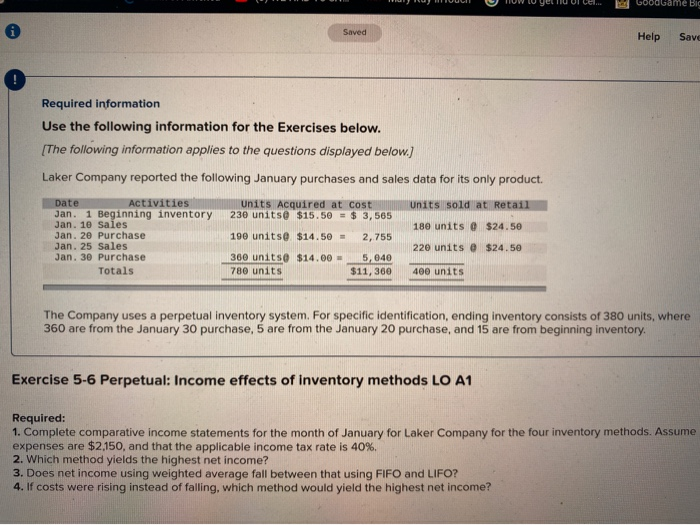

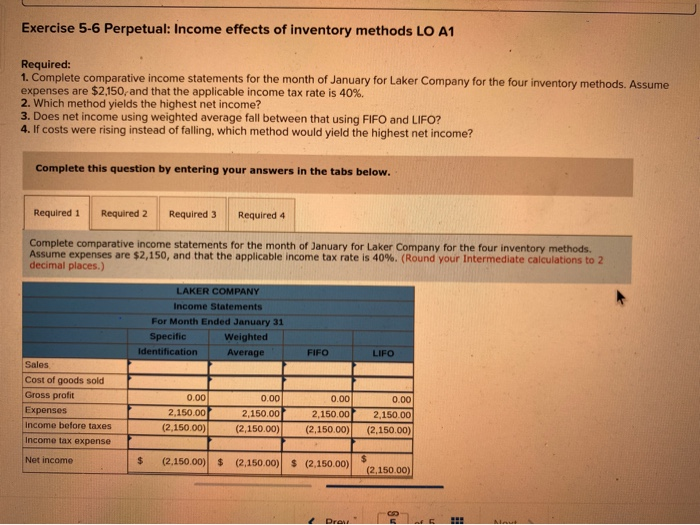

W HU HUULI U TUWIU YETU UI Cel... GoodGame Bic Saved Help Save Required information Use the following information for the Exercises below. The following information applies to the questions displayed below.) Laker Company reported the following January purchases and sales data for its only product. Units Acquired at cost 230 units@ $15.50 = $ 3,565 Units sold at Retail 180 units @ $24.50 Date Activities Jan. 1 Beginning inventory Jan. 10 Sales Jan. 20 Purchase Jan. 25 Sales Jan. 30 Purchase Totals 220 units @ $24.50 190 units@ $14.50 = 360 units@ $14.00 = 780 units 2,755 5, 640 $11,360 400 units The Company uses a perpetual inventory system. For specific ide 360 are from the January 30 purchase, 5 are from the January 20 purchase, and 15 are from beginning inventory. Exercise 5-6 Perpetual: Income effects of Inventory methods LO A1 Required: 1. Complete comparative income statements for the month of January for Laker Company for the four inventory methods. Assume expenses are $2,150, and that the applicable income tax rate is 40%. 2. Which method yields the highest net income? 3. Does net income using weighted average fall between that using FIFO and LIFO? 4. If costs were rising instead of falling, which method would yield the highest net income? Exercise 5-6 Perpetual: Income effects of inventory methods LO A1 Required: 1. Complete comparative income statements for the month of January for Laker Company for the four inventory methods. Assume expenses are $2,150, and that the applicable income tax rate is 40%. 2. Which method yields the highest net income? 3. Does net income using weighted average fall between that using FIFO and LIFO? 4. If costs were rising instead of falling, which method would yield the highest net income? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Complete comparative income statements for the month of January for Laker Company for the four inventory methods. Assume expenses are $2,150, and that the applicable income tax rate is 40%. (Round your Intermediate calculations to 2 decimal places.) LAKER COMPANY Income Statements For Month Ended January 31 Specific Weighted Identification Average FIFO LIFO Sales Cost of goods sold Gross profit 0.00 0.00 0.00 0.00 Expenses Income before taxes Income tax expense expense 2,150.00 (2,150.00) 2,150.00 (2,150.00) 2,150.00 (2,150.00) 2,150.00 (2.150.00) Net income $ 2.150.00) $ (2.150.00) $ (2.150.00) (2,150 00)