Answered step by step

Verified Expert Solution

Question

1 Approved Answer

w Homework Q Search in Document Home Insert Design Layout References Mailings Review View Zotero Share Times New R... 16 A- A A abe. A

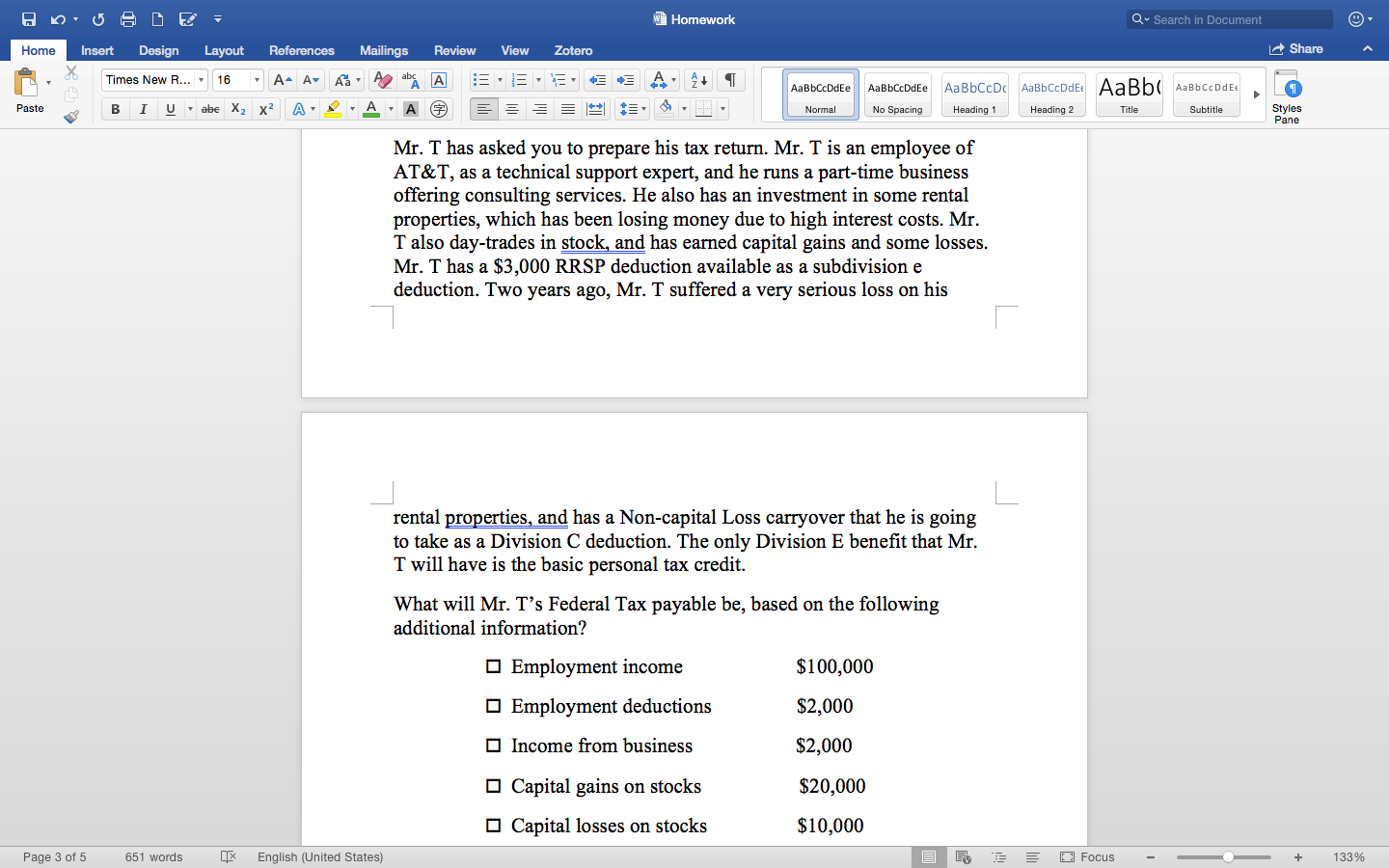

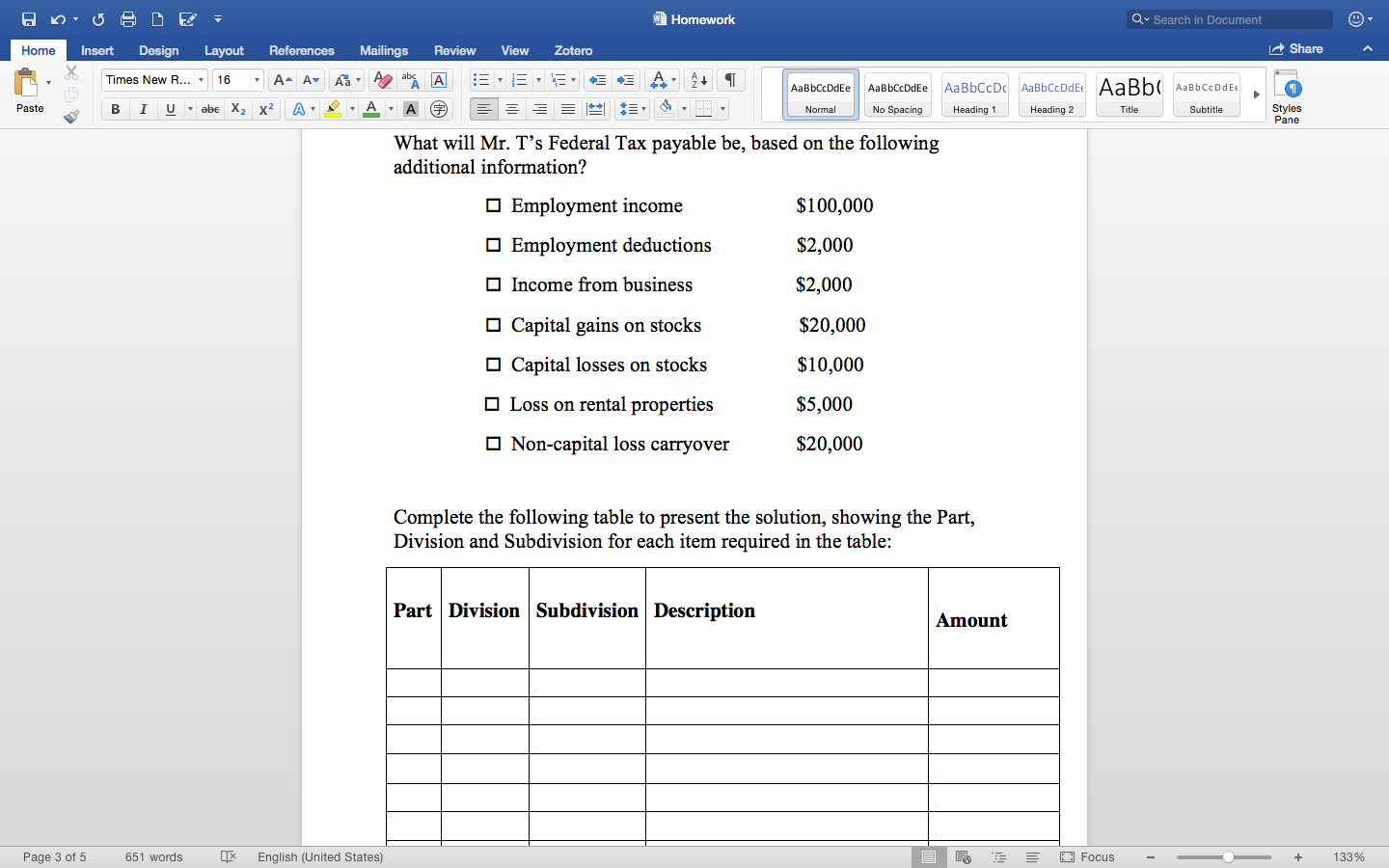

w Homework Q Search in Document Home Insert Design Layout References Mailings Review View Zotero Share Times New R... 16 A- A A abe. A + AaBbCcDdEe Aa BbCcDc AaBbCcDdE AaBb AaBbceDdEt AaBbCcDdEe Normal Paste B I Uabe Xx? A A += No Spacing Heading 1 Heading 2 Title Subtitle Styles Pane Mr. T has asked you to prepare his tax return. Mr. T is an employee of AT&T, as a technical support expert, and he runs a part-time business offering consulting services. He also has an investment in some rental properties, which has been losing money due to high interest costs. Mr. T also day-trades in stock, and has earned capital gains and some losses. Mr. T has a $3,000 RRSP deduction available as a subdivision e deduction. Two years ago, Mr. T suffered a very serious loss on his rental properties, and has a Non-capital Loss carryover that he is going to take as a Division C deduction. The only Division E benefit that Mr. I will have is the basic personal tax credit. What will Mr. T's Federal Tax payable be, based on the following additional information? $100,000 Employment income Employment deductions $2,000 Income from business $2,000 Capital gains on stocks $20,000 O Capital losses on stocks $10,000 Page 3 of 5 651 words English (United States) O Focus + 133% w Homework Q Search in Document Home Insert Design Layout References Mailings Review View Zotero Share Times New R... 16 A- A A. abe A A+ T AaBbCcDdEe AaBbCcDdEe AaBbCcDc AaBbccDdEt AaBbc AabbCeDd Ee Paste B I Uabe Xx? A Normal No Spacing Heading 1 Heading 2 Title Subtitle Styles Pane What will Mr. T's Federal Tax payable be, based on the following additional information? Employment income $100,000 Employment deductions $2,000 O Income from business $2,000 Capital gains on stocks $20,000 Capital losses on stocks $10,000 Loss on rental properties $5,000 Non-capital loss carryover $20,000 Complete the following table to present the solution, showing the Part, Division and Subdivision for each item required in the table: Part Division Subdivision Description Amount Page 3 of 5 651 words English (United States) D Focus + 133%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started