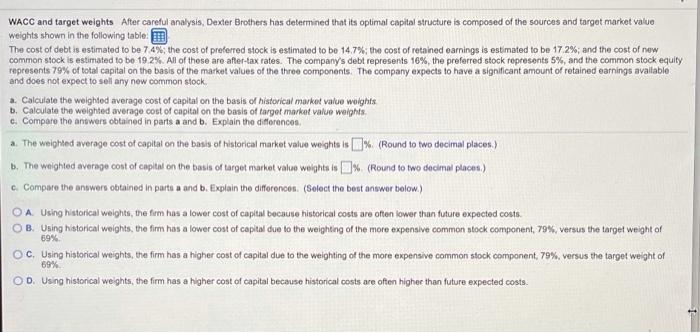

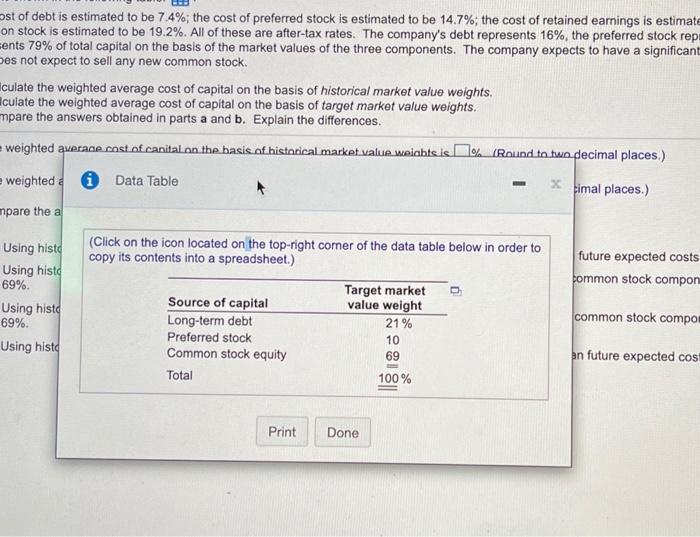

WACC and target weights After careful analysis, Dexder Brothers has determined that its optimal capital structure is composed of the sources and target market value weights shown in the following table: The cost of debt is estimated to be 74%; the cost of preferred stock is estimated to be 14.7%; the cost of retained earnings is estimated to be 17.2%; and the cost of new common stock is estimated to be 19.2%. All of these are after-tax rates. The company's debt represents 16%, the preferred stock represents 5%, and the common stock equity represents 79% of total capital on the basis of the market values of the three components. The company expects to have a significant amount of retained earnings available and does not expect to sell any new common stock a Calculate the weighted average cost of capital on the basis of historical market value weights. b. Calculate the weighted average cost of capital on the basis of target market value weights c. Compare the antwers obtained in parts a and b. Explain the differences, a. The weighted average cost of capital on the basis of historical market value weights is % (Round to wo decimal places.) b. The weighted average cost of capital on the basis of target market value weights le % (Round to two decimal places.) c. Compare the answers obtained in parts a and b. Explain the differences. (Select the best answer below.) O A Using historical welghts, the firm has a lower cost of capital becaule historical costu are often lower than future expected costs. B. Using historical wolghts, the firm has a lower cost of capital due to the weighing of the more expensive common stock component, 79%, versus the target weight of 69% OC. Using historical weights, the firm has a higher cost of capital due to the weighting of the more expensive common stock component, 79%, versus the target weight of 69% OD. Using historical weights, the firm has a higher cost of capital because historical costs are often higher than future expected costs. st of debt is estimated to be 7.4%; the cost of preferred stock is estimated to be 14.7%; the cost of retained earnings is estimate on stock is estimated to be 19.2%. All of these are after-tax rates. The company's debt represents 16%, the preferred stock rep ents 79% of total capital on the basis of the market values of the three components. The company expects to have a significant Des not expect to sell any new common stock. Hlculate the weighted average cost of capital on the basis of historical market value weights. culate the weighted average cost of capital on the basis of target market value weights. mpare the answers obtained in parts a and b. Explain the differences. weighted averane cost of canital on the basis of historical market value wichts.is. % (Round to two decimal places.) -weighted 0 Data Table X imal places.) mpare the a (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) future expected costs common stock compon Using histo Using histo 69% Using histo 69% Using histo Target market value weight 21% common stock compor Source of capital Long-term debt Preferred stock Common stock equity 10 69 an future expected cost Total 100% Print Done