Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Wages of $13,000 are earned by workers but not paid as of December 31, 2017. b. Depreciation on the company's equipment for 2017 is

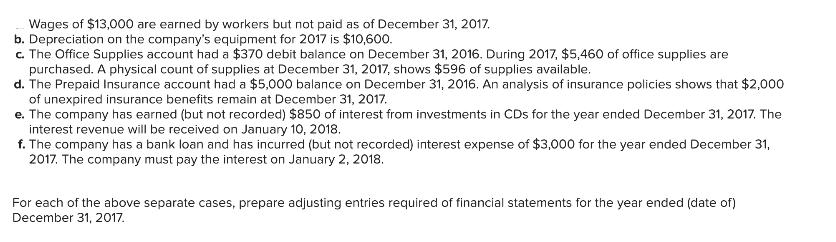

Wages of $13,000 are earned by workers but not paid as of December 31, 2017. b. Depreciation on the company's equipment for 2017 is $10,600. c. The Office Supplies account had a $370 debit balance on December 31, 2016. During 2017, $5,460 of office supplies are purchased. A physical count of supplies at December 31, 2017, shows $596 of supplies available. d. The Prepaid Insurance account had a $5,000 balance on December 31, 2016. An analysis of insurance policies shows that $2,000 of unexpired insurance benefits remain at December 31, 2017. e. The company has earned (but not recorded) $850 of interest from investments in CDs for the year ended December 31, 2017. The interest revenue will be received on January 10, 2018. f. The company has a bank loan and has incurred (but not recorded) interest expense of $3,000 for the year ended December 31, 2017. The company must pay the interest on January 2, 2018. For each of the above separate cases, prepare adjusting entries required of financial statements for the year ended (date of) December 31, 2017.

Step by Step Solution

★★★★★

3.50 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

To prepare the adjusting entries for each case lets go through them one by one a Wages earned but not paid Adjusting entry Wage Expense 13000 Wages Pa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started