Question

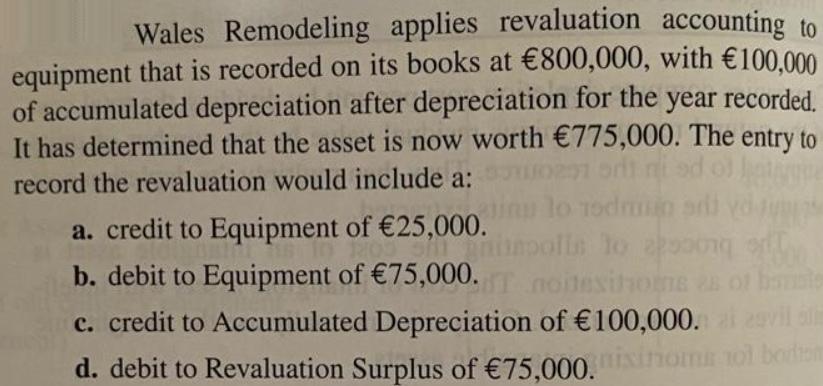

Wales Remodeling applies revaluation accounting to equipment that is recorded on its books at 800,000, with 100.000 of accumulated depreciation after depreciation for the

Wales Remodeling applies revaluation accounting to equipment that is recorded on its books at 800,000, with 100.000 of accumulated depreciation after depreciation for the year recorded. It has determined that the asset is now worth 775,000. The entry to record the revaluation would include a: Todmn arli ofls lo aooong a. credit to Equipment of 25,000. b. debit to Equipment of 75,000. c. credit to Accumulated Depreciation of 100,000. d. debit to Revaluation Surplus of 75,000. nol borten

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The entry to record the revaluation would include a Here the correct option is b Debit to Equipment ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting IFRS

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield

3rd edition

1119372933, 978-1119372936

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App