Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Wagner Company is considering the possibility of replacing one of its current machines used in production with a new machine. The new machine has an

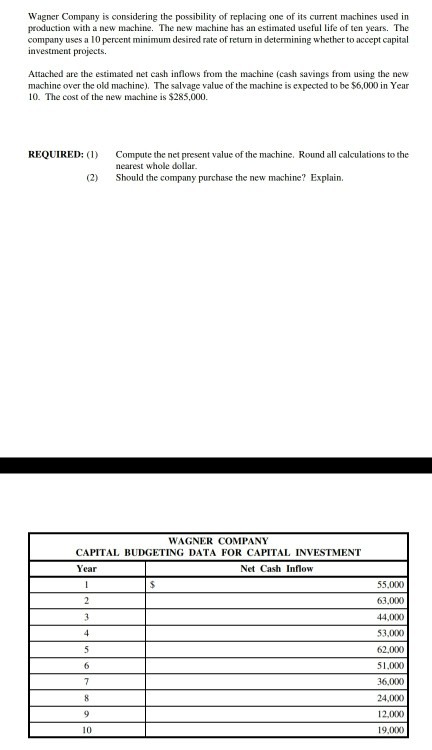

Wagner Company is considering the possibility of replacing one of its current machines used in production with a new machine. The new machine has an estimated useful life of ten years. The company uses a 10 percent minimum desired rate of retum in determining whether to accept capital investment projects. Attached are the estimated net cash inflows from the machine (cash savings from using the new machine over the old machine). The salvage value of the machine is expected to be $6,000 in Year 10. The cost of the new machine is $285.000 REQUIRED: (1) Compute the net present value of the machine. Round all calculations to the nearest whole dollar. Should the company purchase the new machine? Explain. (2) WAGNER COMPANY CAPITAL BUDGETING DATA FOR CAPITAL INVESTMENT Year Net Cash Inflow 63.000 44 0 SHO 62. W S1.000 36.00 24.0 ) 12.000 19.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started