Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(W12) please help!! i have most of these figured out, i just need someone check them and tell me how im getting wrong :/ literally

(W12) please help!! i have most of these figured out, i just need someone check them and tell me how im getting wrong :/ literally figured out the whole question except one part. thank you!!

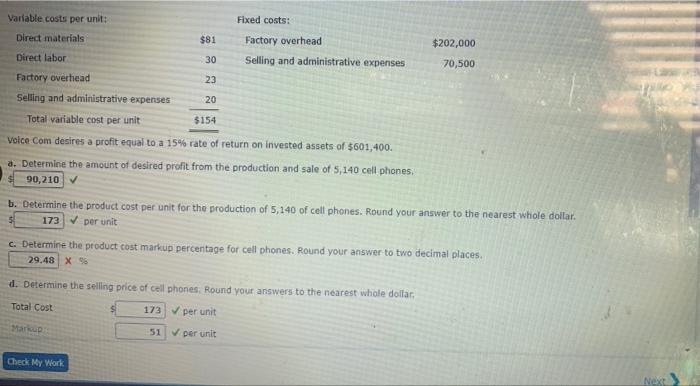

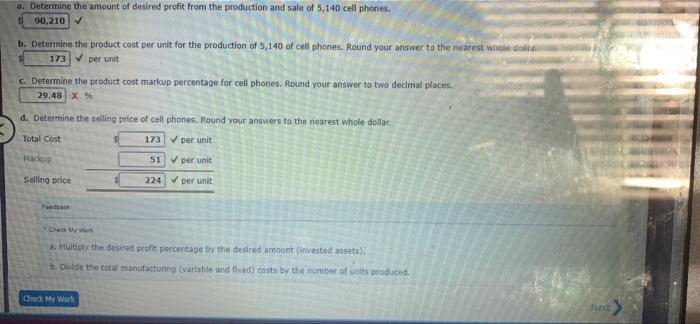

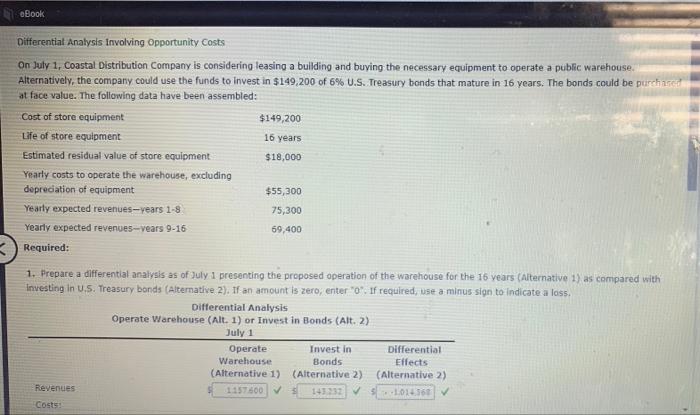

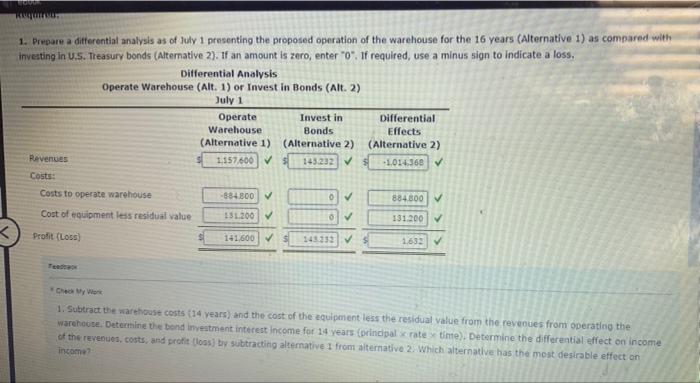

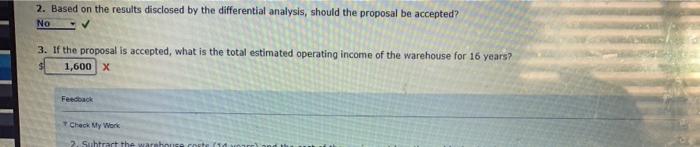

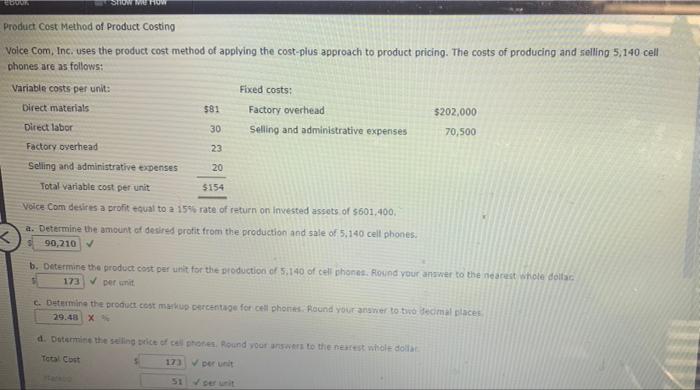

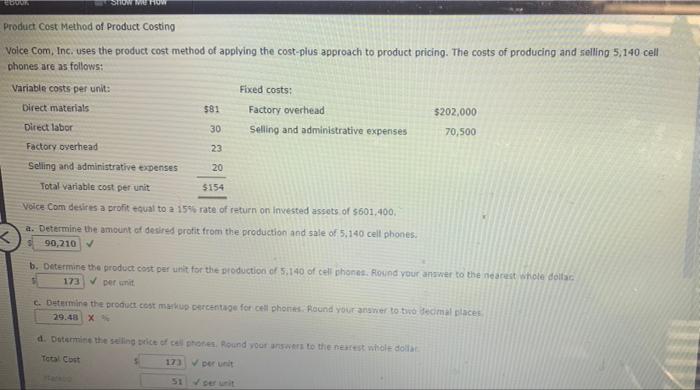

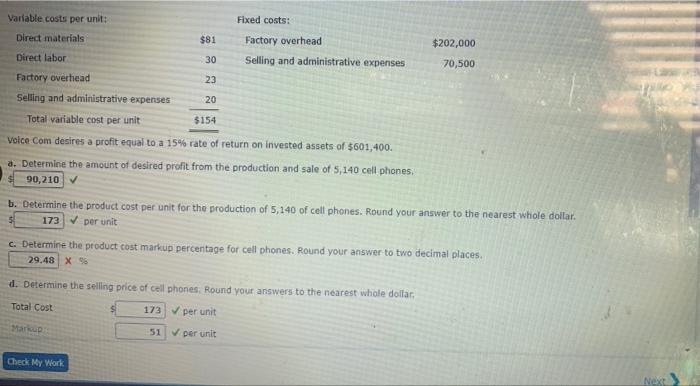

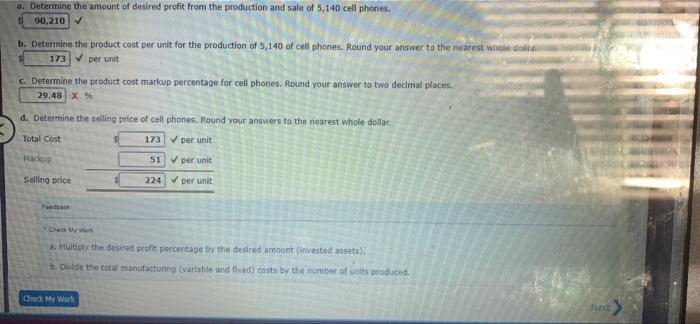

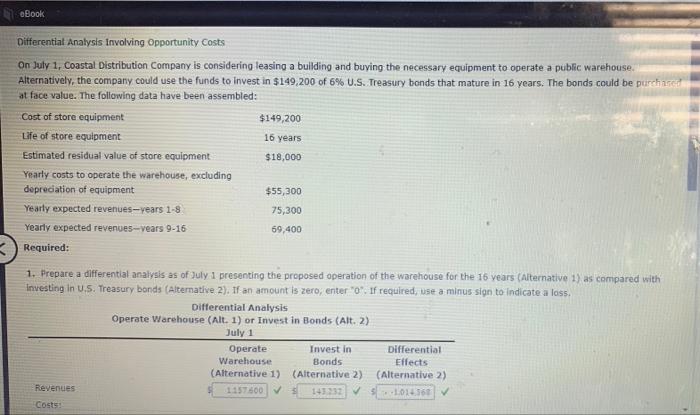

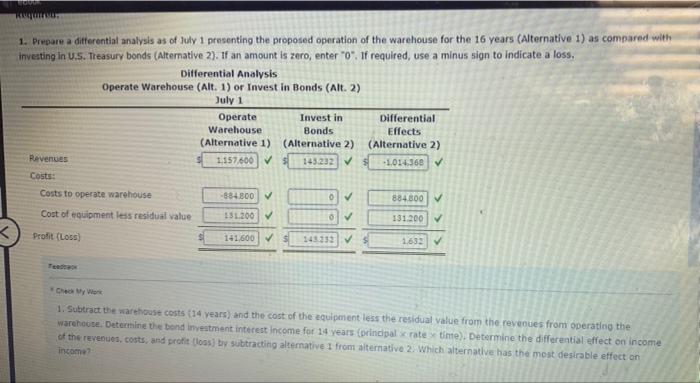

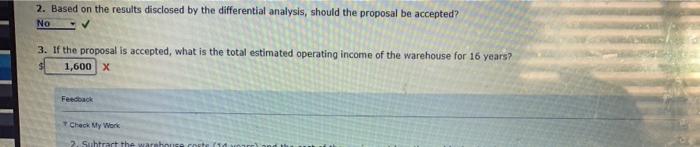

ebook Product Cost Method of Product Costing Voice Com, Inc. uses the product cost method of applying the cost-plus approach to product pricing. The costs of producing and selling 5,140 cell phones are as follows: Variable costs per unit: Fixed costs: Direct materials $81 Factory overhead $202,000 Direct labor 30 Selling and administrative expenses 70,500 Factory overhead 23 Selling and administrative expenses 20 Total variable cost per unit $154 Voice Com desires a profit equal to a 15% rate of return on invested assets of $601,400. a. Determine the amount of desired profit from the production and sale of 5,140 cell phones. 90,210 b. Determine the product cost per unit for the production of 5,140 of cell phones. Round your answer to the nearest whole dollac 173 per unit c. Determine the product cost markup percentage for cell phones. Round your answer to two decimal places 29.48 X % d. Determine the selling price of cell phones. Round your answers to the nearest whole dollar Total Cost 173 per unit Variable costs per unit: Direct materials $81 Factory overhead $202,000 70,500 Direct labor. 