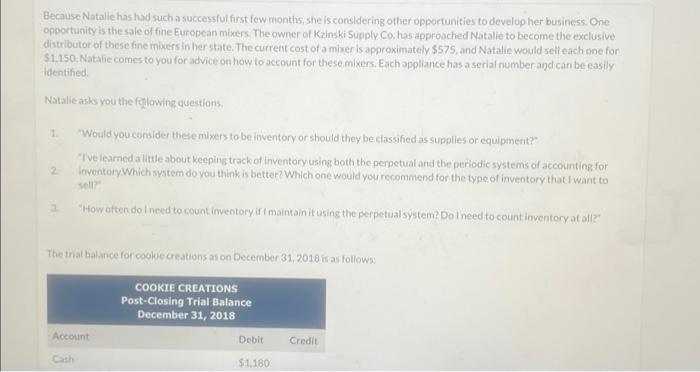

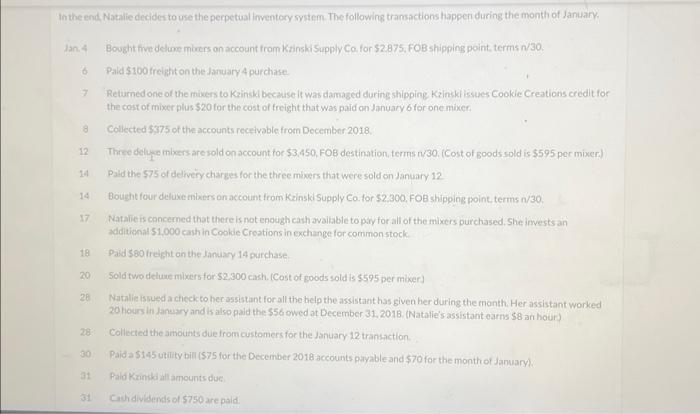

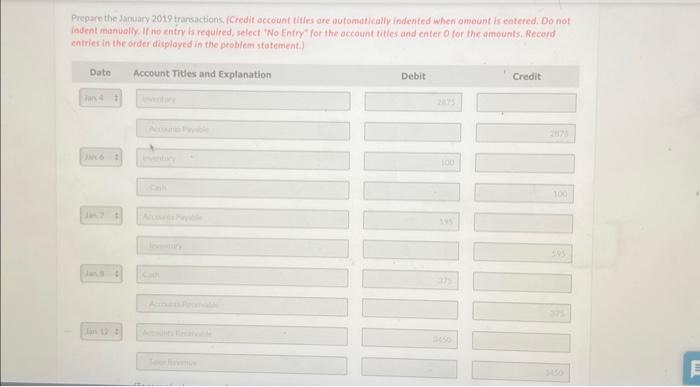

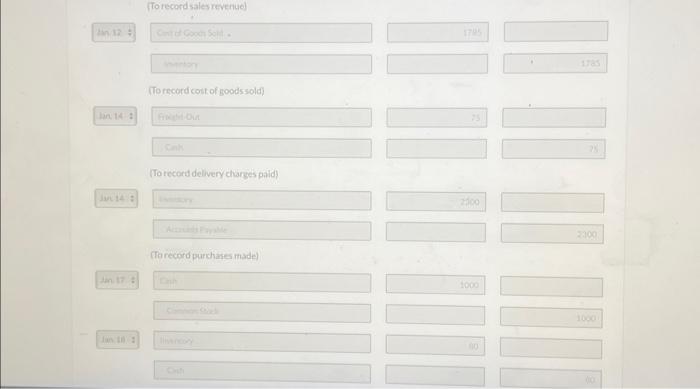

w Because Natalie has had such a successful first few months, she is considering other opportunities to develop her business. One opportunity is the sale

