Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Wages and salaries are compensation paid by the employer for work or services performed. Compensation also includes all but which one of the following?

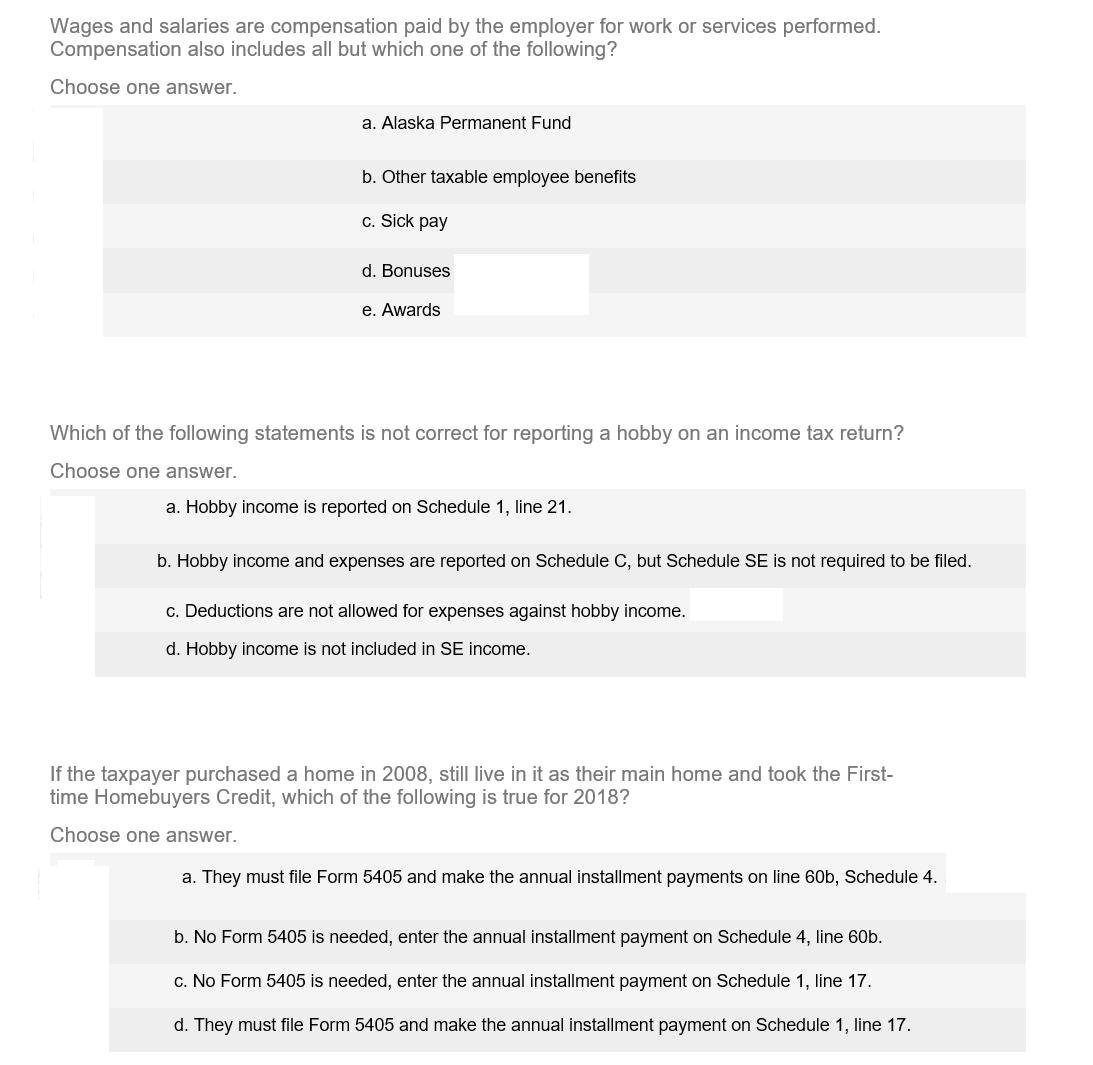

Wages and salaries are compensation paid by the employer for work or services performed. Compensation also includes all but which one of the following? Choose one answer. a. Alaska Permanent Fund b. Other taxable employee benefits c. Sick pay d. Bonuses e. Awards Which of the following statements is not correct for reporting a hobby on an income tax return? Choose one answer. a. Hobby income is reported on Schedule 1, line 21. b. Hobby income and expenses are reported on Schedule C, but Schedule SE is not required to be filed. c. Deductions are not allowed for expenses against hobby income. d. Hobby income is not included in SE income. If the taxpayer purchased a home in 2008, still live in it as their main home and took the First- time Homebuyers Credit, which of the following is true for 2018? Choose one answer. a. They must file Form 5405 and make the annual installment payments on line 60b, Schedule 4. b. No Form 5405 is needed, enter the annual installment payment on Schedule 4, line 60b. c. No Form 5405 is needed, enter the annual installment payment on Schedule 1, line 17. d. They must file Form 5405 and make the annual installment payment on Schedule 1, line 17.

Step by Step Solution

★★★★★

3.45 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

1 e Awards Awards are not considered compensation paid by the employer for ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started