Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Waiting For Question A answer From a Legend.Thank you sir Problem 1 (20 marks) Your investment screen helps you identify Gear Stop as a potential

Waiting For Question A answer From a Legend.Thank you sir

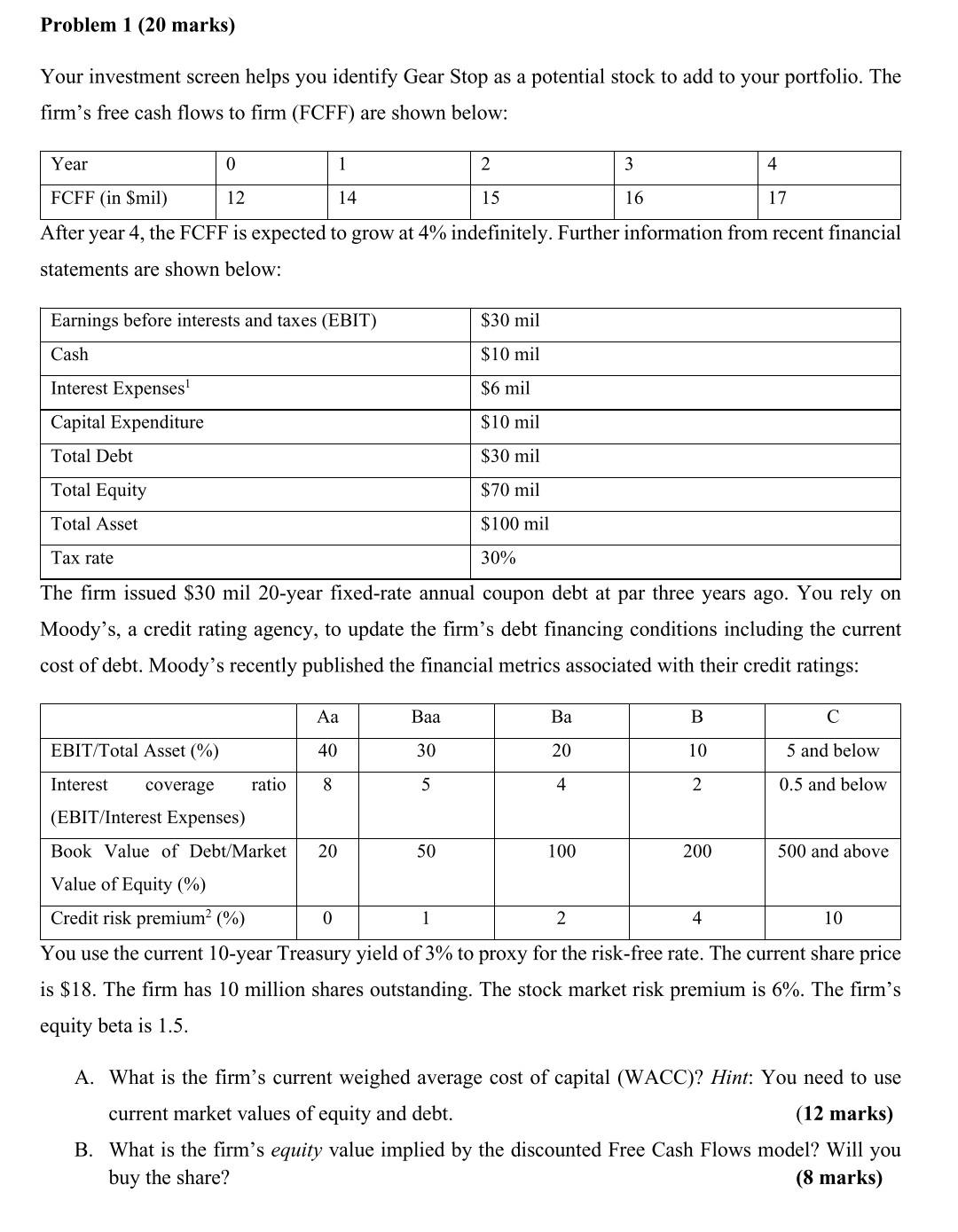

Problem 1 (20 marks) Your investment screen helps you identify Gear Stop as a potential stock to add to your portfolio. The firm's free cash flows to firm (FCFF) are shown below: Year 0 1 2 3 4 FCFF (in $mil) 12 14 15 16 17 After year 4, the FCFF is expected to grow at 4% indefinitely. Further information from recent financial statements are shown below: Earnings before interests and taxes (EBIT) $30 mil Cash $10 mil Interest Expenses $6 mil Capital Expenditure $10 mil Total Debt $30 mil Total Equity $70 mil Total Asset $100 mil Tax rate 30% The firm issued $30 mil 20-year fixed-rate annual coupon debt at par three years ago. You rely on Moody's, a credit rating agency, to update the firm's debt financing conditions including the current cost of debt. Moody's recently published the financial metrics associated with their credit ratings: Aa Baa Ba B C EBIT/Total Asset (%) 40 30 20 10 5 and below Interest coverage ratio 8 5 4 2 0.5 and below (EBIT/Interest Expenses) Book Value of Debt/Market 20 50 100 200 500 and above Value of Equity (%) 0 1 2 4 10 Credit risk premium (%) You use the current 10-year Treasury yield of 3% to proxy for the risk-free rate. The current share price is $18. The firm has 10 million shares outstanding. The stock market risk premium is 6%. The firm's equity beta is 1.5. A. What is the firm's current weighed average cost of capital (WACC)? Hint: You need to use current market values of equity and debt. (12 marks) B. What is the firm's equity value implied by the discounted Free Cash Flows model? Will you buy the share? (8 marks) Problem 1 (20 marks) Your investment screen helps you identify Gear Stop as a potential stock to add to your portfolio. The firm's free cash flows to firm (FCFF) are shown below: Year 0 1 2 3 4 FCFF (in $mil) 12 14 15 16 17 After year 4, the FCFF is expected to grow at 4% indefinitely. Further information from recent financial statements are shown below: Earnings before interests and taxes (EBIT) $30 mil Cash $10 mil Interest Expenses $6 mil Capital Expenditure $10 mil Total Debt $30 mil Total Equity $70 mil Total Asset $100 mil Tax rate 30% The firm issued $30 mil 20-year fixed-rate annual coupon debt at par three years ago. You rely on Moody's, a credit rating agency, to update the firm's debt financing conditions including the current cost of debt. Moody's recently published the financial metrics associated with their credit ratings: Aa Baa Ba B C EBIT/Total Asset (%) 40 30 20 10 5 and below Interest coverage ratio 8 5 4 2 0.5 and below (EBIT/Interest Expenses) Book Value of Debt/Market 20 50 100 200 500 and above Value of Equity (%) 0 1 2 4 10 Credit risk premium (%) You use the current 10-year Treasury yield of 3% to proxy for the risk-free rate. The current share price is $18. The firm has 10 million shares outstanding. The stock market risk premium is 6%. The firm's equity beta is 1.5. A. What is the firm's current weighed average cost of capital (WACC)? Hint: You need to use current market values of equity and debt. (12 marks) B. What is the firm's equity value implied by the discounted Free Cash Flows model? Will you buy the share? (8 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started