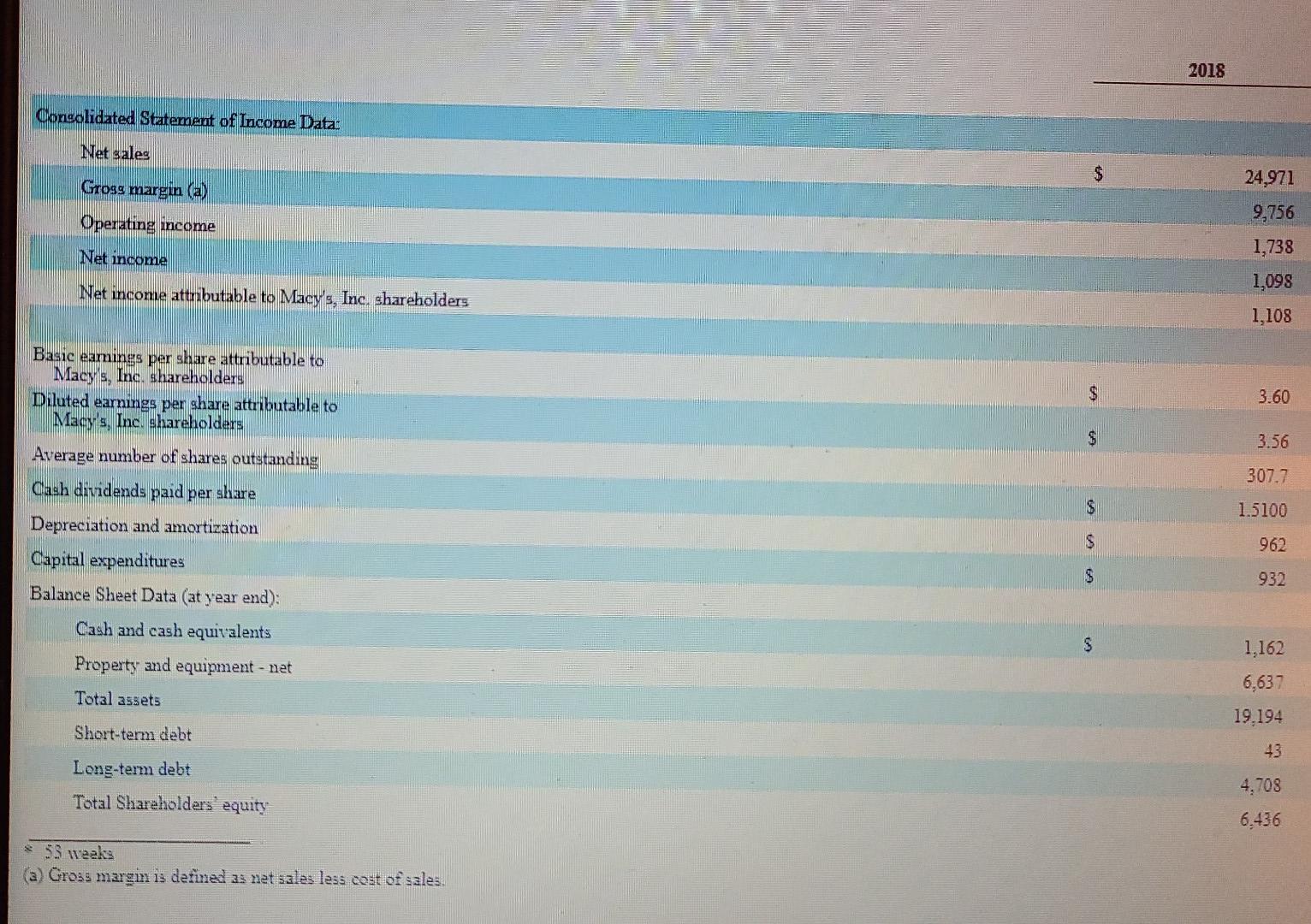

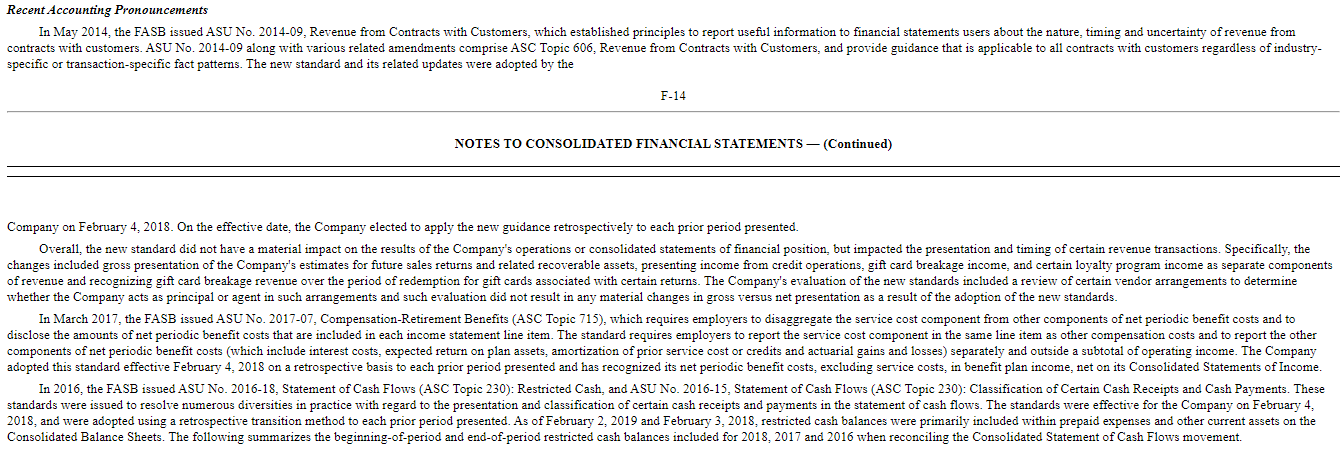

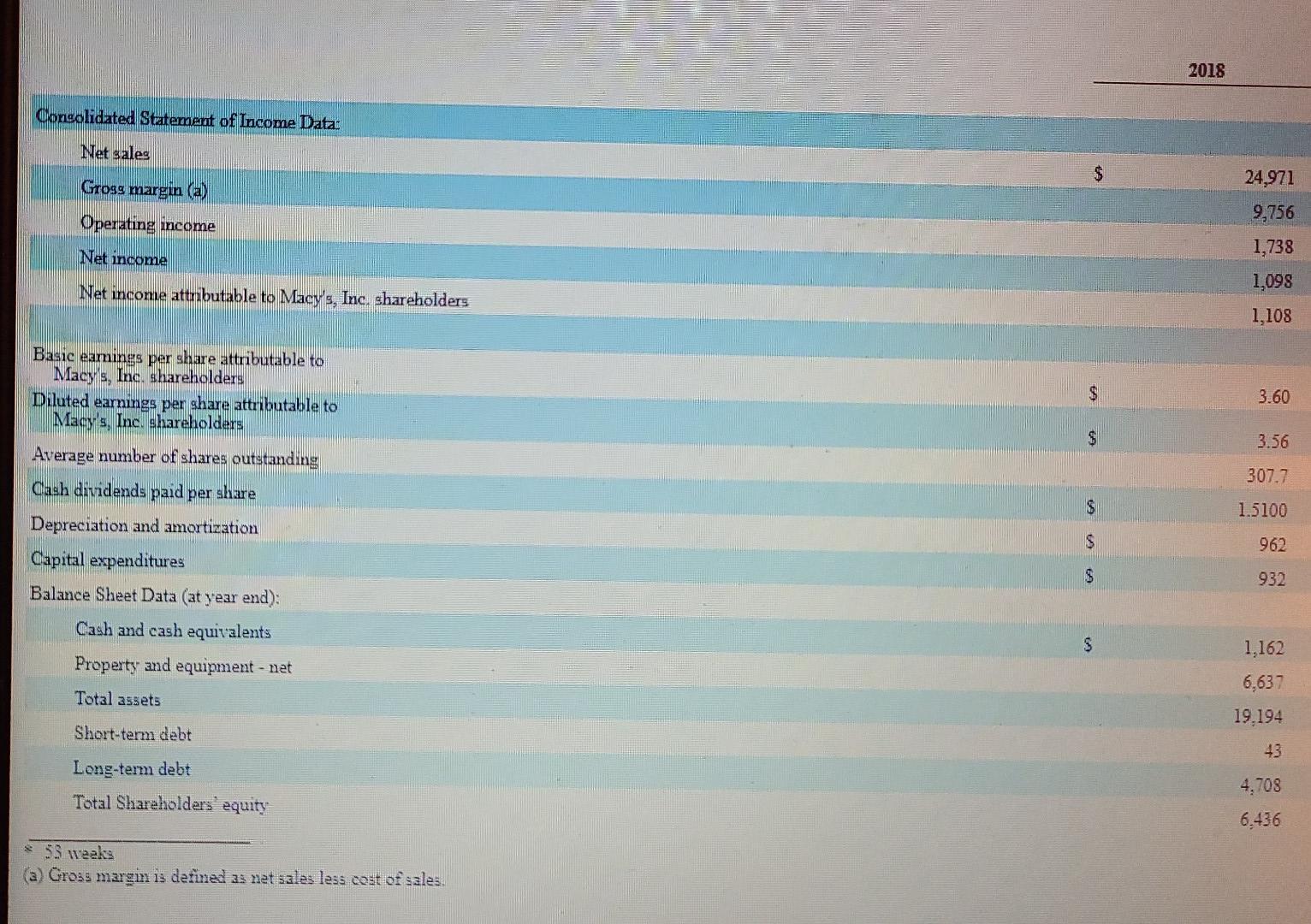

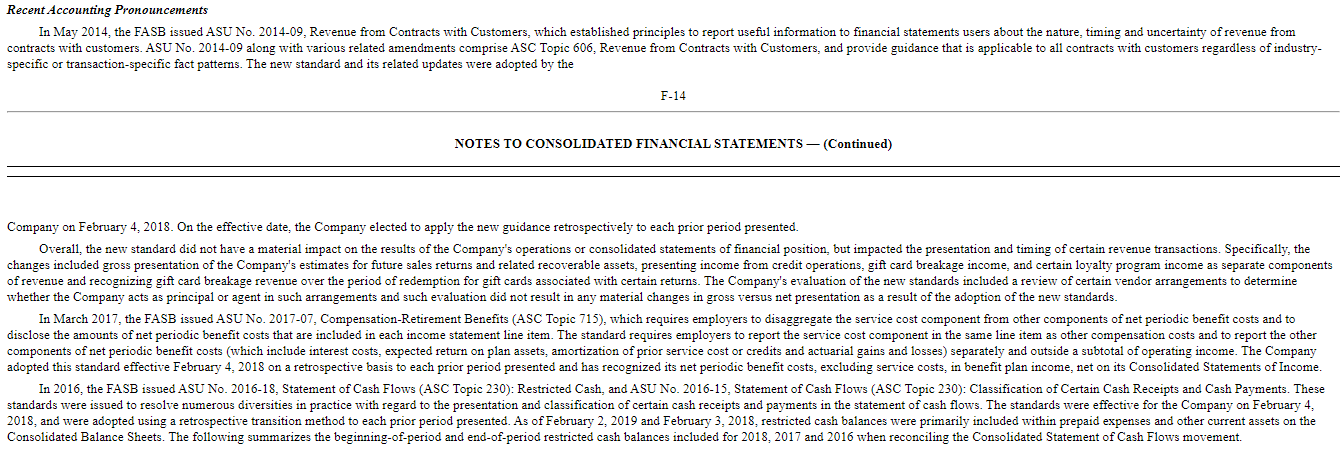

W Macy's, Inc. is a premier retailer in the United States, operating nearly 867 stores in 43 states. Macy's, Bloomingdale's, and bluemercury are all brands that operate under Macy's, Inc. The company sells a wide range of merchandise including apparel and accessories, cosmetics, home furnishings, and other goods. Macy's, Inc. purchases its merchandise from many suppliers and also develops its own private label brands. Requirements 1. Review the notes to the consolidated financial statements, specifically Recent Accounting Pronouncements. When did Macy's adopt the new revenue recognition standard (ASU No. 2014-09. Revenue from Contracts with Customers)? What impact and changes did the new revenue recognition standard have on Macy's? 2. Macy's, Inc. reported cost of sales of $15,215 million for the year ending February 2, 2019. Which financial statement is cost of sales (also known as cost of goods sold) reported on? What does cost of sales represent? What type of account is cost of sales? 3. Assume Macy's, Inc. purchases $100,000 of inventory from one of its vendors. The terms of the purchase are FOB shipping point. Who pays the freight and how does the cost of the freight get recorded? Assume Macy's uses the perpetual inventory system. 4. On which financial statement will Macy's report its merchandise inventory? How much is Macy's merchandise inventory as of February 2, 2019? 