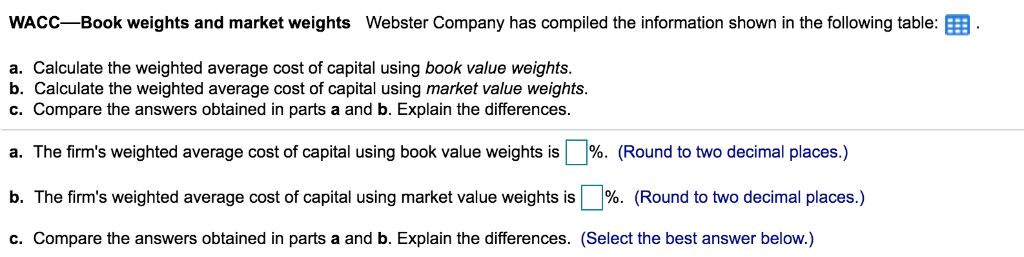

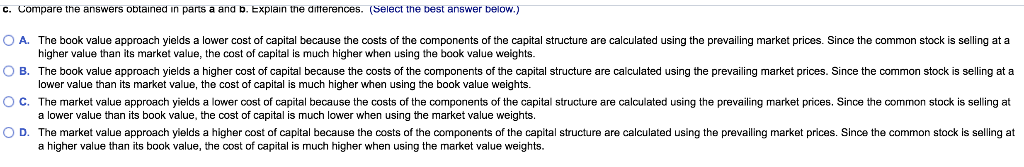

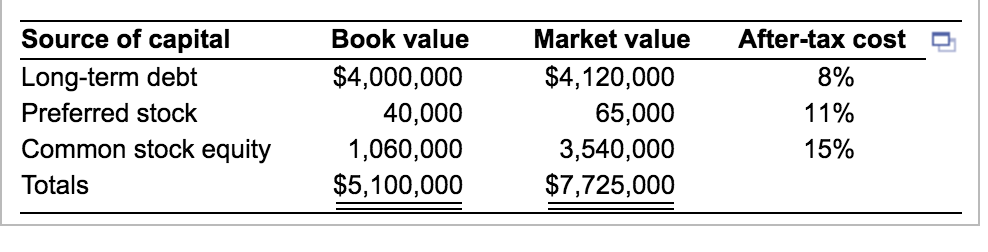

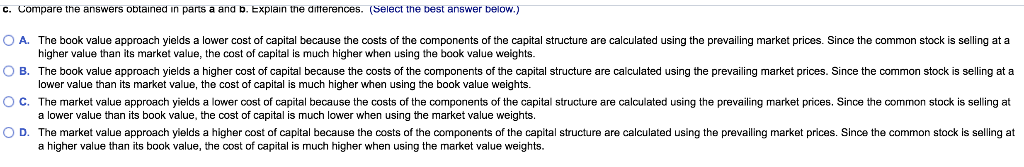

WACC Book weights and market weights Webster Company has compiled the information shown in the following table: a. Calculate the weighted average cost of capital using book value weights. b. Calculate the weighted average cost of capital using market value weights c. Compare the answers obtained in parts a and b. Explain the differences. a. The firm's weighted average cost of capital using book value weights is %. (Round to two decimal places.) b. The firm's weighted average cost of capital using market value weights is | %. (Round to two decimal places.) c. Compare the answers obtained in parts a and b. Explain the differences. (Select the best answer below.) Source of capital Long-term debt Preferred stock Common stock equity ,060,000 Totals Book value Market value After-tax cost $4,000,000$4,120,000 65,000 3,540,000 $7,725,000 5% 11% 15% 40,000 $5,100,000 c. Compare the answers obtained in parts a and b. Explain the ditterences. (Select the best answer below.) A. The book value approa yields a lower cost o cap al because he costs o the components o he cap al s c re are calculated using the r va ng market prices in the ommon stock i gata O B. The book value approach yields a higher cost of capital because the costs of the components of the capital structure are calculated using the prevailing market prices. Since the common stock is selling at a O C. The market value approach yields a lower cost of capital because the costs of the components of the capital structure are calculated using the prevailing market prices. Since the common stock is selling at O D. The market value approach yields a higher cost of capital because the costs of the components of the capital structure are calculated using the prevalling market prices. Since the common stock is selling at higher value than its market value, the cost of capital is much higher when using the book value weights. lower value than its market value, the cost of capital is much higher when using the book value weights. a lower value than its book value, the cost of capital is much lower when using the market value weights. a higher value than its book value, the cost of capital is much higher when using the market value weights