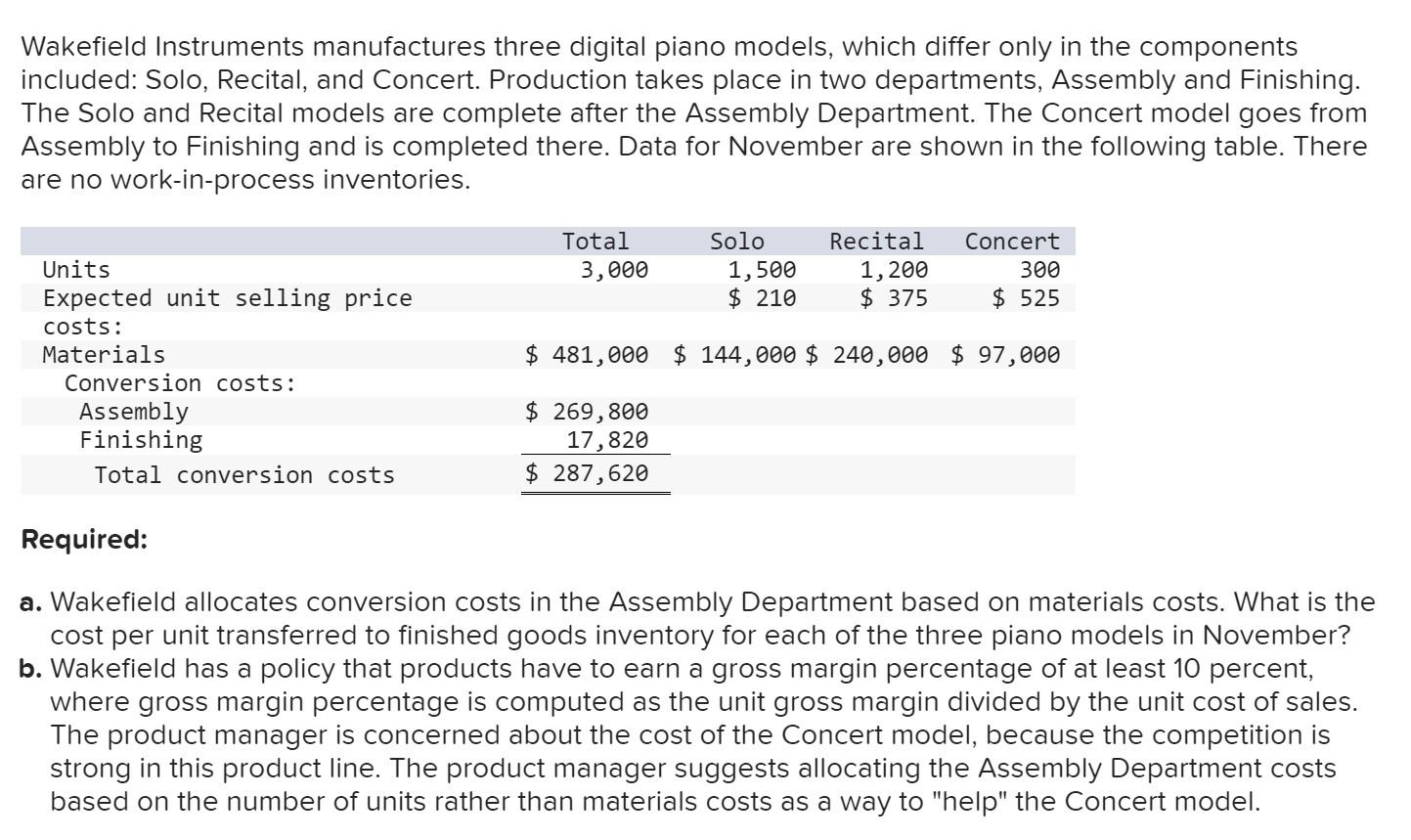

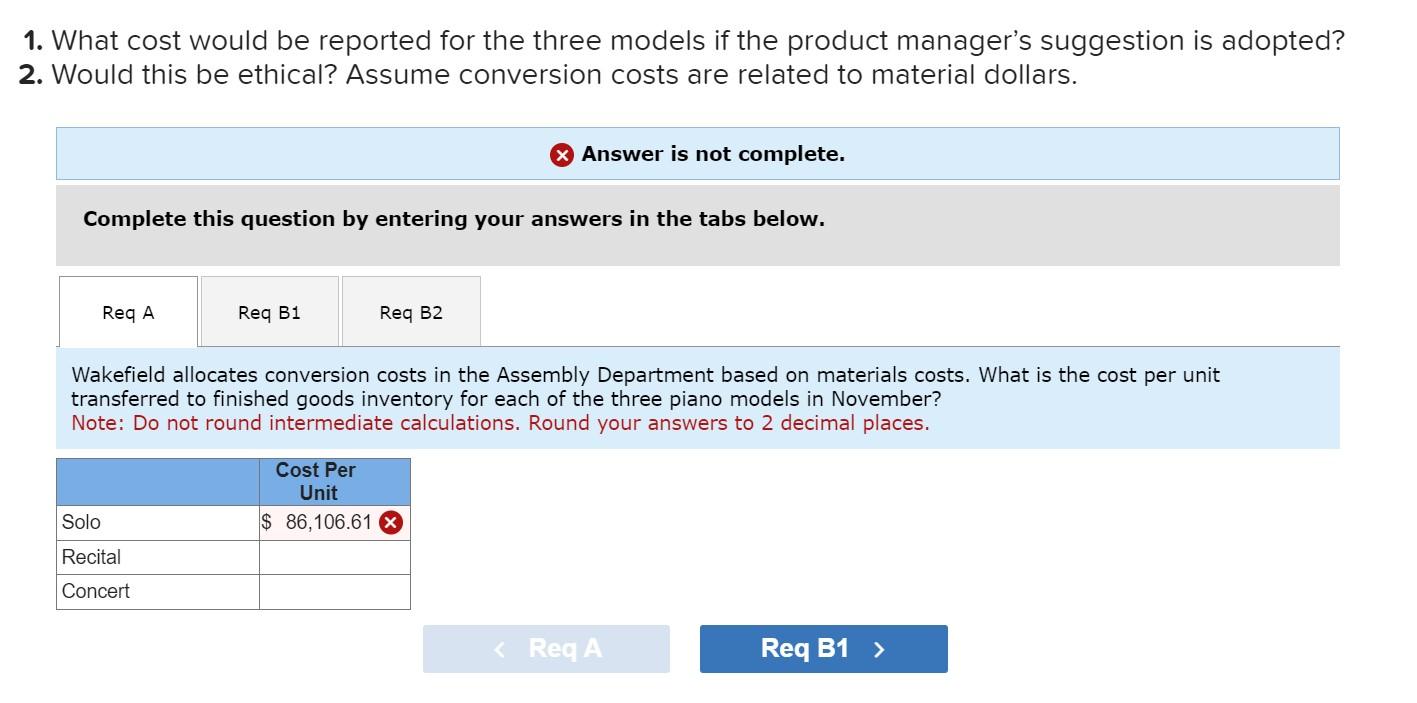

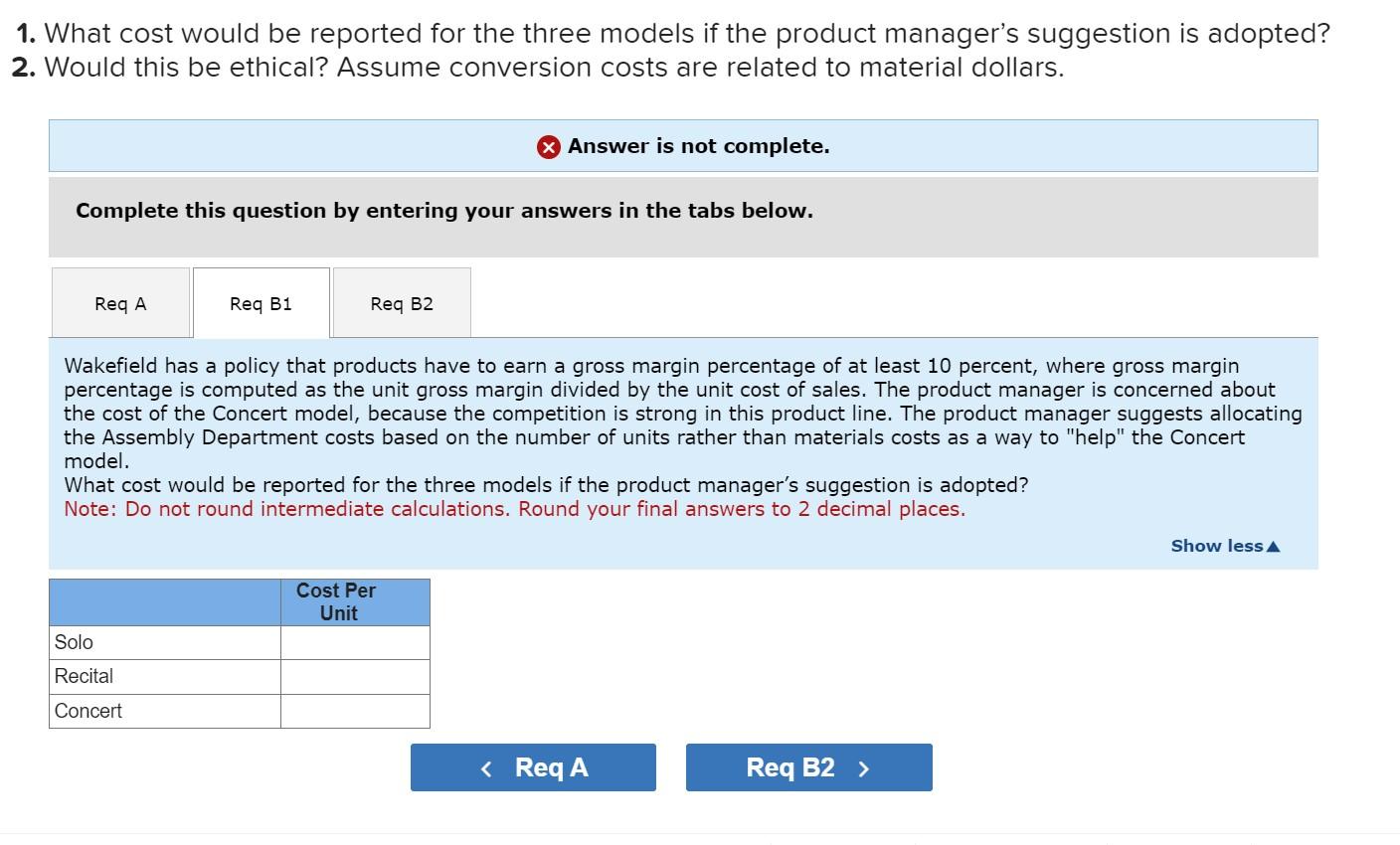

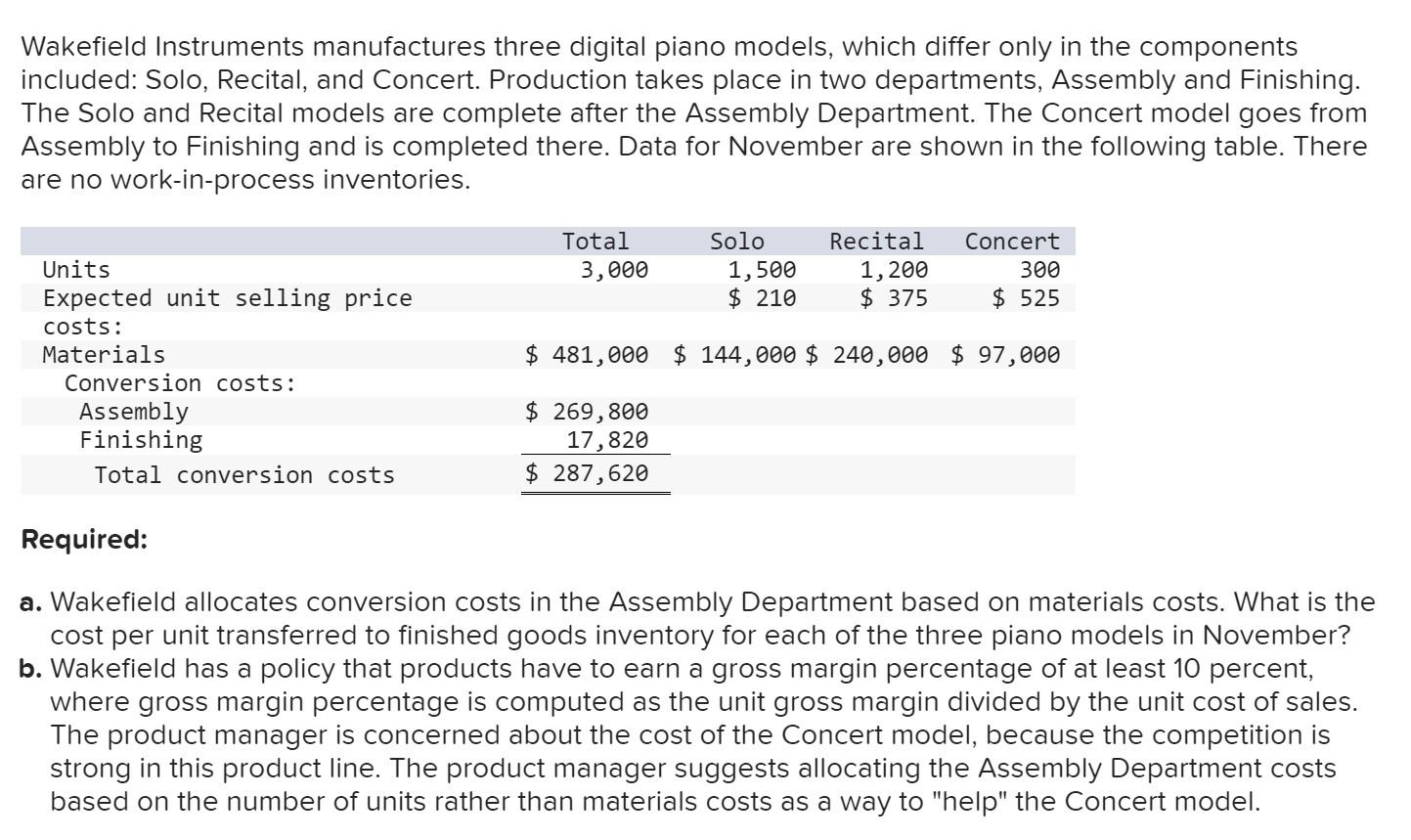

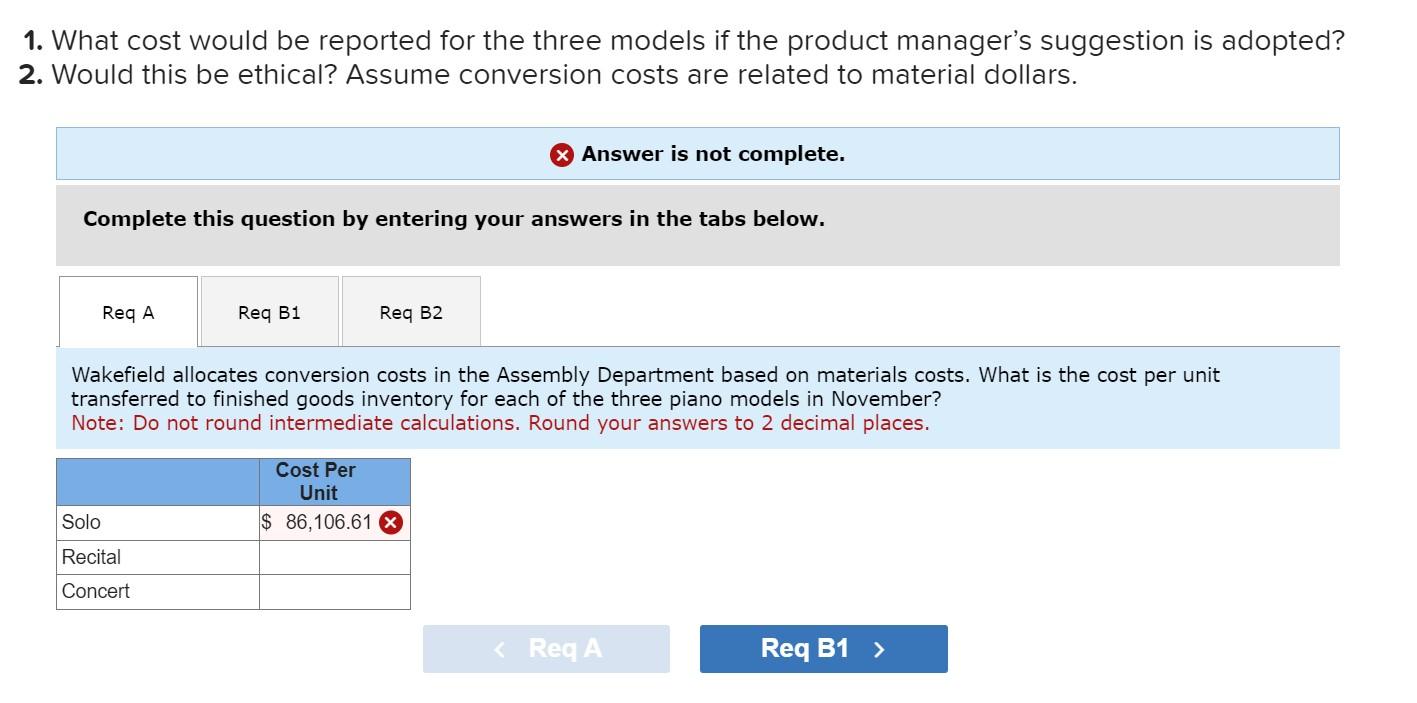

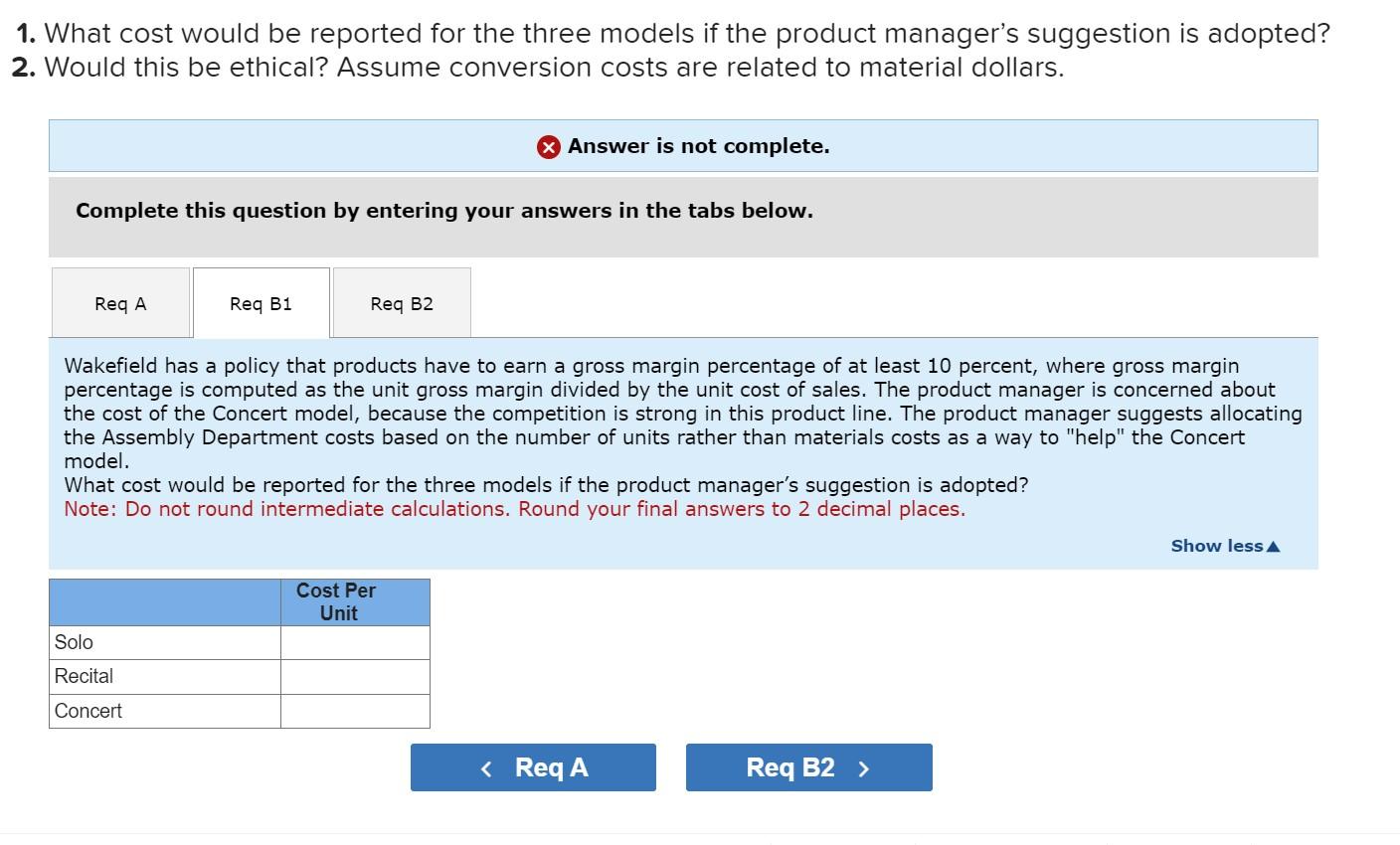

Wakefield Instruments manufactures three digital piano models, which differ only in the components included: Solo, Recital, and Concert. Production takes place in two departments, Assembly and Finishing. The Solo and Recital models are complete after the Assembly Department. The Concert model goes from Assembly to Finishing and is completed there. Data for November