Answered step by step

Verified Expert Solution

Question

1 Approved Answer

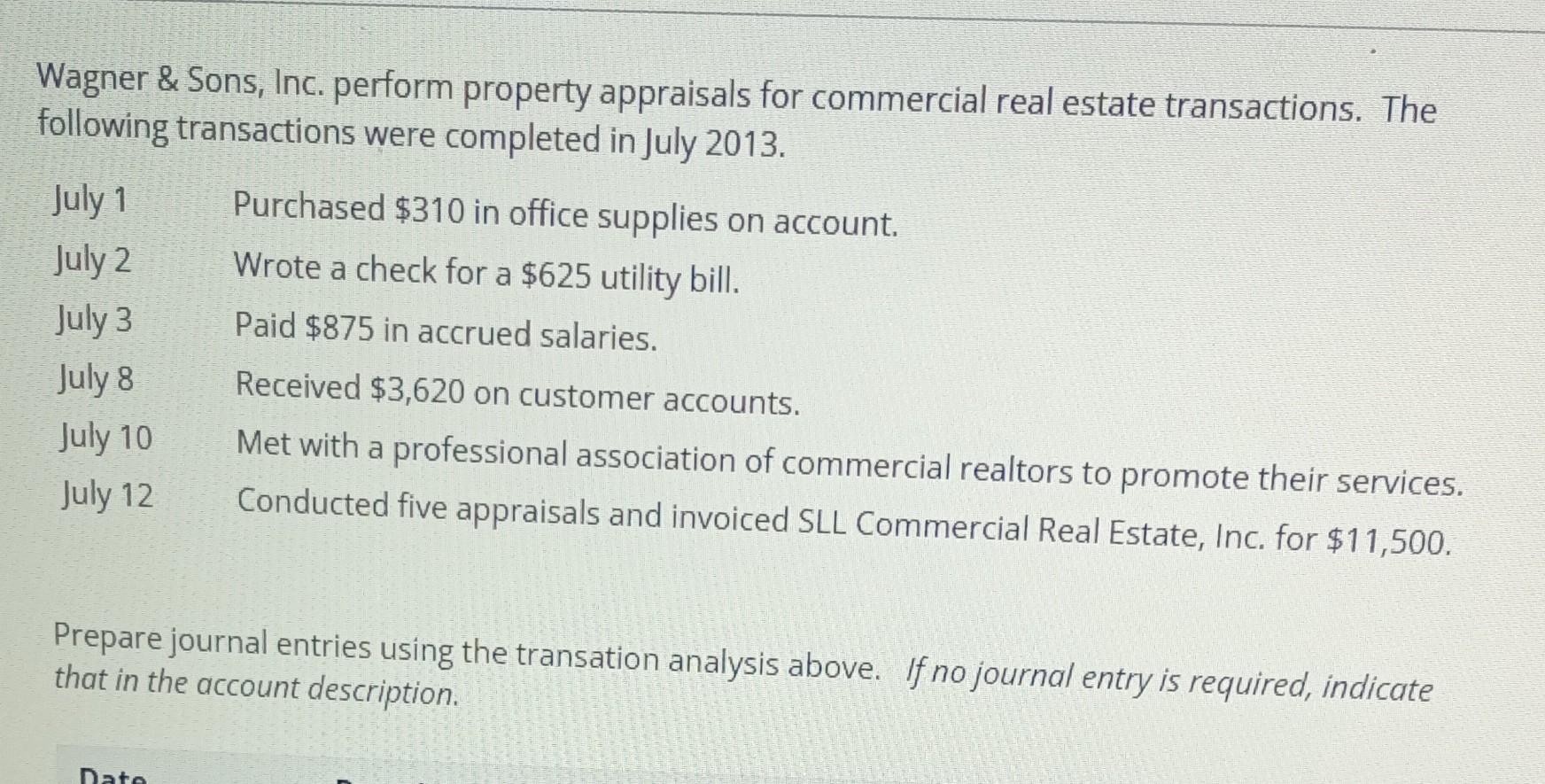

Wagner & Sons, lnc. perform property appraisals for commercial real estate transactions. The following transactions were completed in July 2013. July 1 Purchased $310 in

