Question

Wallace Chan and his wife May Chan are the second generation owners of Chans Apparel Manufacturer Company Ltd, a family-owned manufacturer of mens dress shirt

Wallace Chan and his wife May Chan are the second generation owners of Chans Apparel Manufacturer Company Ltd, a family-owned manufacturer of mens dress shirt that was started by Wallaces father, Eric Chan, in 1964 in Hong Kong. In its nearly 50 years, Chans Apparel Manufacturer has grown from its roots from a small garment factory, into a large and modern factory with sophisticated production and quality control equipment. Now, the company has a large number of customers from the US, and Europe. Wallace and May have built on the companys reputation as an honest, reliable and good quality supplier of mens dress shirts. The prices they charge are above the industry average but are not anywhere near the highest prices in the industry even though the company is known for producing quality products.

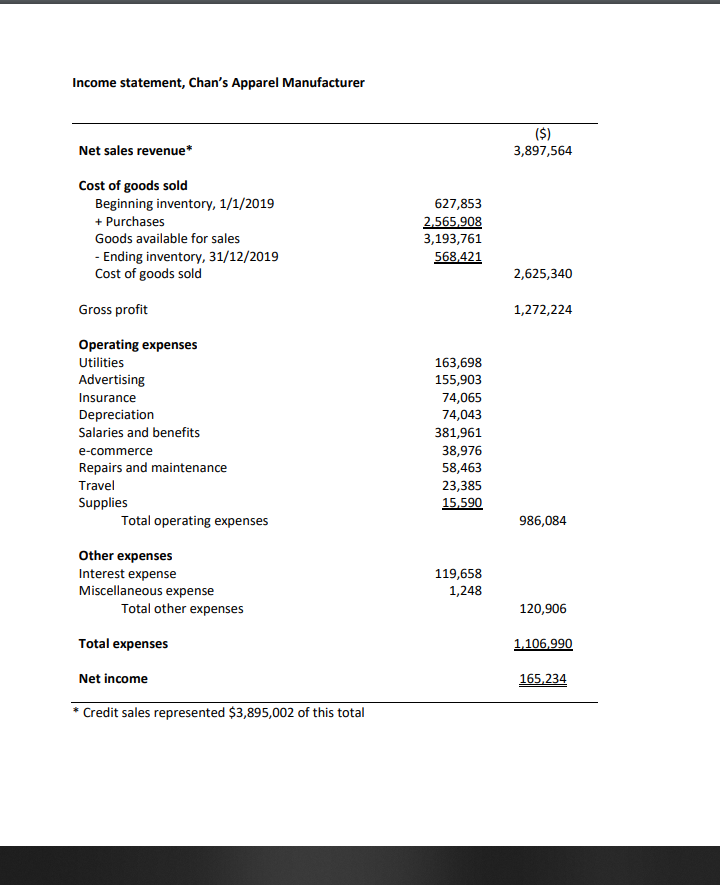

Annual sales for the company have grown to HK$3.9 million, and its purchases of cotton fabrics used as the raw materials for their products have increased significantly. However, the recent escalating cotton prices are squeezing the companys profit margins. They are concerned about the impacts of the increasing material costs and planning to conduct a comprehensive financial analysis for their company.

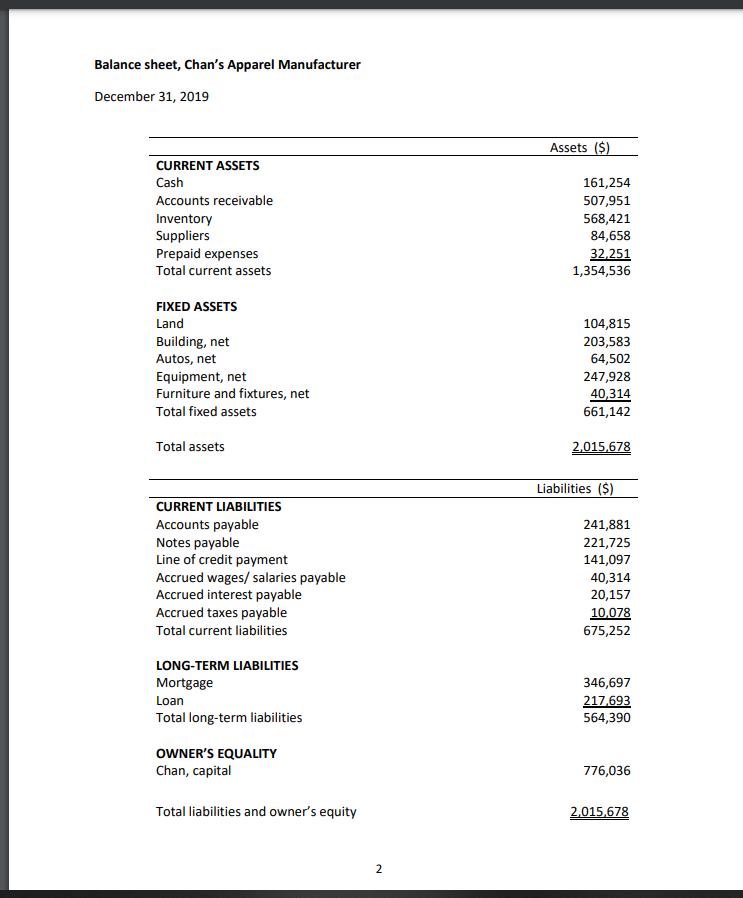

May Chan, who has the primary responsibility for managing Chans Apparel Manufacturers finances, has complied the balance sheet and the income statement for the fiscal year that just ended. The two financial statements appear below