w

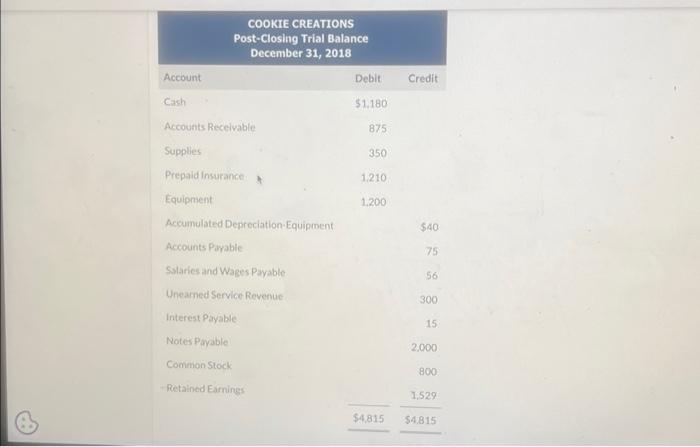

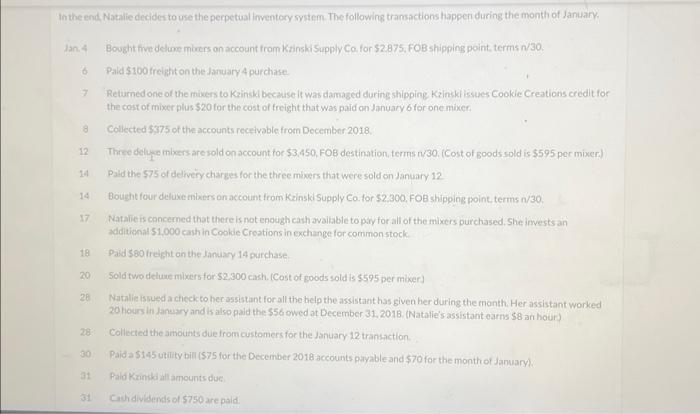

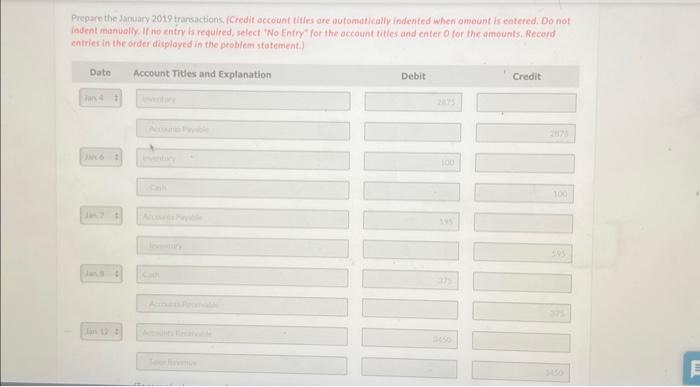

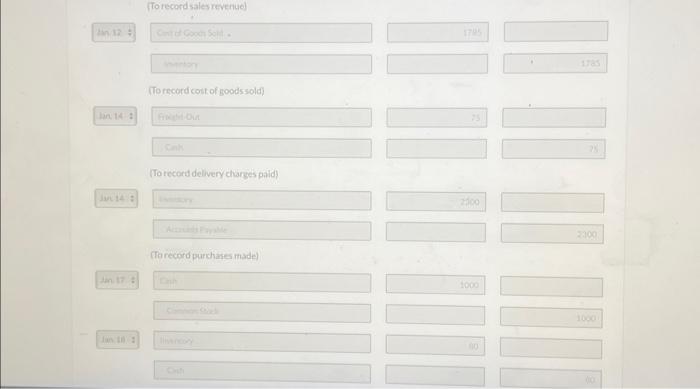

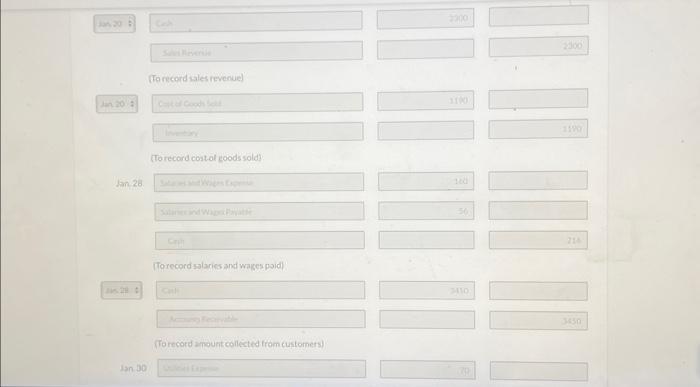

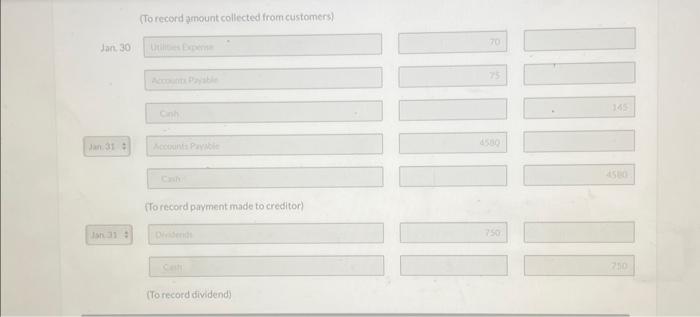

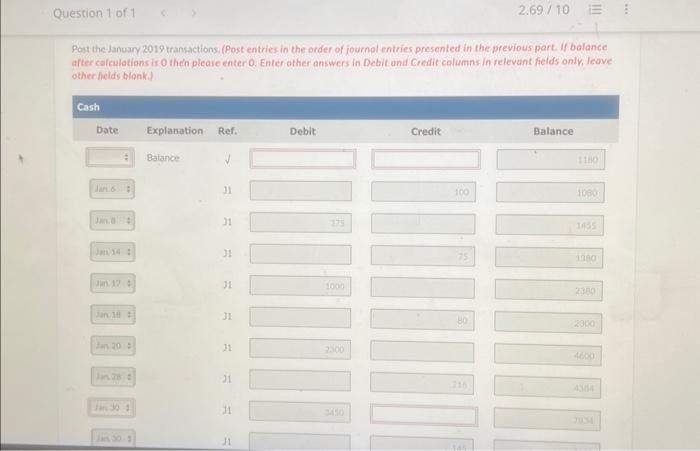

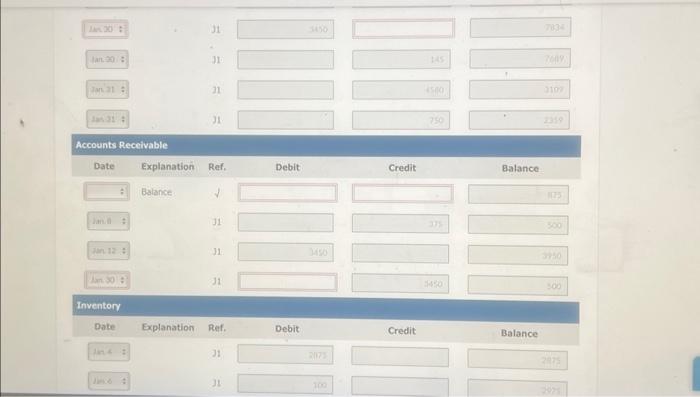

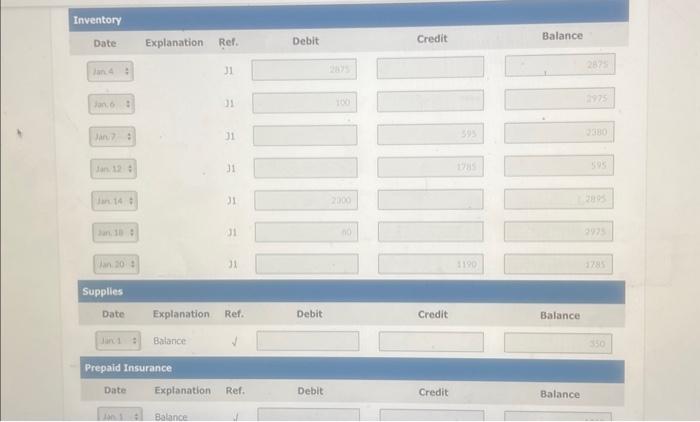

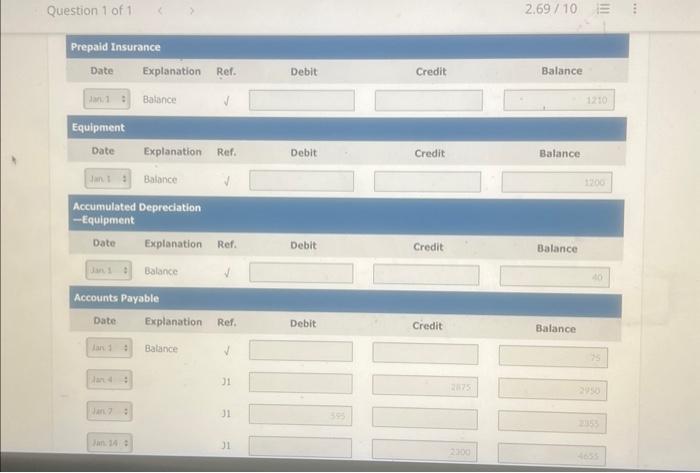

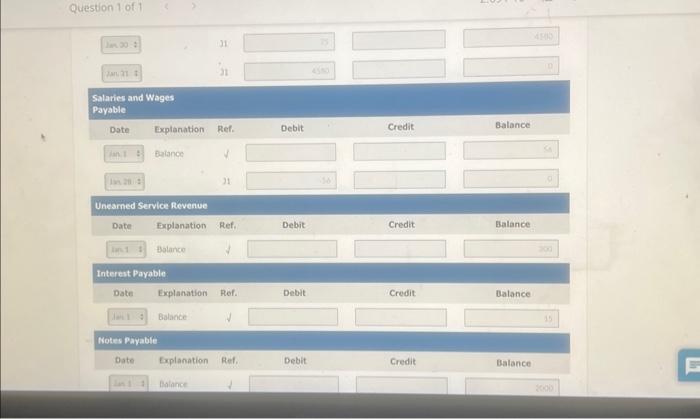

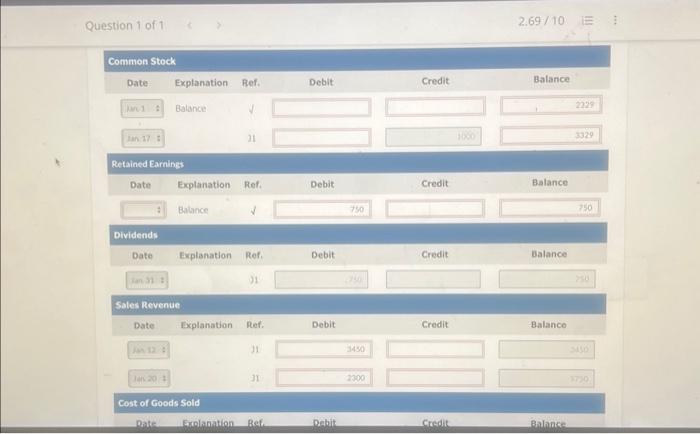

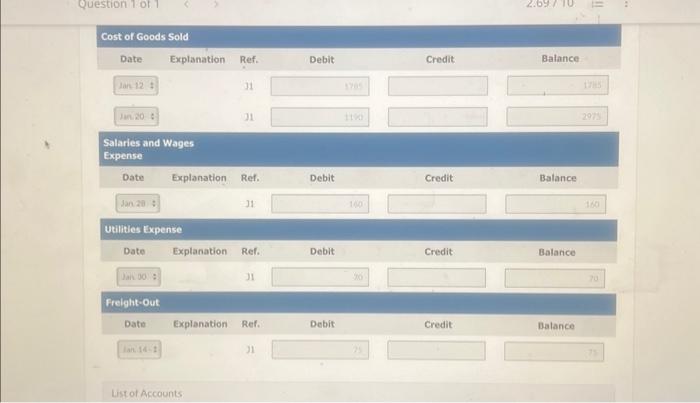

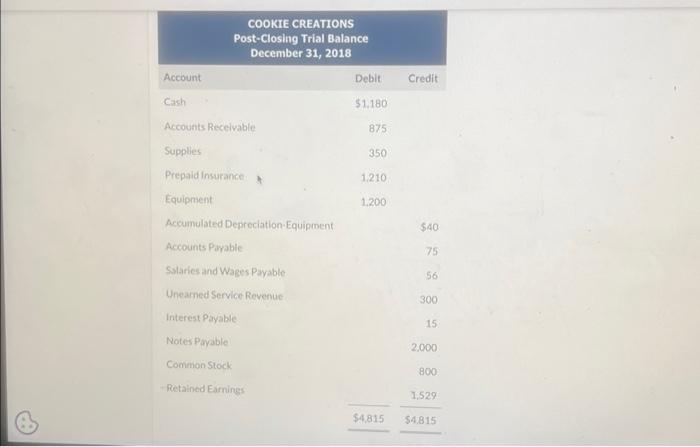

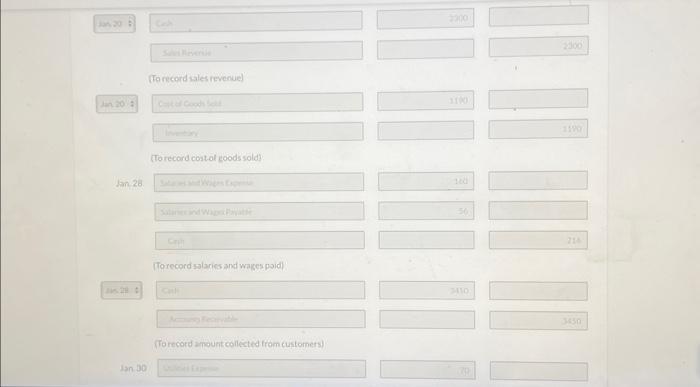

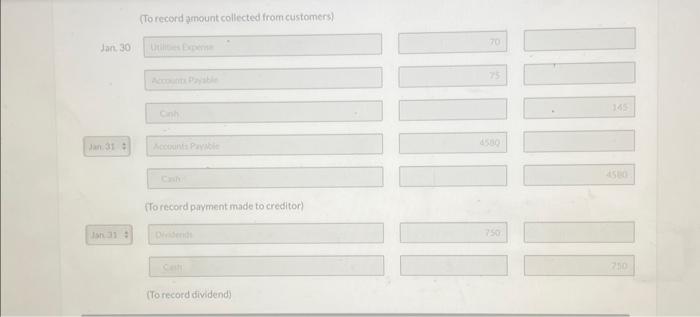

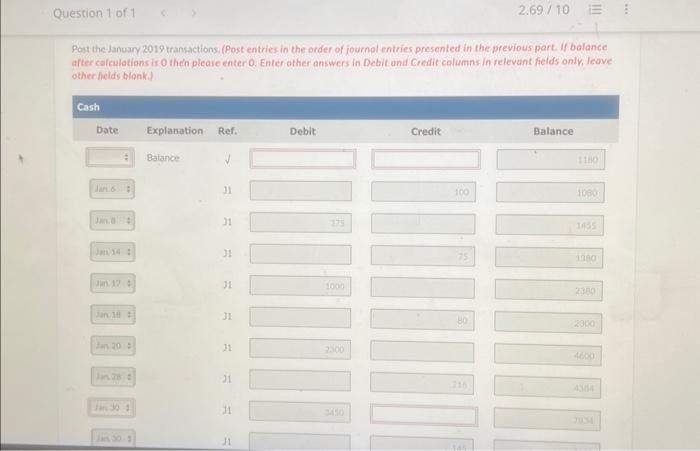

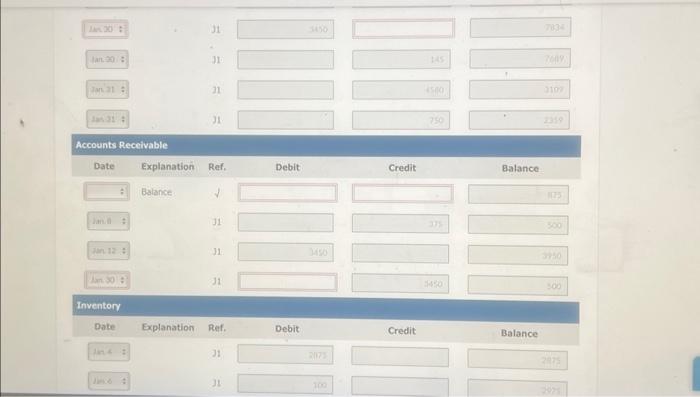

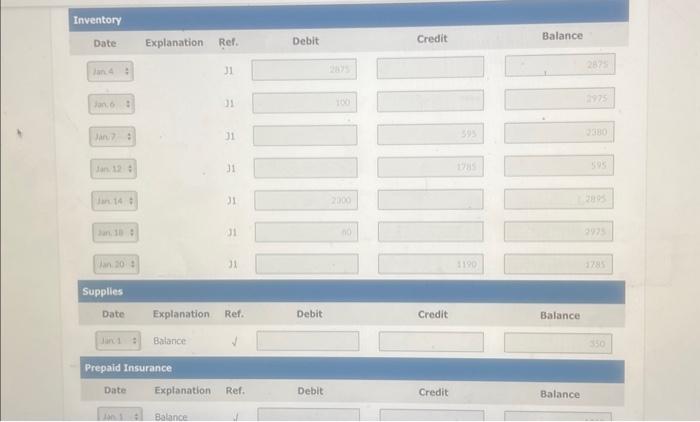

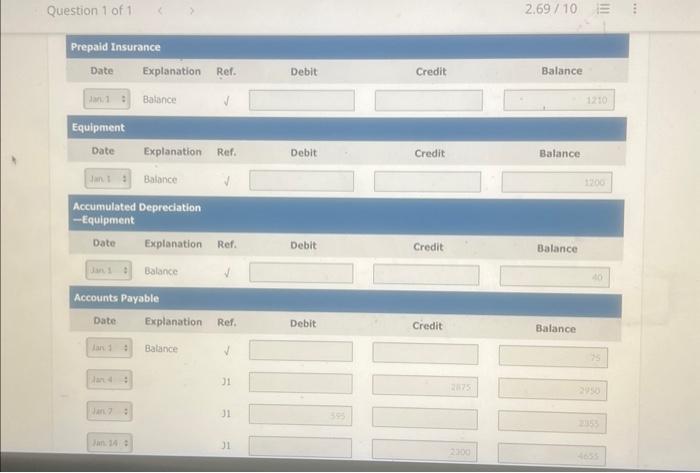

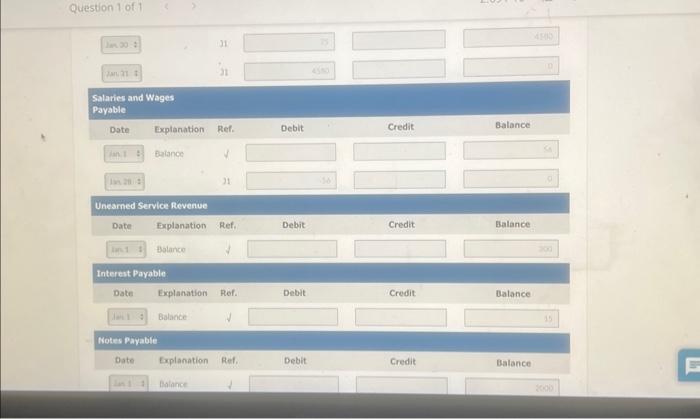

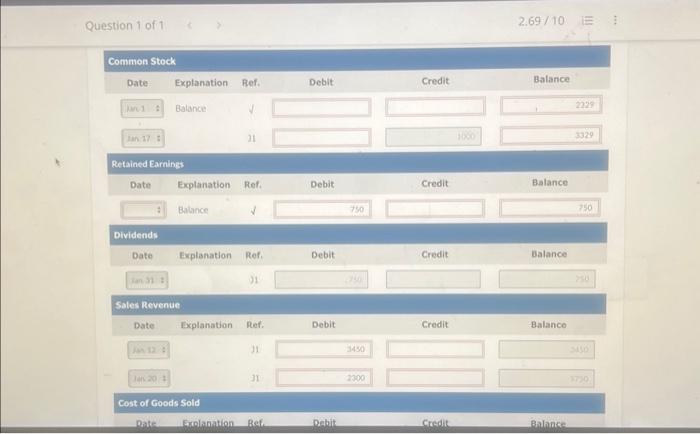

