Answered step by step

Verified Expert Solution

Question

1 Approved Answer

wacc? please post answer in comments ABC Company's current share price is $18.65 and it is expected to pay a $0.85 dividend per share next

wacc? please post answer in comments

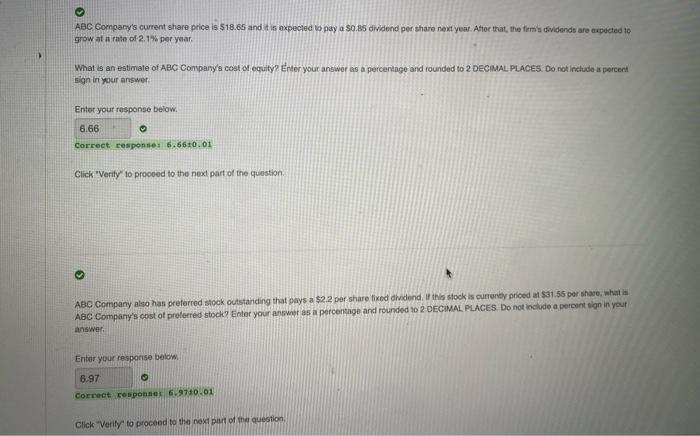

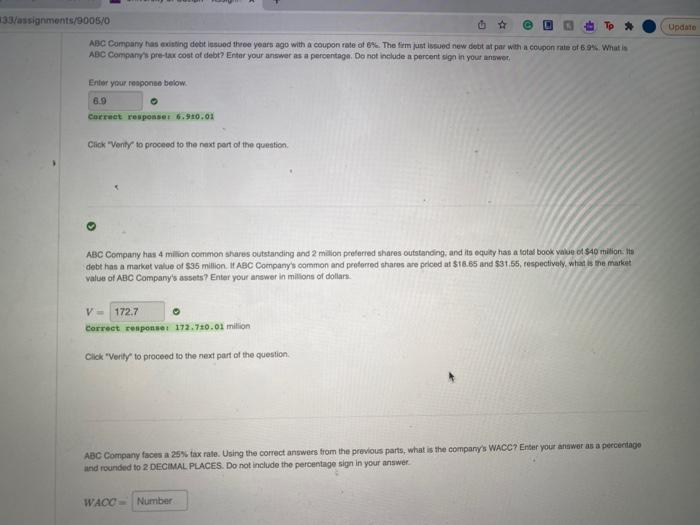

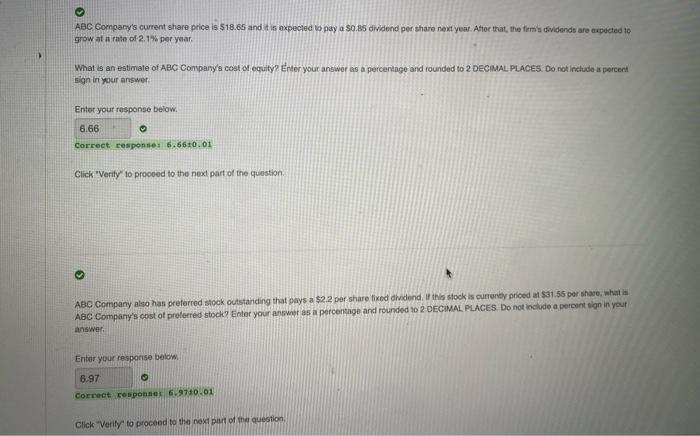

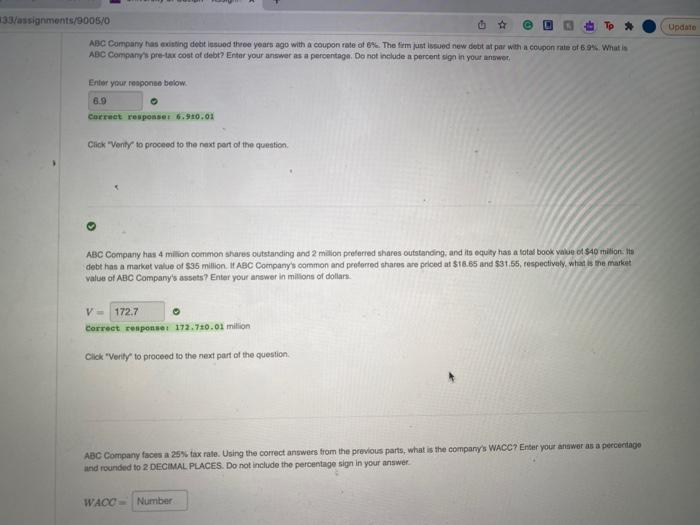

ABC Company's current share price is $18.65 and it is expected to pay a $0.85 dividend per share next year. After that, the firm's dividends are expected to grow at a rate of 2.1% per year. What is an estimate of ABC Company's cost of equity Enter your answer as a percentage and rounded to 2 DECIMAL PLACES. Do not include a percent Sign in your answer Enter your response below. 6.66 Correct response 6.6610.01 Click "Verity to proceed to the next part of the question ABC Company also has preferred stock outstanding that pays a $2.2 per share fixed dividend this stock is currently priced at $31.55 per share, what ABC Company's cost of proferred stock Enter your answer as a percentage and rounded to 2 DECIMAL PLACES. Do not include a percent sign in your answer Enter your response below 6.97 Correct response 9710.01 Click "Verity to proceed to the next part of the question Update 133/assignments/9005/0 ABC Company has exciting debt ned three years ago with a coupon rate of 6%. The firm just woed new det at par with a coupon rate of 69. What is ABC Company's pre-tax cost of debt? Enter your answer as a percentage. Do not include a percent sign in your answer Enter your response below 6.9 Correct responser 6.910.01 Click "Venty to proceed to the next part of the question ABC Company has 4 million common shares outstanding and 2 milion preferred shares outstanding, and its equity has a total book value of $10 milion. Ita debt han a market value of $35 million. If ABC Company's common and preferred shares are priced at $16.65 and $31.55, respectively, what is the market value of Abc Company's assets? Enter your answer in milions of dollars. V = 172.7 correct response 172.710.01 million Click "Verity to proceed to the next part of the question. ABC Company faces a 25% tax rate. Using the correct answers from the previous parts, what is the company's WACC? Enter your answer as a percentage and rounded to 2 DECIMAL PLACES. Do not include the percentage sign in your answer WACC Number

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started