5. Assume Macy's, Inc. prepares a multi-step income statement What would the format of that income statement look like? What is one benefit of preparing a multi-step income statement for merchandising companies such as Macy's, Inc.? 2018 Congolidated Statement of Income Data: Net sales $ Grogg margin (a) 24,971 9,756 Operating income Net income 1,738 1,098 Net income attributable to Macy's, Inc. shareholders 1,108 Macy's, $ 3.60 $ 3.56 307.7 Basic eamings per share attributable to Inc. shareholders Diluted earnings per share attributable to Macy's, Inc. shareholders Average number of shares outstanding Cash dividends paid per share Depreciation and amortization Capital expenditures Balance Sheet Data (at year end): Cash and cash equivalents Property and equipment - net $ 1.5100 $ 962 $ 932 S 1,162 6,637 19.194 Total assets Short-term debt 43 Long-term debt 4,708 Total Shareholders equity 6.436 weeks (a) Gross margin is defined as net sales less cost of sales, Recent Accounting Pronouncements In May 2014, the FASB issued ASU No. 2014-09, Revenue from Contracts with Customers, which established principles to report useful information to financial statements users about the nature, timing and uncertainty of revenue from contracts with customers. ASU No. 2014-09 along with various related amendments comprise ASC Topic 606, Revenue from Contracts with Customers, and provide guidance that is applicable to all contracts with customers regardless of industry- specific or transaction-specific fact patterns. The new standard