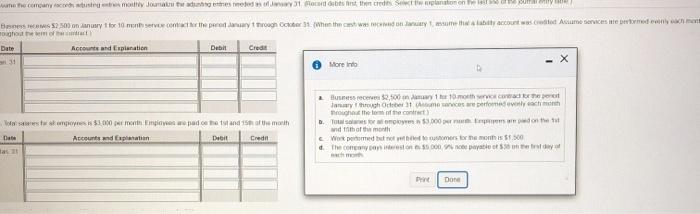

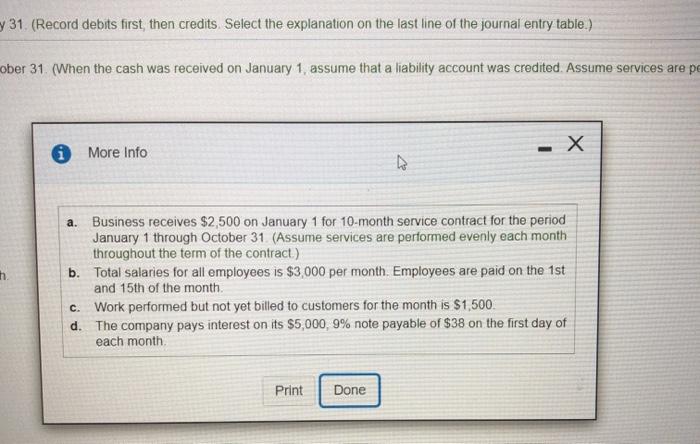

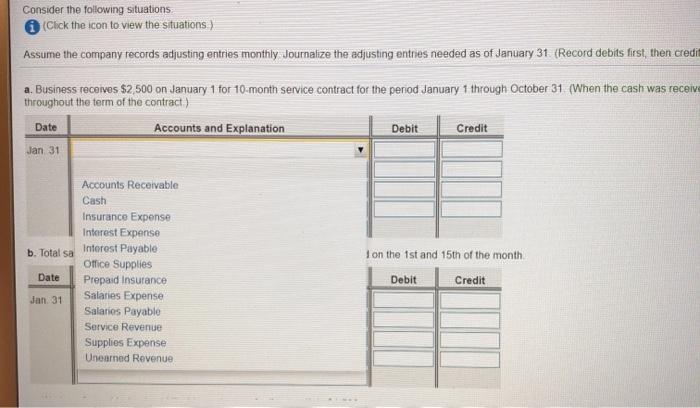

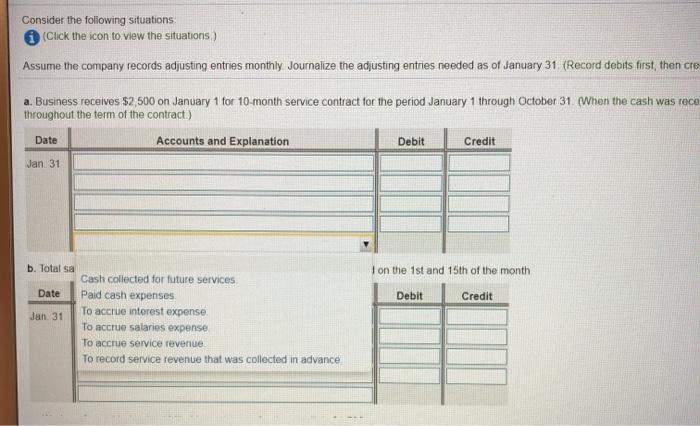

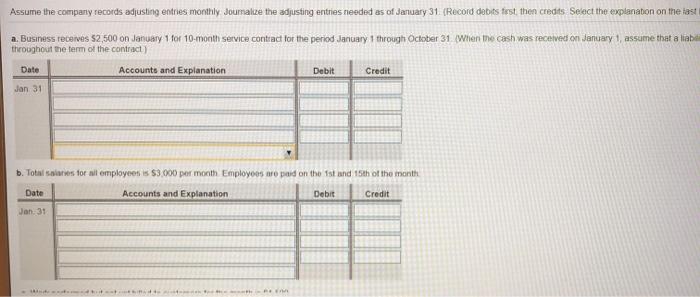

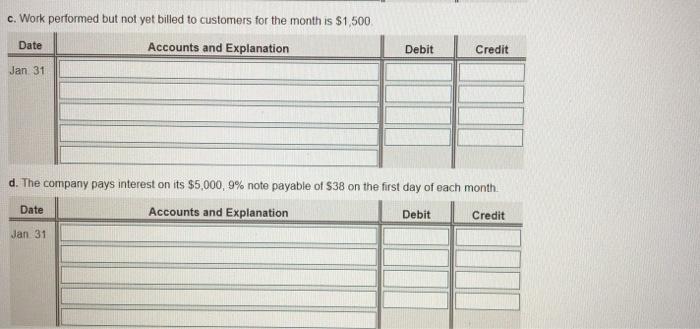

w the context mit Joan de fotos de plannen B 2.0 or 1 to 10 metery rough when the www was created Acium vicesine med nye me hemoft Account and Explanation Debit Credit 31 More Indo Wat ke 3 000 m Impiado hot and 15 moi Date Account and Explanation Debit Credo 2. Berece,000 motor Jan desperat that the forme content D. T.000 and that this month Wome to more months 500 The content on pable of the Done 31. (Record debits first, then credits Select the explanation on the last line of the journal entry table.) ober 31. (When the cash was received on January 1, assume that a liability account was credited. Assume services are pe * More Info a. Business receives $2,500 on January 1 for 10-month service contract for the period January 1 through October 31 (Assume services are performed evenly each month throughout the term of the contract) b. Total salaries for all employees is $3,000 per month. Employees are paid on the 1st and 15th of the month c. Work performed but not yet billed to customers for the month is $1,500 d. The company pays interest on its $5,000,9% note payable of $38 on the first day of each month Print Done Consider the following situations (Click the icon to view the situations ) Assume the company records adjusting entries monthly Journalize the adjusting entries needed as of January 31 (Record debits first, then credit a. Business receives $2,500 on January 1 for 10-month service contract for the period January 1 through October 31 (When the cash was receive throughout the term of the contract) Accounts and Explanation Debit Credit Date Jan 31 I