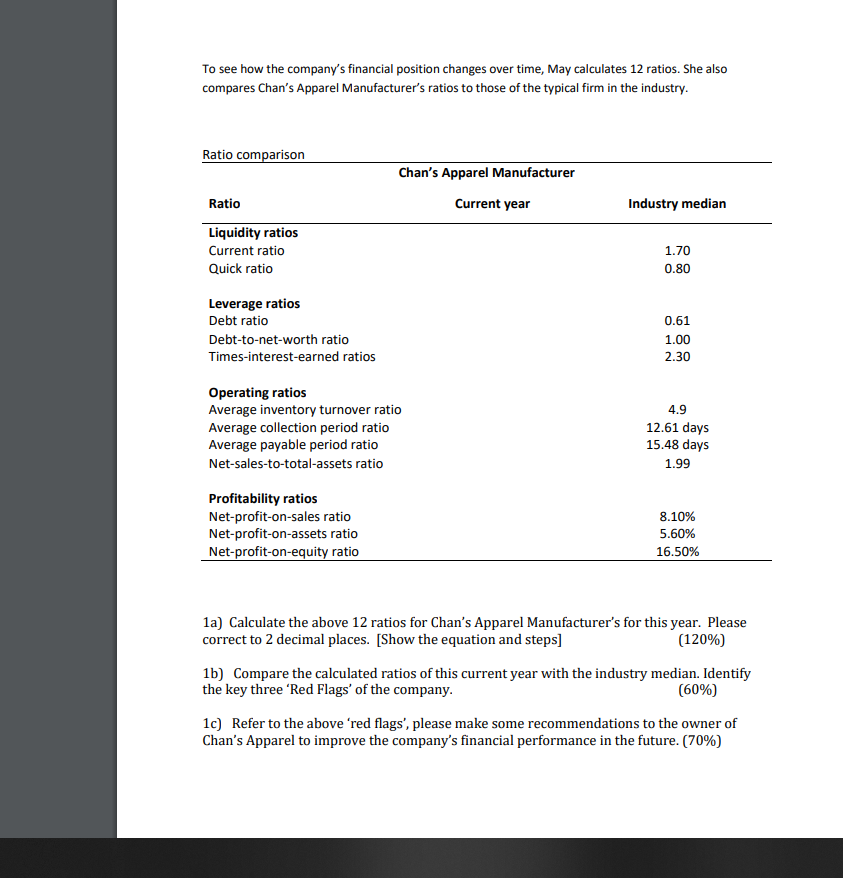

1b) Compare the calculated ratios of this current year with the industry median. Identify the key three Red Flags of the company.

1c) Refer to the above red flags, please make some recommendations to the owner of Chans Apparel to improve the companys financial performance in the future. (70%)

Balance sheet, Chan's Apparel Manufacturer December 31, 2019 Assets ($) CURRENT ASSETS Cash Accounts receivable Inventory Suppliers Prepaid expenses Total current assets 161,254 507,951 568,421 84,658 32,251 1,354,536 FIXED ASSETS Land Building, net Autos, net Equipment, net Furniture and fixtures, net Total fixed assets 104,815 203,583 64,502 247,928 40,314 661,142 Total assets 2,015,678 Liabilities ($) CURRENT LIABILITIES Accounts payable Notes payable Line of credit payment Accrued wages/ salaries payable Accrued interest payable Accrued taxes payable Total current liabilities 241,881 221,725 141,097 40,314 20,157 10,078 675,252 LONG-TERM LIABILITIES Mortgage Loan Total long-term liabilities 346,697 217,693 564,390 OWNER'S EQUALITY Chan, capital 776,036 Total liabilities and owner's equity 2,015,678 2 Income statement, Chan's Apparel Manufacturer Net sales revenue* ($) 3,897,564 Cost of goods sold Beginning inventory, 1/1/2019 + Purchases Goods available for sales - Ending inventory, 31/12/2019 Cost of goods sold 627,853 2.565,908 3,193,761 568,421 2,625,340 Gross profit 1,272,224 Operating expenses Utilities Advertising Insurance Depreciation Salaries and benefits e-commerce Repairs and maintenance Travel Supplies Total operating expenses 163,698 155,903 74,065 74,043 381,961 38,976 58,463 23,385 15,590 986,084 Other expenses Interest expense Miscellaneous expense Total other expenses 119,658 1,248 120,906 Total expenses 1.106.990 Net income 165,234 Credit sales represented $3,895,002 of this total To see how the company's financial position changes over time, May calculates 12 ratios. She also compares Chan's Apparel Manufacturer's ratios to those of the typical firm in the industry. Ratio comparison Chan's Apparel Manufacturer Current year Industry median Ratio Liquidity ratios Current ratio Quick ratio 1.70 0.80 Leverage ratios Debt ratio Debt-to-net-worth ratio Times-interest-earned ratios 0.61 1.00 2.30 4.9 Operating ratios Average inventory turnover ratio Average collection period ratio Average payable period ratio Net-sales-to-total-assets ratio 12.61 days 15.48 days 1.99 Profitability ratios Net-profit-on-sales ratio Net-profit-on-assets ratio Net-profit-on-equity ratio 8.10% 5.60% 16.50% 1a) Calculate the above 12 ratios for Chan's Apparel Manufacturer's for this year. Please correct to 2 decimal places. [Show the equation and steps] (120%) 1b) Compare the calculated ratios of this current year with the industry median. Identify the key three 'Red Flags' of the company. (60%) 1c) Refer to the above 'red flags', please make some recommendations to the owner of Chan's Apparel to improve the company's financial performance in the future. (70%)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started