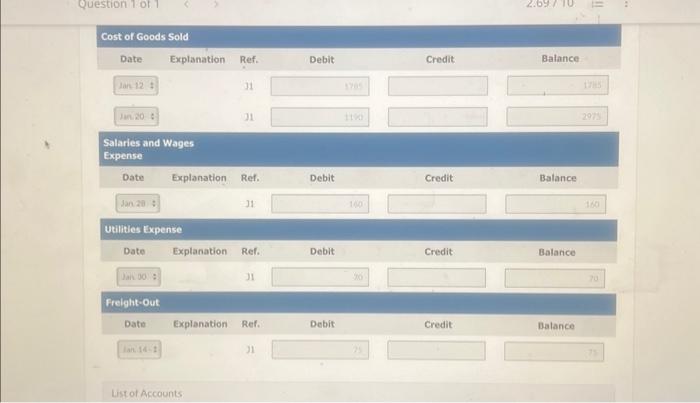

Because Natalie has had such a successful first few months, she is considering other opportunities to develop her business. One opportunity is the sale of fine European mixers. The owner of Kainski Supply Co. has approached Natalie to become the exclusive distributor of these fine mixers in her state. The current cost of a mixer is approximately $575, and Natalie would sell each one for \$1.150. Natalie comes to you for advice on how to account for these.mixers. Each appliance has a serial number agd can be easily identified. Natalie askis you the fonlowing questions. 1. Would you consider these mixers to be inventory or should they be classified as supplies or equipment?" "Tve learned a little about keeping track of inventory using both the perpetual and the periodic systems of accounting for 2. inventory. Which system do you think is better? Which one would you recommend for the type