30 Selling and administrative expenses 23 Factory overhead Selling and administrative expenses 20 Total variable cost per unit $154 Voice Com desires a profit equal to a 15% rate of return on invested assets of $601,400. a. Determine the amount of desired profit from the production and sale of 5,140 cell phones. $90,210 b. Determine the product cost per unit for the production of 5,140 of cell phones. Round your answer to the nearest whole dollar. 173 per unit c. Determine the product cost markup percentage for cell phones. Round your answer to two decimal places. 29.48 X 96 d. Determine the selling price of cell phones. Round your answers to the nearest whole dollar Total Cost 173 per unit Markup 51 per unit Check My Work Fixed costs: Next a. Determine the amount of desired profit from the production and sale of 5,140 cell phones. 90,210 b. Determine the product cost per unit for the production of 5,140 of cell phones. Round your answer to the nearest whole dolin 173 per unit c. Determine the product cost markup percentage for cell phones. Round your answer to two decimal places. 29.48 X % d. Determine the selling price of cell phones. Round your answers to the nearest whole dollar. Total Cost 173 per unit Markup 51 per unit 224 per unit Selling price Feedback Check My Wo a. Multiply the desired profit percentage by the desired amount (invested assets). b. Divide the total manufacturing (variable and fixed) costs by the number of units produced. Check My Work Nod eBook Differential Analysis Involving Opportunity Costs On July 1, Coastal Distribution Company is considering leasing a building and buying the necessary equipment to operate a public warehouse. Alternatively, the company could use the funds to invest in $149,200 of 6% U.S. Treasury bonds that mature in 16 years. The bonds could be purchased at face value. The following data have been assembled: Cost of store equipment $149,200 Life of store equipment 16 years Estimated residual value of store equipment $18,000 Yearly costs to operate the warehouse, excluding depreciation of equipment $55,300 Yearly expected revenues-years 1-8 75,300 Yearly expected revenues-vears 9-16 69,400 Required: 1. Prepare a differential analysis as of July 1 presenting the proposed operation of the warehouse for the 16 years (Alternative 1) as compared with Investing in U.S. Treasury bonds (Alternative 2). If an amount is zero, enter "0". If required, use a minus sign to indicate a loss. Differential Analysis Operate Warehouse (Alt. 1) or Invest in Bonds (Alt. 2) July 1 Operate Invest in Differential Effects Warehouse Bonds (Alternative 1) (Alternative 2) (Alternative 2) 1157600 143 232 1014368 Revenues Costs: Bood Required. 1. Prepare a differential analysis as of July 1 presenting the proposed operation of the warehouse for the 16 years (Alternative 1) as compared with investing in U.S. Treasury bonds (Alternative 2). If an amount is zero, enter "0". If required, use a minus sign to indicate a loss, Differential Analysis Operate Warehouse (Alt. 1) or Invest in Bonds (Alt. 2) July 1 Operate Invest in Bonds Differential Effects Warehouse (Alternative 1) (Alternative 2) (Alternative 2) 1,157,600 S 143.232 -1.014.368 Revenues Costs: Costs to operate warehouse -884.800 0 884.800 V Cost of equipment less residual value 131.200 0 131.200 Profit (Loss) 141,600 145.232 1632 Check My Work 1. Subtract the warehouse costs (14 years) and the cost of the equipment less the residual value from the revenues from operating the warehouse. Determine the bond investment interest income for 14 years (principal x ratex time). Determine the differential effect on income of the revenues, costs, and profit (loss) by subtracting alternative 1 from alternative 2. Which alternative has the most desirable effect on income? 1.)

2.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started