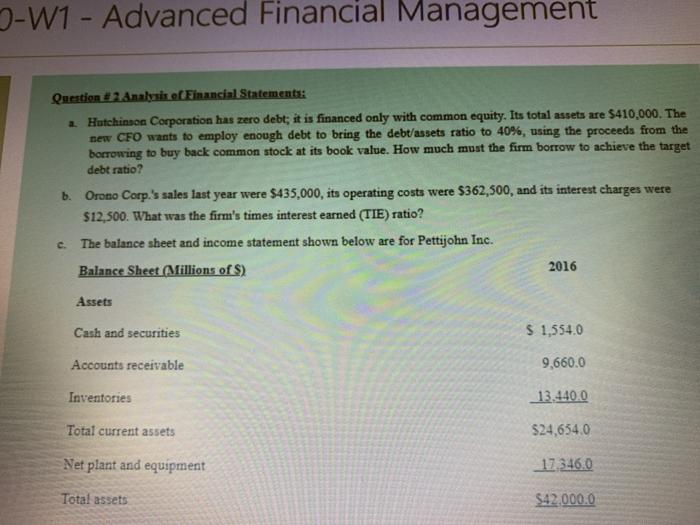

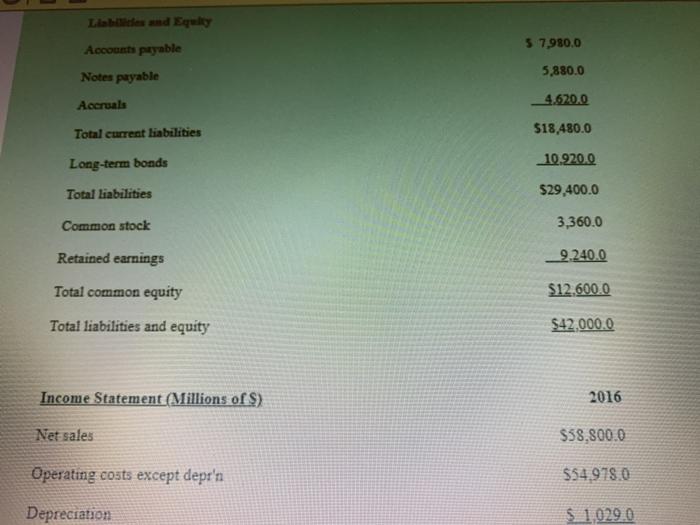

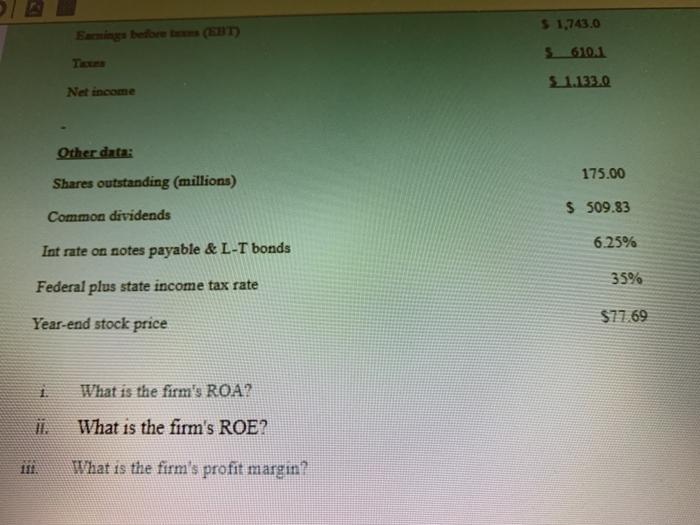

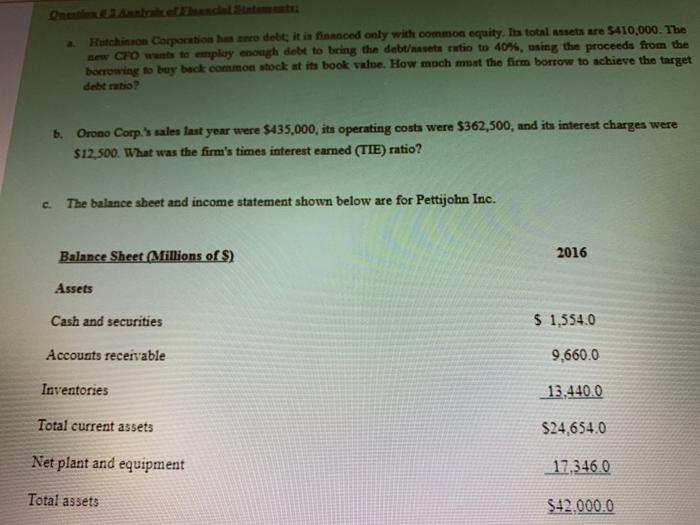

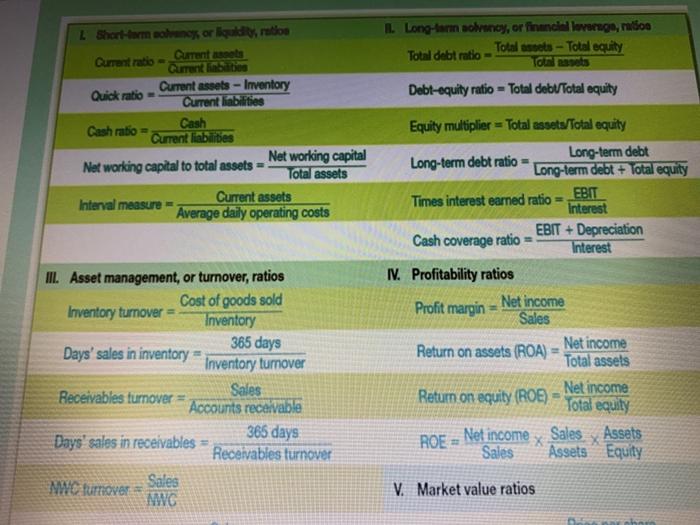

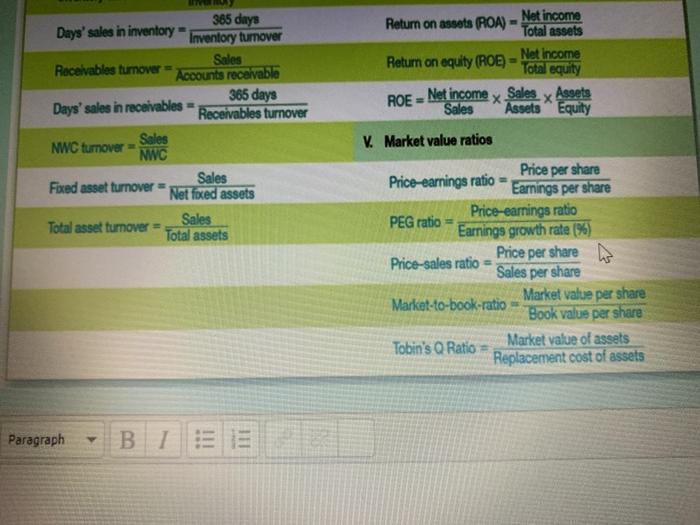

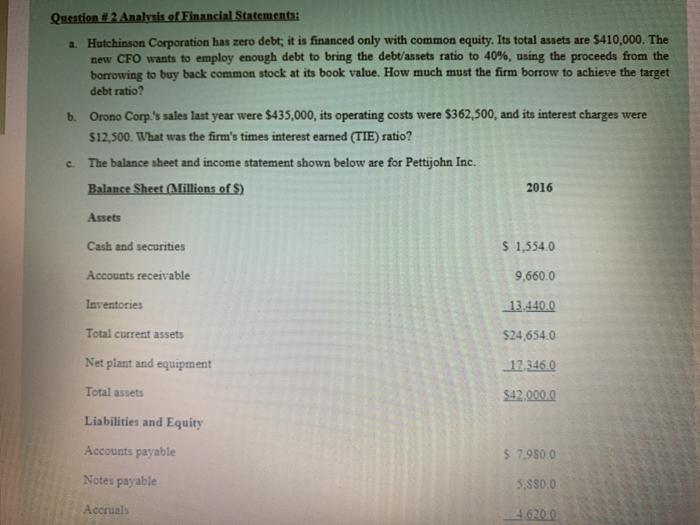

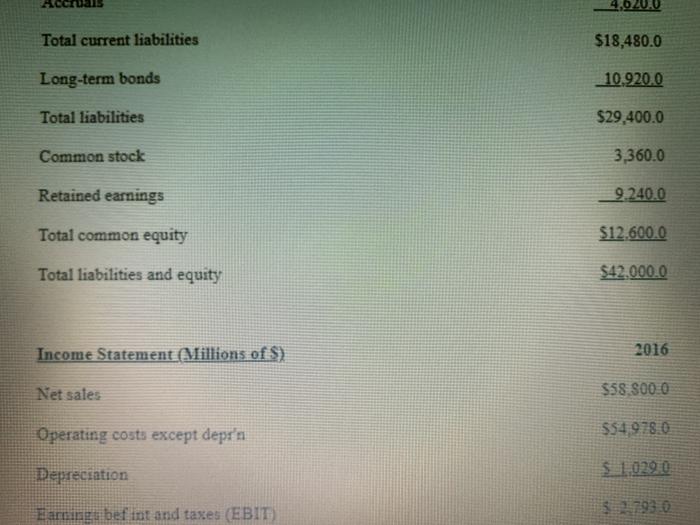

-W1 - Advanced Financial Management Question Analysis of Financial Statements: a Hutchinson Corporation has zero debt; it is financed only with common equity. Its total assets are $410,000. The new CFO wants to employ enough debt to bring the debt/assets ratio to 40%, using the proceeds from the borrowing to buy back common stock at its book value. How much must the firm borrow to achieve the target debt ratio? b. Orono Corp.'s sales last year were $435,000, its operating costs were $362,500, and its interest charges were $12,500. What was the firm's times interest earned (TIE) ratio? The balance sheet and income statement shown below are for Pettijohn Inc. Balance Sheet (Millions of S) 2016 Assets Cash and securities $ 1,554.0 Accounts receivable 9,660.0 Inventories 13,440.0 Total current assets $24,654.0 Net plant and equipment 17.346,0 Total assets $42,000.0 Liables and Equity 5 7.980.0 Accounts payable Notes payable 5,880.0 Accruals 4.620.0 Total current liabilities $18.480.0 Long-term bonds 10.920,0 Total liabilities $29,400.0 Common stock 3,360.0 Retained earnings 9.240.0 Total common equity $12.600.0 Total liabilities and equity $42.000.0 Income Statement (Millions of $) 2016 Net sales $58.800.0 Operating costs except depr'n $54.9780 Depreciation S 1029.0 $ 1,743.0 Famiga before (ET) 56101 5.1.133.0 Net income Other data: 175.00 Shares outstanding (millions) $ 509.83 Common dividends 6.25% Intrate on notes payable & L-T bonds 35% Federal plus state income tax rate Year-end stock price $77.69 What is the firm's ROA? What is the firm's ROE? What is the firm's profit margin? Hutchinson Corporation