and its related updates were adopted by the F-14 NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) Company on February 4, 2018. On the effective date, the Company elected to apply the new guidance retrospectively to each prior period presented. Overall, the new standard did not have a material impact on the results of the Company's operations or consolidated statements of financial position, but impacted the presentation and timing of certain revenue transactions. Specifically, the changes included gross presentation of the Company's estimates for future sales returns and related recoverable assets, presenting income from credit operations, gift card breakage income, and certain loyalty program income as separate components of revenue and recognizing gift card breakage revenue over the period of redemption for gift cards associated with certain returns. The Company's evaluation of the new standards included a review of certain vendor arrangements to determine whether the Company acts as principal or agent in such arrangements and such evaluation did not result in any material changes in gross versus net presentation as a result of the adoption of the new standards. In March 2017, the FASB issued ASU No. 2017-07, Compensation-Retirement Benefits (ASC Topic 715), which requires employers to disaggregate the service cost component from other components of net periodic benefit costs and to disclose the amounts of net periodic benefit costs that are included in each income statement line item. The standard requires employers to report the service cost component in the same line item as other compensation costs and to report the other components of net periodic benefit costs (which include interest costs, expected return on plan assets, amortization of prior service cost or credits and actuarial gains and losses) separately and outside a subtotal of operating income. The Company adopted this standard effective February 4, 2018 on a retrospective basis to each prior period presented and has recognized its net periodic benefit costs, excluding service costs, in benefit plan income, net on its Consolidated Statements of Income. In 2016, the FASB issued ASU No. 2016-18, Statement of Cash Flows (ASC Topic 230): Restricted Cash, and ASU No. 2016-15, Statement of Cash Flows (ASC Topic 230): Classification of Certain Cash Receipts and Cash Payments. These standards were issued to resolve numerous diversities in practice with regard to the presentation and classification of certain cash receipts and payments in the statement of cash flows. The standards were effective for the Company on February 4, 2018, and were adopted using a retrospective transition method to each prior period presented. As of February 2, 2019 and February 3, 2018, restricted cash balances were primarily included within prepaid expenses and other current assets on the Consolidated Balance Sheets. The following summarizes the beginning-of-period and end-of-period restricted cash balances included for 2018, 2017 and 2016 when reconciling the Consolidated Statement of Cash Flows movement