WACC of question 1 or 2 = 8.96%

a) NPV= $ 333.41

b) IRR= 20.64%

c) MIRR= 14.88%

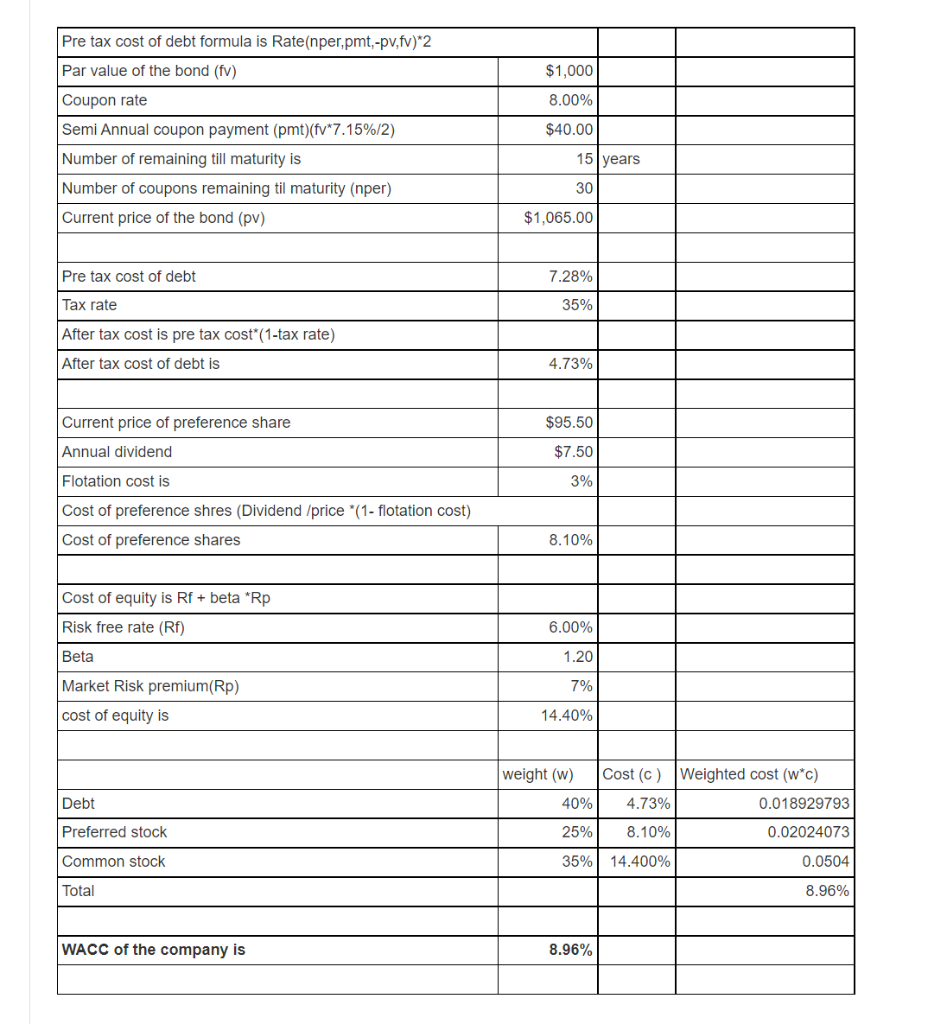

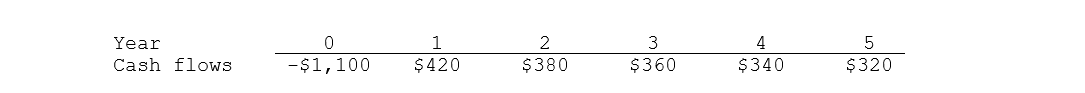

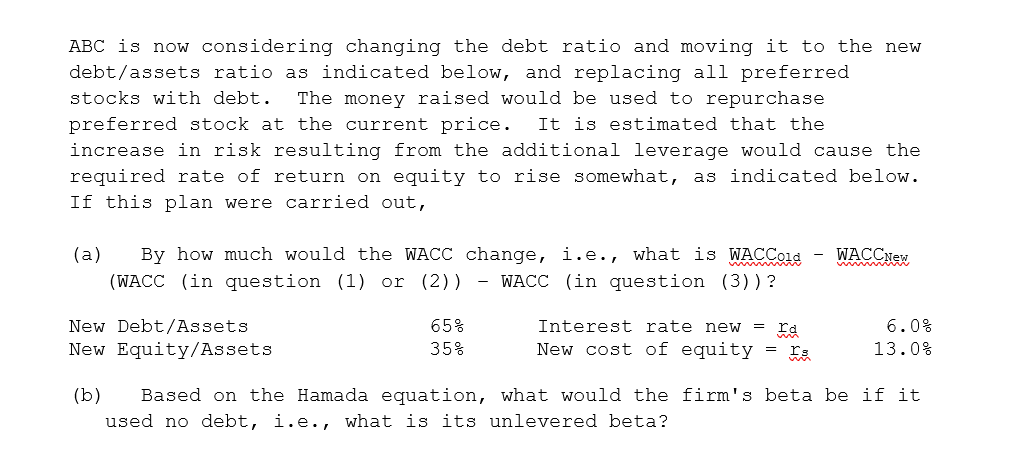

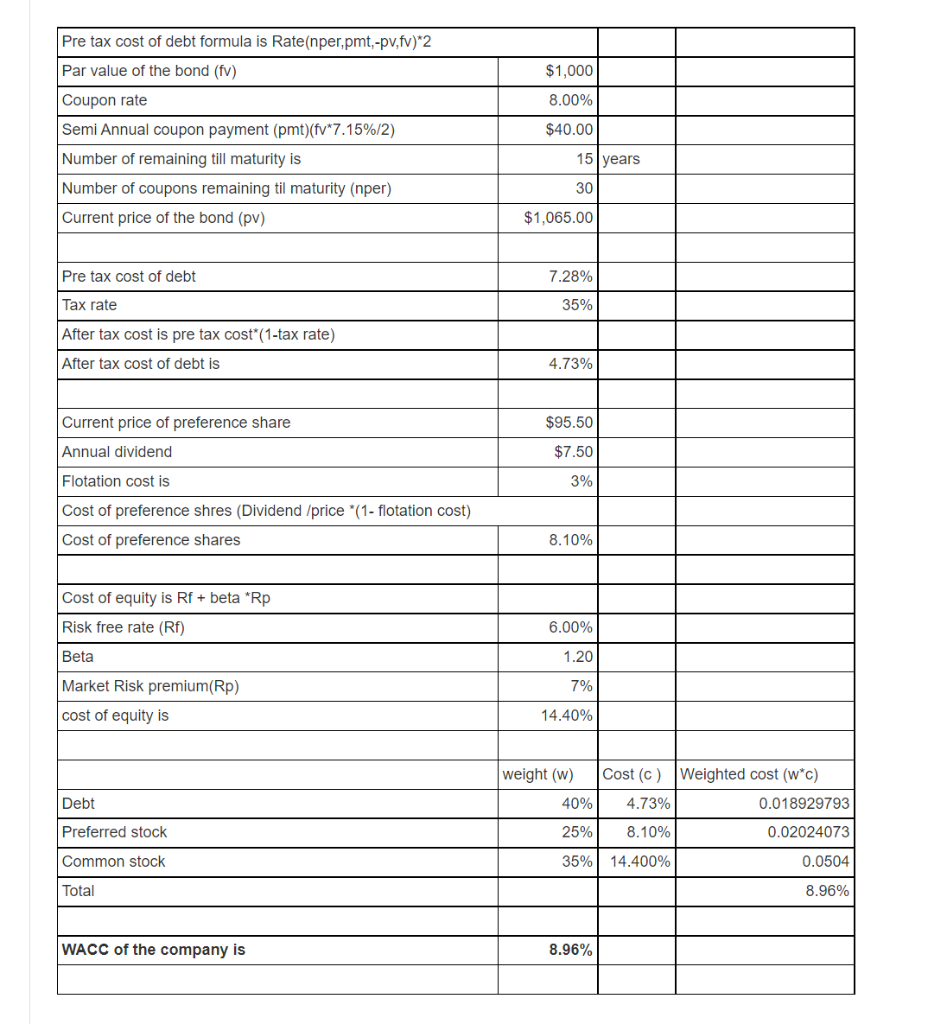

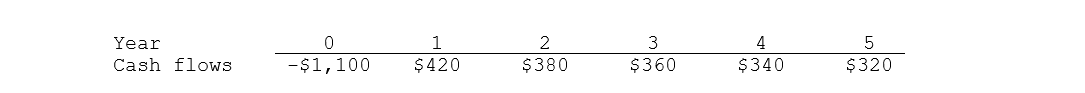

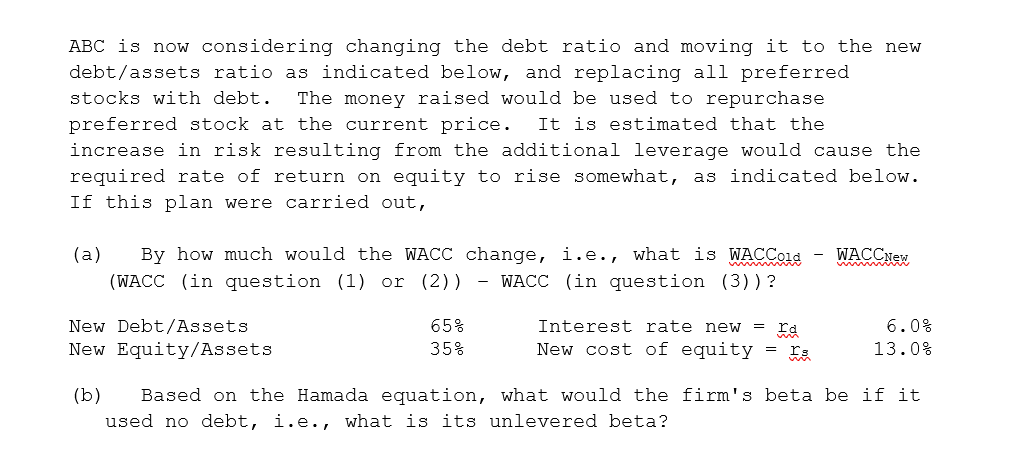

$1,000 8.00% Pre tax cost of debt formula is Rate(nper,pmt,-pv,fv)*2 Par value of the bond (fv) Coupon rate Semi Annual coupon payment (pmt)(fv*7.15%/2) Number of remaining till maturity is Number of coupons remaining til maturity (nper) Current price of the bond (pv) $40.00 15 years 30 $1,065.00 Pre tax cost of debt 7.28% Tax rate 35% After tax cost is pre tax cost*(1-tax rate) After tax cost of debt is 4.73% Current price of preference share $95.50 Annual dividend $7.50 Flotation cost is 3% Cost of preference shres (Dividend /price *(1-flotation cost) Cost of preference shares 8.10% Cost of equity is Rf + beta *Rp Risk free rate (RF) 6.00% Beta 1.20 7% Market Risk premium(Rp) cost of equity is 14.40% weight (w) Cost (C) Weighted cost (w*c) 40% 4.73% 0.018929793 Debt Preferred stock 25% 8.10% 0.02024073 0.0504 Common stock 35% 14.400% Total 8.96% WACC of the company is 8.96% Year Cash flows 0 -$1,100 1 $ 420 2 $380 3 $360 4. $340 5 $320 ABC is now considering changing the debt ratio and moving it to the new debt/assets ratio as indicated below, and replacing all preferred stocks with debt. The money raised would be used to repurchase preferred stock at the current price. It is estimated that the increase in risk resulting from the additional leverage would cause the required rate of return on equity to rise somewhat, as indicated below. If this plan were carried out, (a) By how much would the WACC change, i.e., what is WACCald (WACC (in question (1) or (2)) - WACC (in question (3)) ? 6.0% New Debt/Assets New Equity/Assets 65% 35% Interest rate new = id New cost of equity = fa 13.0% (b) Based on the Hamada equation, what would the firm's beta be if it used no debt, i.e., what is its unlevered beta? $1,000 8.00% Pre tax cost of debt formula is Rate(nper,pmt,-pv,fv)*2 Par value of the bond (fv) Coupon rate Semi Annual coupon payment (pmt)(fv*7.15%/2) Number of remaining till maturity is Number of coupons remaining til maturity (nper) Current price of the bond (pv) $40.00 15 years 30 $1,065.00 Pre tax cost of debt 7.28% Tax rate 35% After tax cost is pre tax cost*(1-tax rate) After tax cost of debt is 4.73% Current price of preference share $95.50 Annual dividend $7.50 Flotation cost is 3% Cost of preference shres (Dividend /price *(1-flotation cost) Cost of preference shares 8.10% Cost of equity is Rf + beta *Rp Risk free rate (RF) 6.00% Beta 1.20 7% Market Risk premium(Rp) cost of equity is 14.40% weight (w) Cost (C) Weighted cost (w*c) 40% 4.73% 0.018929793 Debt Preferred stock 25% 8.10% 0.02024073 0.0504 Common stock 35% 14.400% Total 8.96% WACC of the company is 8.96% Year Cash flows 0 -$1,100 1 $ 420 2 $380 3 $360 4. $340 5 $320 ABC is now considering changing the debt ratio and moving it to the new debt/assets ratio as indicated below, and replacing all preferred stocks with debt. The money raised would be used to repurchase preferred stock at the current price. It is estimated that the increase in risk resulting from the additional leverage would cause the required rate of return on equity to rise somewhat, as indicated below. If this plan were carried out, (a) By how much would the WACC change, i.e., what is WACCald (WACC (in question (1) or (2)) - WACC (in question (3)) ? 6.0% New Debt/Assets New Equity/Assets 65% 35% Interest rate new = id New cost of equity = fa 13.0% (b) Based on the Hamada equation, what would the firm's beta be if it used no debt, i.e., what is its unlevered beta