has no debt, it is acced only with common equity. The total assets are $410,000. The De CFO wants to employ enough debt to bring the debtases rutio to 40%, using the proceeds from the borrowing to buy back common stock at its book value. How much must the firm borrow to achieve the target debetto b. Orono Corp.'s sales last year were $435,000, its operating costs were $362,500, and its interest charges were $12,500. What was the firm's times interest earned (TIE) ratio? c. The balance sheet and income statement shown below are for Pettijohn Inc. Balance Sheet Millions of $) 2016 Assets Cash and securities $ 1,554.0 Accounts receivable 9.660.0 Inventories 13.440.0 Total current assets $24.654.0 Net plant and equipment 17,346.0 Total assets $42.000.0 L. Long-term sonoy, or financial leverage, nation Total debt ratio- Total sets - Total equity Jonats Debt-equity ratio - Total debTotal equity L Short-term songs, or liquidity ratio Current sets Current limba Current assets - Inventory Quick ratio Current liabilities Cash ratio Cash Current liabilities Net working capital to total assets Net working capital Total assets Interval measure Current assets Average daily operating costs III. Asset management, or turnover, ratios Cost of goods sold Inventory turnover Inventory 365 days Days' sales in inventory Inventory turnover Sales Receivables turnover Accounts receivable 365 days Days' sales in receivables = Receivables turnover Sales MWC furtover NVC Equity multiplier = Total assets/Total equity Long-term debt Long-term debt ratio Long-term debt + Total equity EBIT Times interest earned ratio = Interest EBIT + Depreciation Cash coverage ratio- Interest I. Profitability ratios Profit margin Net income Sales Return on assets (ROA) Net income Total assets Net income Return on equity (ROE) Total equity ROE Net income Sales Assets Sales Assets Equity V. Market value ratios Net income 365 days Days' sales in inventory Inventory tumover Sales