Answered step by step

Verified Expert Solution

Question

1 Approved Answer

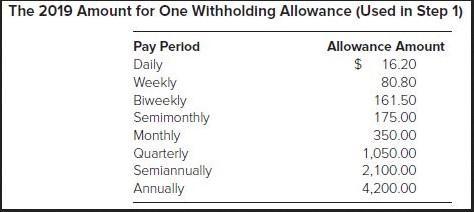

Wage Bracket Method Tables for Income Tax Withholding - 2019 Lisa Is single and clalms one allowance. Assume that her employer uses wage bracket tables

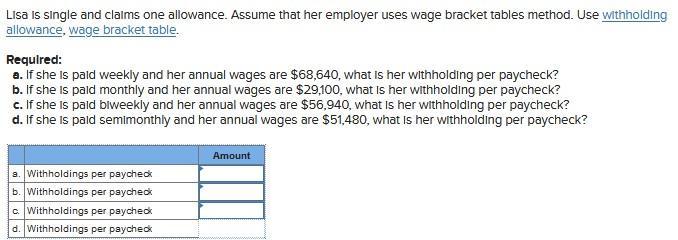

Lisa Is single and clalms one allowance. Assume that her employer uses wage bracket tables method. Use withholding allowance, wage bracket table. Required: a. If she is pald weekly and her annual wages are $68,640, what is her withholding per paycheck? b. If she is pald monthly and her annual wages are $29,100, what Is her withholding per paycheck? c. If she is paid blweekly and her annual wages are $56,940, what Is her withholding per paycheckK? d. If she is paid semimonthly and her annual wages are $51,480, what Is her withholding per paycheck? Amount a. Withholdings per paycheck b. Withholdings per paycheck c. Withholdings per paycheck d. Withholdings per paycheck

Step by Step Solution

★★★★★

3.52 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Solution Status single No of allowance claim 1 Year 2019 Requirement A Annual wages 68640 No of week ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started