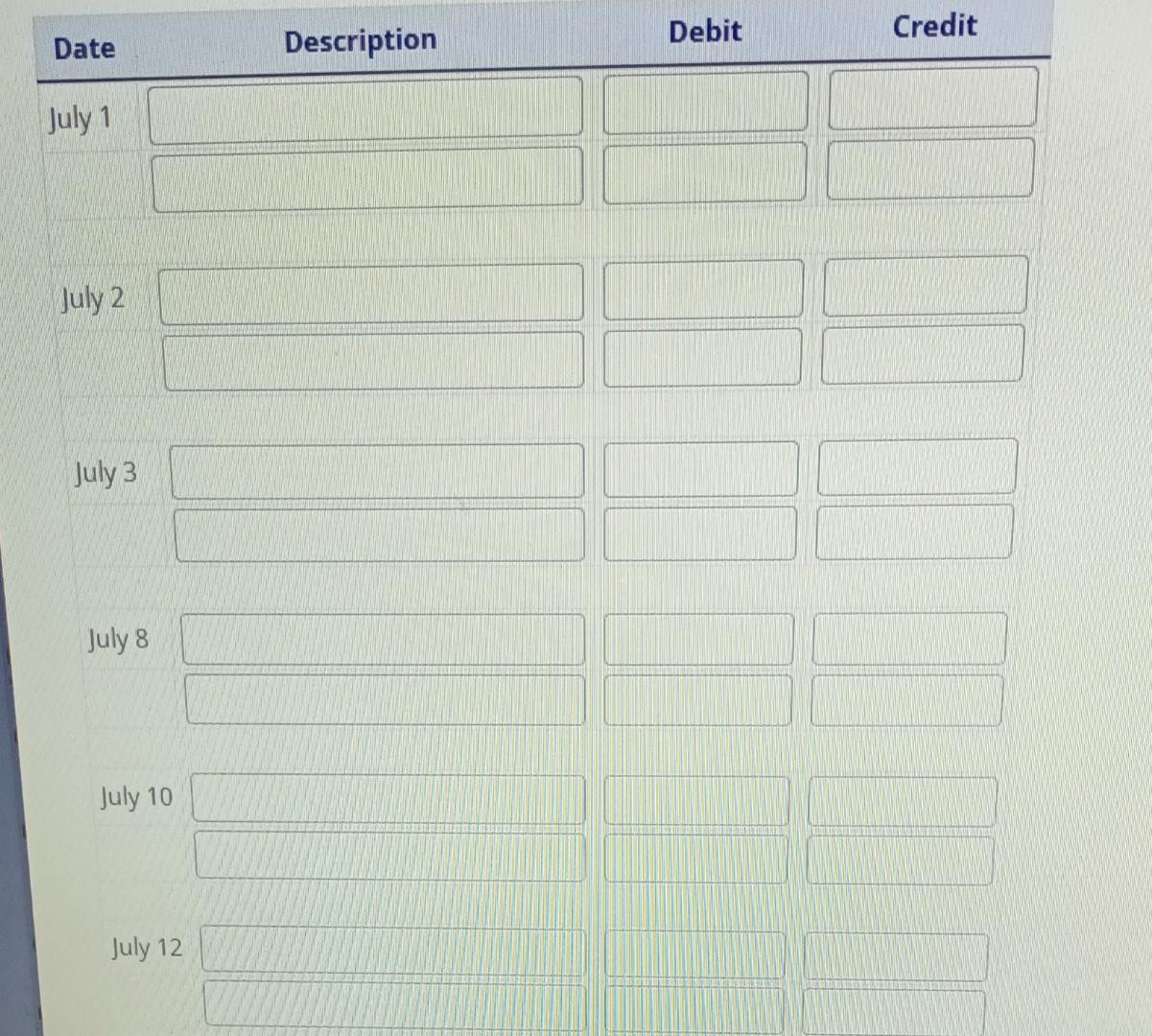

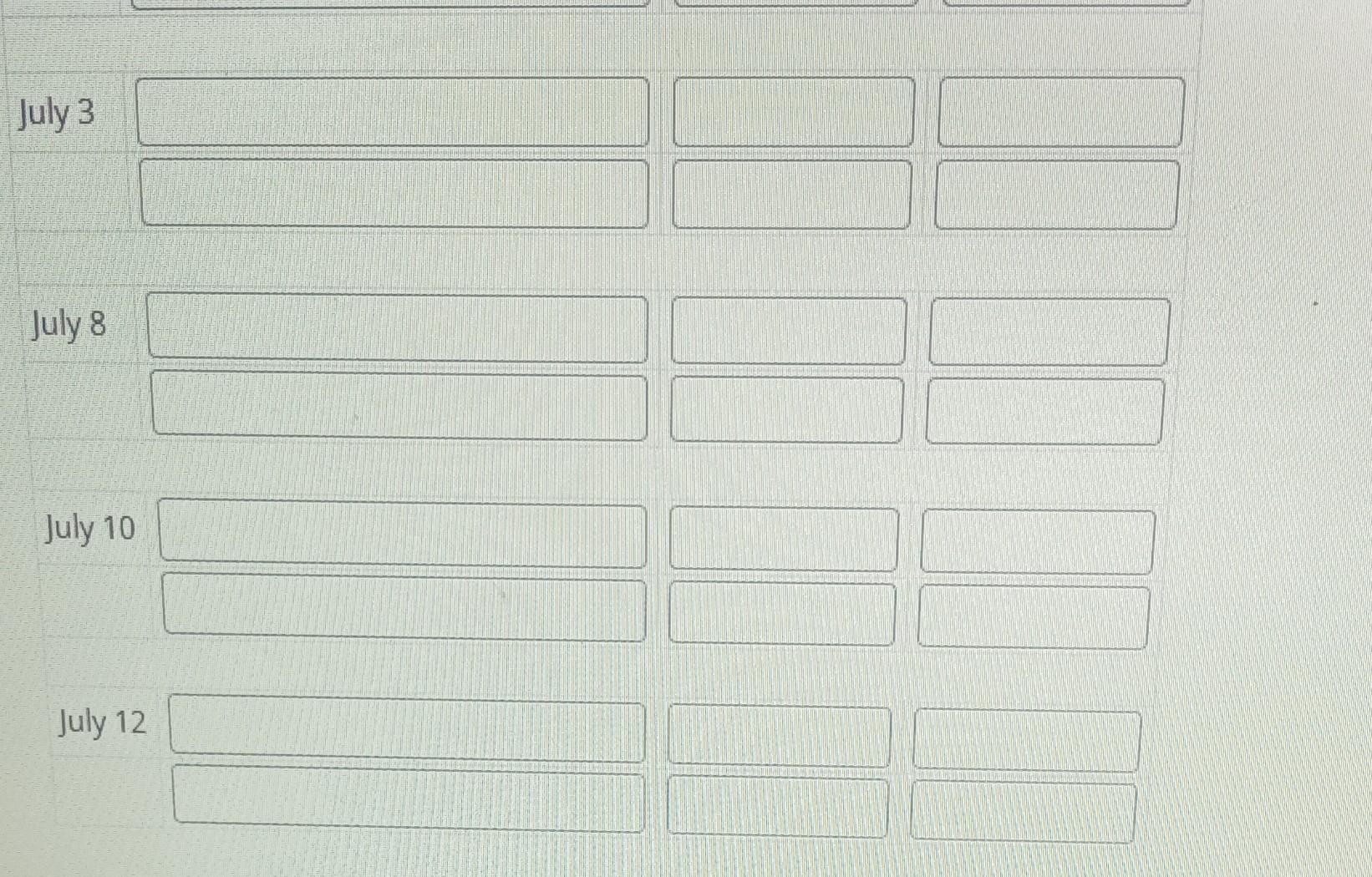

Wagner \& Sons, lnc. perform property appraisals for commercial real estate transactions. The following transactions were completed in July 2013. July 1 Purchased $310 in office supplies on account. July 2 Wrote a check for a $625 utility bill. July 3 Paid $875 in accrued salaries. July 8 Received $3,620 on customer accounts. July 10 Met with a professional association of commercial realtors to promote their services. July 12 Conducted five appraisals and invoiced SLL Commercial Real Estate, Inc. for $11,500. Prepare journal entries using the transation analysis above. If no journal entry is required, indicate that in the account description. July 2 July 3 July 8 July 10 July 12 July 3 July 8 July 10 July 12

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started