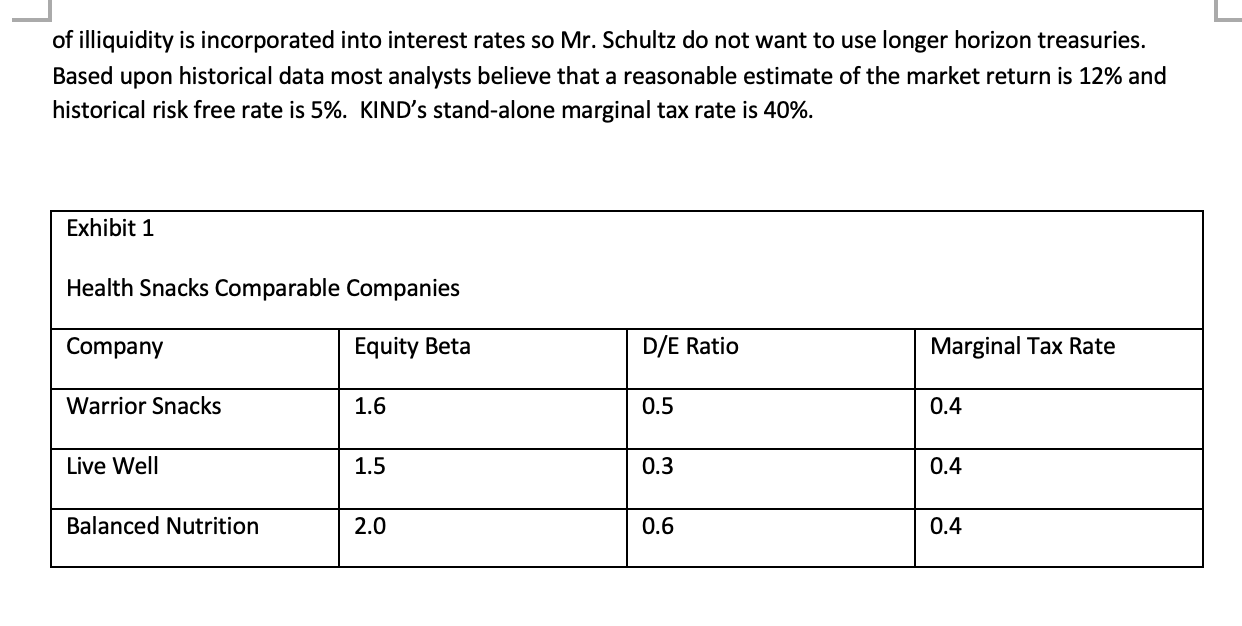

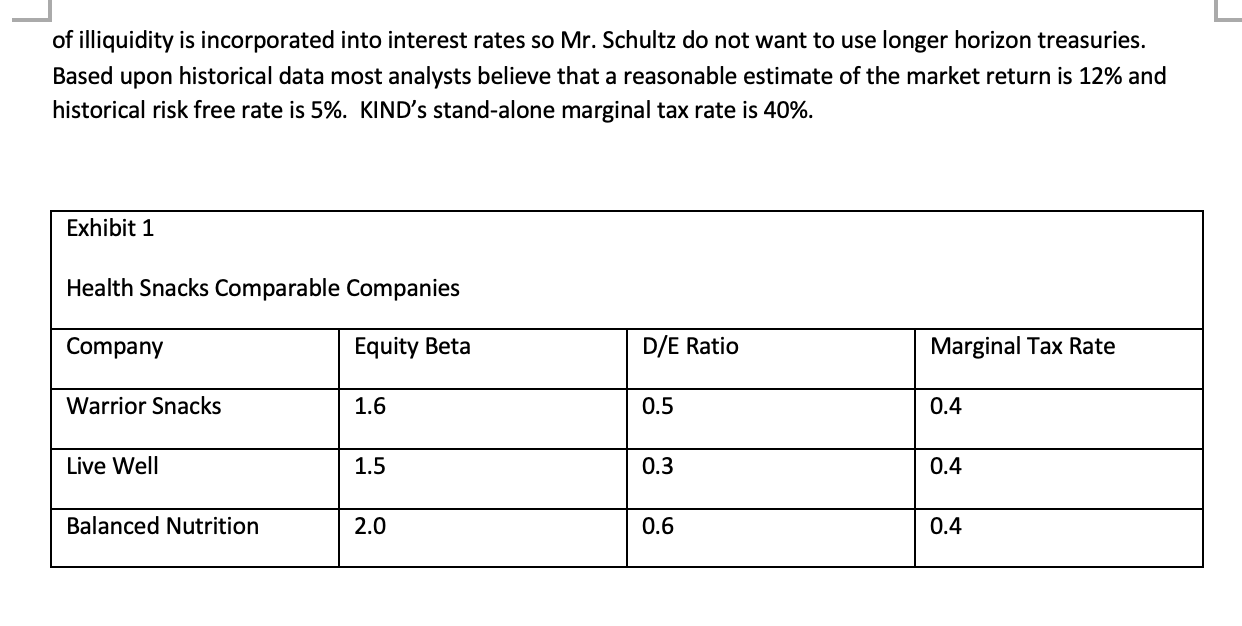

WACC: Starbucks's Decision to 'Control Its Own Destiny' On a conference call Wednesday morning to discuss its $2.7 billion arbitration settlement with Kraft Inc., Starbucks reassured investors that the cost of breaking ties with the distributor of its packaged coffee was the right move at the right time. "We are literally in [the] very nascent stages of building a multibillion-dollar global consumer packaged business," Starbucks Chief Executive Howard Schultz said on the call, a day after an arbitrator issued the ruling in a dispute dating back to 2010. To do so, Mr. Schultz said, the company had no choice but to move away from its distribution deal with Kraft. "Having gained full operating control, we now have the flexibility and the freedom to control our own destiny and, most importantly, preserve and enhance the Starbucks Global business and brand around the world." The coffee chain hasn't been shy about asserting greater control of the brand, says Brian Sozzi, chief executive of Belus Capital Advisors. Since 2011, Starbucks cafs began rolling out the company's own Evolution brand of juices and snacks. The product switches, Sozzi says, set Starbucks up for faster growth "managers can make decisions quicker. As part of a policy to control its own destiny, Starbucks is considering acquiring KIND healthy snacks. KIND is a privately held healthy snacks manufacturer, which provides breakfast bars sold at Starbuck's stores. In 2017, KIND Healthy Snacks founder Daniel Lubetzky was profiled in the New York Times. The story described how Starbucks had started selling KIND snack bars; the result of Lubetzky's many efforts to connect with the coffee behemoth. The small company was founded in 2004 to fill what Lubetzky saw as a void for snack bars made with natural ingredients. Starbucks expressed interest in acquiring his company or having KIND produce a private label snack bar for Starbucks. Valuation of KIND is complicated because the company is not publicly traded. Mr Shultz uses a 15% discount rate for investments in coffee business. However, he is not sure whether he should use the same discount rate to value a healthy snacks company. Mr Shultz believes that a target debt to equity (D/E) ratio of 30% (in market value terms) is appropriate for KIND. KIND's borrowing cost (return on debt) is 8%. Information about free-standing publicly-traded comparable companies in the health snacks industry is provided in Exhibit 1 below. At the present time, the short term (1 year) treasury rate is 2%, medium term (5 years) treasury rate is (3%) and long term treasury (10 year) rate is 4%. Even longer term treasuries are traded but cost of illiquidity is incorporated into interest rates so Mr. Schultz do not want to use longer horizon treasuries. Based upon historical data most analysts believe that a reasonable estimate of the market return is 12% and historical risk free rate is 5%. KIND's stand-alone marginal tax rate is 40%. Exhibit 1 Health Snacks Comparable Companies Company Equity Beta D/E Ratio Marginal Tax Rate Warrior Snacks 1.6 0.5 0.4 Live Well 1.5 0.3 0.4 Balanced Nutrition 2.0 0.6 0.4 ha Is it appropriate to use the weighted average cost of capital of Starbucks to determine the enterprise value of KIND for the Starbuck shareholders? Please