Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following explanation is the basic idea of refinancing a mortgage/home. Refinancing a mortgage involves applying and receiving a new mortgage (at a new

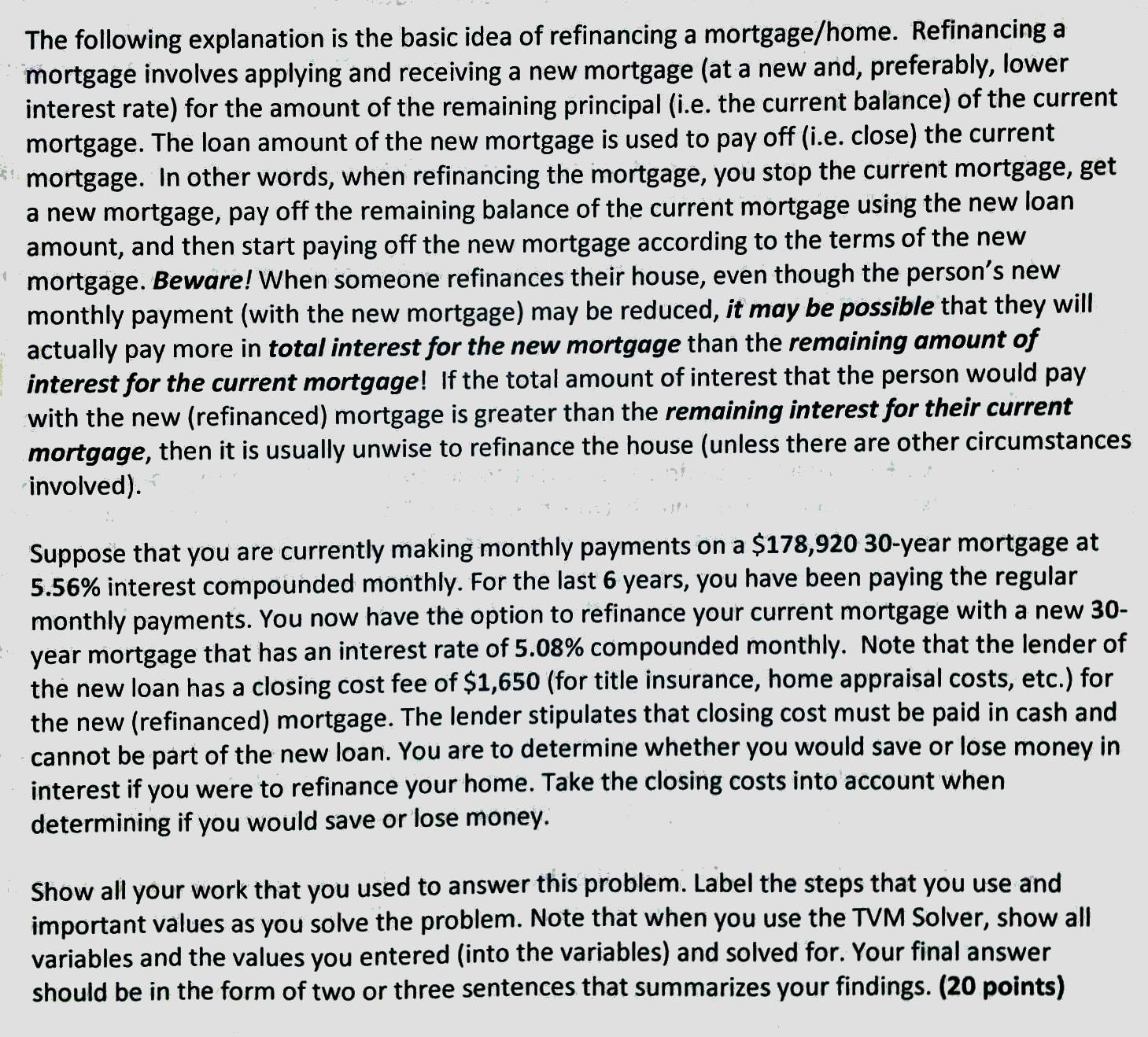

The following explanation is the basic idea of refinancing a mortgage/home. Refinancing a mortgage involves applying and receiving a new mortgage (at a new and, preferably, interest rate) for the amount of the remaining principal (i.e. the current balance) of the current mortgage. The loan amount of the new mortgage is used to pay off (i.e. close) the current mortgage. In other words, when refinancing the mortgage, you stop the current mortgage, get a new mortgage, pay off the remaining balance of the current mortgage using the new loan amount, and then start paying off the new mortgage according to the terms of the new mortgage. Beware! When someone refinances their house, even though the person's new monthly payment (with the new mortgage) may be reduced, it may be possible that they will actually pay more in total interest for the new mortgage than the remaining amount of interest for the current mortgage! If the total amount of interest that the person would pay with the new (refinanced) mortgage is greater than the remaining interest for their current mortgage, then it is usually unwise to refinance the house (unless there are other circumstances involved). lower Suppose that you are currently making monthly payments on a $178,920 30-year mortgage at 5.56% interest compounded monthly. For the last 6 years, you have been paying the regular monthly payments. You now have the option to refinance your current mortgage with a new 30- year mortgage that has an interest rate of 5.08% compounded monthly. Note that the lender of the new loan has a closing cost fee of $1,650 (for title insurance, home appraisal costs, etc.) for the new (refinanced) mortgage. The lender stipulates that closing cost must be paid in cash and cannot be part of the new loan. You are to determine whether you would save or lose money in interest if you were to refinance your home. Take the closing costs into account when determining if you would save or lose money. Show all your work that you used to answer this problem. Label the steps that you use and important values as you solve the problem. Note that when you use the TVM Solver, show all variables and the values you entered (into the variables) and solved for. Your final answer should be in the form of two or three sentences that summarizes your findings. (20 points)

Step by Step Solution

★★★★★

3.44 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

Calculate the total interest on 30year mortgage of 178920 at ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started