Receivables turnover Accounts receivable 365 days Days' sales in receivables - Receivables turnover Sales MWC tumover NWC Sales Fixed asset turnover = Net foxed assets Sales Total asset turnover Total assets Return on assots (POA) Total assets Net Income Return on equity (ROE) Total equity ROE = Net income x Sales x Assets Sales Assets Equity V. Market value ratios Price per share Price-earnings ratio - Earnings per share Price-earnings ratio PEG ratio Earnings growth rate (%) Price per share Price-sales ratio Sales per share Market value per share Market-to-book-ratio Book value per share Tobin's Q Ratio Market value of assets Replacement cost of assets Paragraph BIE Question ? Analysis of Financial Statements: a. Hutchinson Corporation has zero debt, it is financed only with common equity. Its total assets are $410,000. The new CFO wants to employ enough debt to bring the debt/assets ratio to 40%, using the proceeds from the borrowing to buy back common stock at its book value. How much must the firm borrow to achieve the target debt ratio? b. Orono Corp.'s sales last year were $435,000, its operating costs were $362,500, and its interest charges were $12,500. What was the firm's times interest earned (TIE) ratio? The balance sheet and income statement shown below are for Pettijohn Inc. Balance Sheet Millions of $) 2016 c Assets Cash and securities $ 1,554.0 9,660.0 Accounts receivable Inventories 13.440.0 S24,654.0 Total current assets Net plant and equipment 12.346.0 Total assets $42.000.0 Liabilities and Equity Accounts payable $ 79500 Notes payable 5.890.0 Accruals 46200 comuals 4,020.0 Total current liabilities $18,480.0 Long-term bonds 10.920.0 Total liabilities $29,400.0 Common stock 3,360.0 Retained earnings 9.240.0 Total common equity $12.600.0 Total liabilities and equity $42.000.0 Income Statement Millions of S) 2016 Net sales $58 8000 Operating costs except depi'n $$4.978.0 Depreciation $ 1029 0 Ezu befint and taxes (EBIT)