first say Yes or No then briefly explain why. WACC: Starbucks's Decision to 'Control Its Own Destiny' On a conference call Wednesday morning to discuss its $2.7 billion arbitration settlement with Kraft Inc., Starbucks reassured investors that the cost of breaking ties with the distributor of its packaged coffee was the right move at the right time. "We are literally in [the] very nascent stages of building a multibillion-dollar global consumer packaged business," Starbucks Chief Executive Howard Schultz said on the call, a day after an arbitrator issued the ruling in a dispute dating back to 2010. To do so, Mr. Schultz said, the company had no choice but to move away from its distribution deal with Kraft. "Having gained full operating control, we now have the flexibility and the freedom to control our own destiny and, most importantly, preserve and enhance the Starbucks Global business and brand around the world." The coffee chain hasn't been shy about asserting greater control of the brand, says Brian Sozzi, chief executive of Belus Capital Advisors. Since 2011, Starbucks cafs began rolling out the company's own Evolution brand of juices and snacks. The product switches, Sozzi says, set Starbucks up for faster growth "managers can make decisions quicker. As part of a policy to control its own destiny, Starbucks is considering acquiring KIND healthy snacks. KIND is a privately held healthy snacks manufacturer, which provides breakfast bars sold at Starbuck's stores. In 2017, KIND Healthy Snacks founder Daniel Lubetzky was profiled in the New York Times. The story described how Starbucks had started selling KIND snack bars; the result of Lubetzky's many efforts to connect with the coffee behemoth. The small company was founded in 2004 to fill what Lubetzky saw as a void for snack bars made with natural ingredients. Starbucks expressed interest in acquiring his company or having KIND produce a private label snack bar for Starbucks. Valuation of KIND is complicated because the company is not publicly traded. Mr Shultz uses a 15% discount rate for investments in coffee business. However, he is not sure whether he should use the same discount rate to value a healthy snacks company. Mr Shultz believes that a target debt to equity (D/E) ratio of 30% (in market value terms) is appropriate for KIND. KIND's borrowing cost (return on debt) is 8%. Information about free-standing publicly-traded comparable companies in the health snacks industry is provided in Exhibit 1 below. At the present time, the short term (1 year) treasury rate is 2%, medium term (5 years) treasury rate is (3%) and long term treasury (10 year) rate is 4%. Even longer term treasuries are traded but cost of illiquidity is incorporated into interest rates so Mr. Schultz do not want to use longer horizon treasuries. Based upon historical data most analysts believe that a reasonable estimate of the market return is 12% and historical risk free rate is 5%. KIND's stand-alone marginal tax rate is 40%. Exhibit 1 Health Snacks Comparable Companies Company Equity Beta D/E Ratio Marginal Tax Rate Warrior Snacks 1.6 0.5 0.4 Live Well 1.5 0.3 0.4 Balanced Nutrition 2.0 0.6 0.4 ha Is it appropriate to use the weighted average cost of capital of Starbucks to determine the enterprise value of KIND for the Starbuck shareholders? Please first say Yes or No then briefly explain why