of inventory that 1 want to sell? 3. How often do I need to count imventory if I maintain it using the perpetual system? Do I need to count inventory at all?" The trial balance for cooke creations as on December 31,2018 is as follows: Post the January 2019 transactions. (Post entries in the order of journal entries presented in the previous part. If bolance after calculations is 0 thn please enter 0 . Enter other answers in Debit and Credit columns in relevant fields only, Icove other fieids blonk. \begin{tabular}{|c|c|c|c|c|c|} \hline \multicolumn{6}{|l|}{ Inventory } \\ \hline Date & Explanation & Ref. & Debit & Credit & Balance \\ \hline tan4= & & 31 & & & 287 \\ \hline & & & & & \\ \hline tan,6= & & 31 & 106 & & 20775 \\ \hline & & & & & . \\ \hline lan7: & ' & 31 & & & 2380 \\ \hline tan12 & . & 31 & & 1785 & 595 \\ \hline Jante & & 31 & 2009 & & 2805 \\ \hline tan10: & & 31 & 10 & & 2975 \\ \hline tan20:= & & 31 & & 1190 & 2785 \\ \hline \multicolumn{6}{|l|}{ Supplies : } \\ \hline Date & Explanation & Ref. & Debit & Credit & Balance \\ \hline tan1: & Balance & & & & 350 \\ \hline \multicolumn{6}{|c|}{ Prepaid Insurance } \\ \hline Date & Explanation & Ref. & Debit & Credit & Balance \\ \hline lon1 & Balance & t & & & \\ \hline \end{tabular} COOKIE CREATIONS Post-Closing Trial Balance December 31, 2018 Account Debit Credit Cash $1,180 Accounts Receivable 875 Supplies 350 Prepaid Insurance. 1.210 Equipment 1.200 Accumulated Depreciation-Equipment $40 Accounts Parable 75 Salaries and Wages Payable 56 Unearned Service Revenue 300 Interest Payable 15. Notes Payable 2.000 Common Stock 800 - Retained Earnings 800 $4,815 Question 1 of 1 2.69/10 Prepaid Insurance Date Explanation Ref. Debit Credit Balance IMM1 : Batance Equipment Date Explanation Ref. Debit Credit Balance Imin1 : Balance Accumulated Depreciation -Equipment Date Explanation