on the 1st and 15th of the month Accounts Receivable Cash Insurance Expense Interest Expense b. Total sa Interest Payable Office Supplies Date Prepaid Insurance Salaries Expense Jan 31 Salarios Payable Service Revenue Supplies Expense Unearned Revenue Debit Credit Consider the following situations Click the icon to view the situations) Assume the company records adjusting entries monthly Journalize the adjusting entries needed as of January 31 (Record debits first, then cte a. Business receives $2.500 on January 1 for 10-month service contract for the period January 1 through October 31. When the cash was rece throughout the term of the contract) Date Accounts and Explanation Debit Credit Jan 31 I on the 1st and 15th of the month Debit Credit b. Total sa Cash collected for future services Date Paid cash expenses To accrue interest expense Jan. 31 To accrue salaries expense To accrue service revenue To record service revenue that was collected in advance Assume the company records adjusting entries monthly Journalize the adjusting entries needed as of January 31 (Record debts fest, then credits Select the explanation on the tast a. Business receives 52,500 on January 1 for 10-month service contract for the period January 1 through October 31. When the cash was recenved on January 1, assume that a liabi throughout the term of the contract) Date Accounts and Explanation Debit Credit Jan 31 b. Total sales for all employees is $3.000 per month Employees are paid on the 1st and 15th of the month Date Accounts and Explanation Debit Credit Jan 31 c. Work performed but not yet billed to customers for the month is $1,500 Date Accounts and Explanation Debit Credit Jan 31 d. The company pays interest on its $5,000,9% note payable of $38 on the first day of each month Date Accounts and Explanation Debit Credit Jan 31