are shown in the following table. There are no work-in-process inventories. Required: a. Wakefield allocates conversion costs in the Assembly Department based on materials costs. What is the cost per unit transferred to finished goods inventory for each of the three piano models in November? b. Wakefield has a policy that products have to earn a gross margin percentage of at least 10 percent, where gross margin percentage is computed as the unit gross margin divided by the unit cost of sales. The product manager is concerned about the cost of the Concert model, because the competition is strong in this product line. The product manager suggests allocating the Assembly Department costs based on the number of units rather than materials costs as a way to "help" the Concert model. What cost would be reported for the three models if the product manager's suggestion is adopted? Would this be ethical? Assume conversion costs are related to material dollars. Answer is not complete. Complete this question by entering your answers in the tabs below. Wakefield allocates conversion costs in the Assembly Department based on materials costs. What is the cost per unit transferred to finished goods inventory for each of the three piano models in November? Note: Do not round intermediate calculations. Round your answers to 2 decimal places. What cost would be reported for the three models if the product manager's suggestion is adopted Would this be ethical? Assume conversion costs are related to material dollars. Answer is not complete. Complete this question by entering your answers in the tabs below. Wakefield has a policy that products have to earn a gross margin percentage of at least 10 percent, where gross margin percentage is computed as the unit gross margin divided by the unit cost of sales. The product manager is concerned about the cost of the Concert model, because the competition is strong in this product line. The product manager suggests allocating the Assembly Department costs based on the number of units rather than materials costs as a way to "help" the Concert model. What cost would be reported for the three models if the product manager's suggestion is adopted? Note: Do not round intermediate calculations. Round your final answers to 2 decimal places. What cost would be reported for the three models if the product manager's suggestion is adopted Would this be ethical? Assume conversion costs are related to material dollars. Complete this question by entering your answers in the tabs below. Wakefield has a policy that products have to earn a gross margin percentage of at least 10 percent, where gross margin percentage is computed as the unit gross margin divided by the unit cost of sales. The product manager is concerned about the cost of the Concert model, because the competition is strong in this product line. The product manager suggests allocating the Assembly Department costs based on the number of units rather than material costs as a way to "help" the Concert model. Would this be ethical? Assume conversion costs are related to material dollars