Ref. Debit Credit Balance Wan 1 : Balance Accounts Payable Date Explanation Ref. Debit Credit Balance tan7: Batance lan4= J1 Jan7: 31 fan 24: 31 1210 (To record sales revenue) (To record cont of goods ssold) Lin14: frikition (To tecord delivery charges paid) sin14: (Torecord purchases made) tan17: tan16: Question 1 of 1 lin20:2 31 \begin{tabular}{|c|c|c|c|} \hline SalariesandPayable & & & \\ \hline Dote & Explanation & Ref. & Debit \\ \hline lan1: & Batance & 4 & \\ \hline & & 21 & 48 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|} \hline \multicolumn{4}{|c|}{ Unearned Servlce Revenue } \\ \hline Date & Explanation & Ref, & Debit \\ \hline lan11 & Balance & d & \\ \hline \end{tabular} Credit Balance Intereat Payable Date Explanation Ref. Debit Credit Balance Init is Balance Notes Pavabie Credit Balance Question 1 of 1 2.69/10 \begin{tabular}{|c|c|c|c|c|c|} \hline \multicolumn{6}{|l|}{ Common stock } \\ \hline Date: & Explanation & Ref. & Debit & Credit & Balance \\ \hline ln1 : & \multirow[t]{3}{*}{ Balance: } & & & & 2228 \\ \hline & & & & & \\ \hline ln17: & & 3 & & 100 & 3329 \\ \hline \multicolumn{6}{|c|}{ Retained Earnings } \\ \hline Date & Explanation & Ref. & Debit & Credit & Balance \\ \hline i) & Balance & & 750 & & 750 \\ \hline \multicolumn{6}{|l|}{ Dividends } \\ \hline Date & Explanation & Ref. & Debit & Credit & Balance \\ \hline tan3: & & 31 & & & rais \\ \hline \multicolumn{6}{|l|}{ Sales Revenue } \\ \hline Date & Explanation & Ref. & Debit & Credit & Balance \\ \hline sin12:1 & & 31 & 3450 & & \\ \hline & & 31 & 2300 & & 1720 \\ \hline \multicolumn{6}{|c|}{ Cost of Goods Sold } \\ \hline Date & Frolanation & Bef: & Pabit & Credit & Balance \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|} \hline \multicolumn{6}{|c|}{ Cost of Goods Sold } \\ \hline Date. & Explanation & Ref. & Debit & Credit & Balance \\ \hline san12= & & 31 & tyas & & this \\ \hline min20C & & 31 & 11% & & 2975 \\ \hline \multicolumn{6}{|c|}{SalariesandWagesExpense} \\ \hline Date & Explanation & Ref. & Debit & Credit & Balance \\ \hline san20: & & 31 & 1000 & & 160 \\ \hline \multicolumn{6}{|c|}{ Utilities Expense } \\ \hline Date & Explanation & Ref. & Debit & Credit & Balance \\ \hline Dan 00: & & 31 & 90 & & 70 \\ \hline \multicolumn{6}{|l|}{ Freight-out } \\ \hline Date & Explanation & Ref. & Debit & Credit: & Batance \\ \hline tan.142 & & 31 & 23 & & 78 \\ \hline \end{tabular} List of Accounts Prepars the January 2019 transactions. (Credit account titles ore au tomatically indented when amount is entered. Do not isdent manually. If ho entry is required, select "No Enfry" for the account titles and enter O for the amounts, Recond coiries in the order displayed in the problem statement.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started