Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Wakeville Marina needs to raise $3.0 milion to expand the company. The company is considering issuing other 33 000 000 of hands payable to borrow

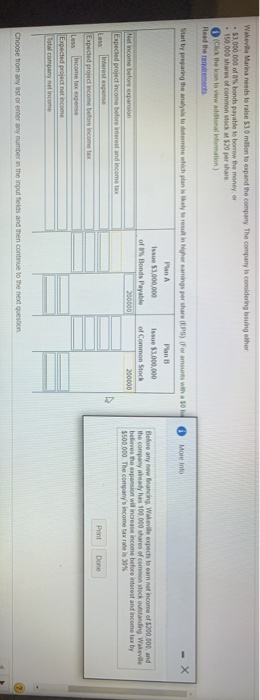

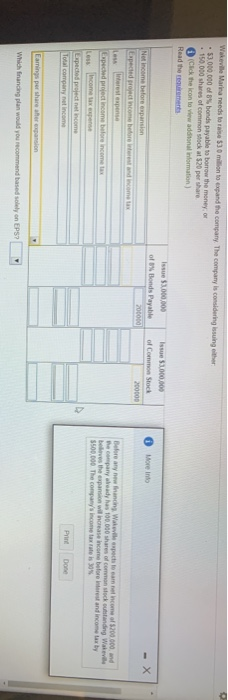

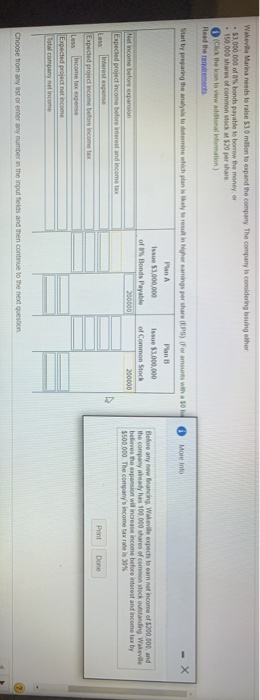

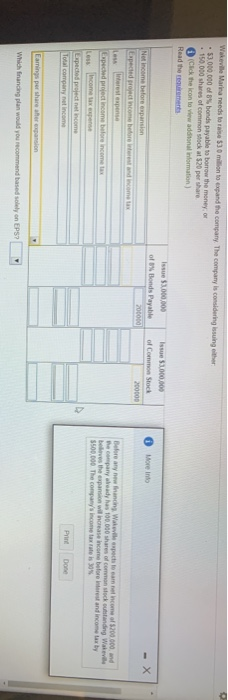

Wakeville Marina needs to raise $3.0 milion to expand the company. The company is considering issuing other 33 000 000 of hands payable to borrow the money or 150.000 shares of common stock 120 per share Click the kosto viw additonal Information) Read the recent More into -X Start by preparing the analysis to determine which plan is likely to rent in Higher earnings per there (EPS). For amounts with a Plan Plan Issue $3.000.000 Issue 53,000,000 of Bonds Payable of Common Stock Net income before expansion 200000 200000 Expected project income before interest and income tax Before any new financing, Wakeville expects to eam net income of $200,000, and the company already has 100,000 shares of common stock outstanding Wakeville believes the expansion will increase income before interest and income tax by $500.000. The company's income tax rate is 30% Print Done Less Expected project income before income tax Less Income tax expense Expected project net income Total company income Choose from any est or emner any number in the input fields and then continue to the next question Wakeville Marina needs to raise $30 milion to expand the company. The company is considering issuing her . 53.000.000 of 8% bonds payable to borrow the money or . 150.000 shares of common stock at 120 per share (Click the icon to view additional information) Read the imments Issue 51.000.000 Issue 1000000 of fonds Payable of Com Stock Net Income before expansion 20000 200000 Expected project income before we come tax Before any new francine Wavespect to come income of 200000. and the company ready has 100.000 shares of common stock outstanding Walevi bove the expansion will increase income before interest and income tax by $500.000 The company's income tax is 0% Expected project income before income tax Income tax expense Expected project net income Total company net income Print Done Earrings per share her expansion Which financing plan would you recommend based solely on EPS

Wakeville Marina needs to raise $3.0 milion to expand the company. The company is considering issuing other 33 000 000 of hands payable to borrow the money or 150.000 shares of common stock 120 per share Click the kosto viw additonal Information) Read the recent More into -X Start by preparing the analysis to determine which plan is likely to rent in Higher earnings per there (EPS). For amounts with a Plan Plan Issue $3.000.000 Issue 53,000,000 of Bonds Payable of Common Stock Net income before expansion 200000 200000 Expected project income before interest and income tax Before any new financing, Wakeville expects to eam net income of $200,000, and the company already has 100,000 shares of common stock outstanding Wakeville believes the expansion will increase income before interest and income tax by $500.000. The company's income tax rate is 30% Print Done Less Expected project income before income tax Less Income tax expense Expected project net income Total company income Choose from any est or emner any number in the input fields and then continue to the next question Wakeville Marina needs to raise $30 milion to expand the company. The company is considering issuing her . 53.000.000 of 8% bonds payable to borrow the money or . 150.000 shares of common stock at 120 per share (Click the icon to view additional information) Read the imments Issue 51.000.000 Issue 1000000 of fonds Payable of Com Stock Net Income before expansion 20000 200000 Expected project income before we come tax Before any new francine Wavespect to come income of 200000. and the company ready has 100.000 shares of common stock outstanding Walevi bove the expansion will increase income before interest and income tax by $500.000 The company's income tax is 0% Expected project income before income tax Income tax expense Expected project net income Total company net income Print Done Earrings per share her expansion Which financing plan would you recommend based solely on EPS

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started