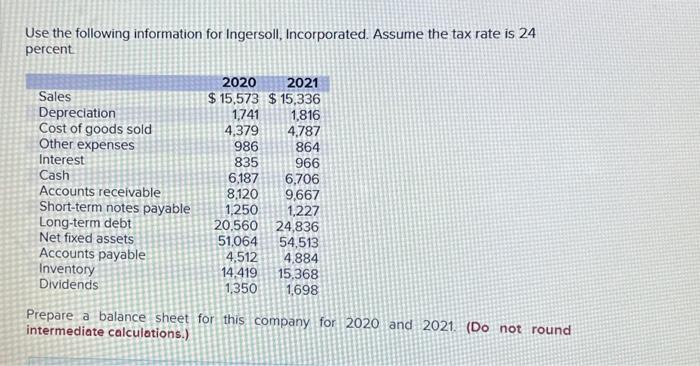

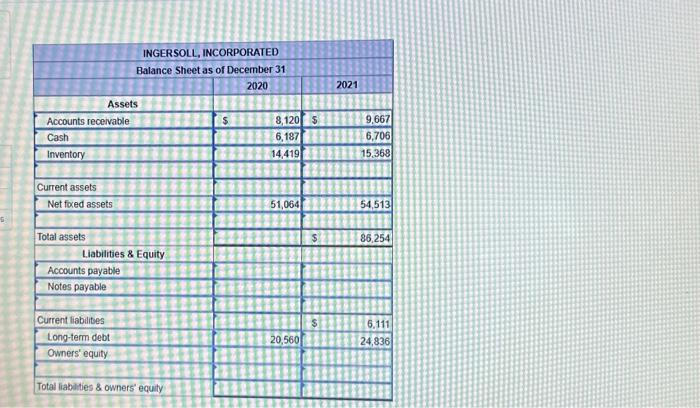

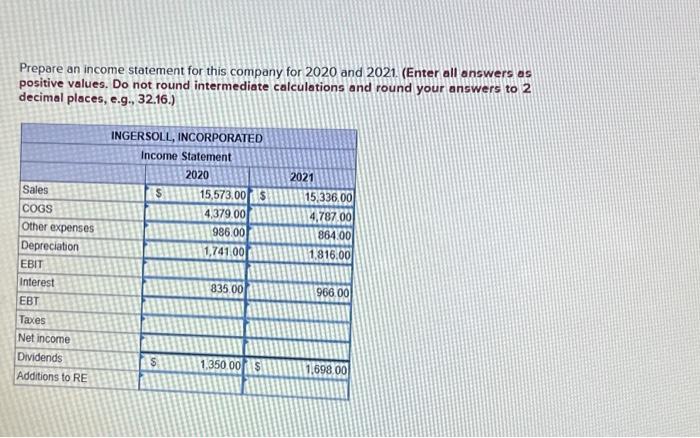

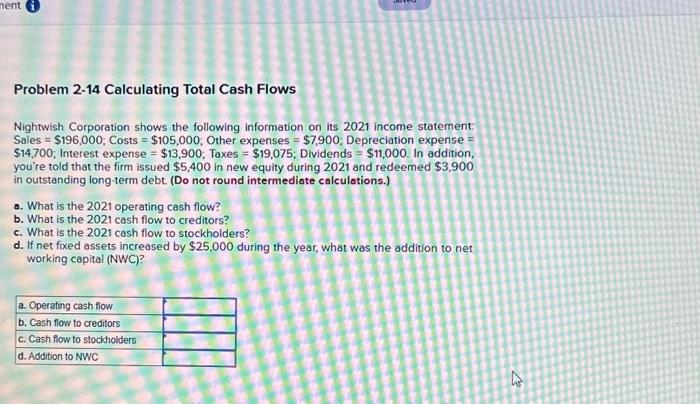

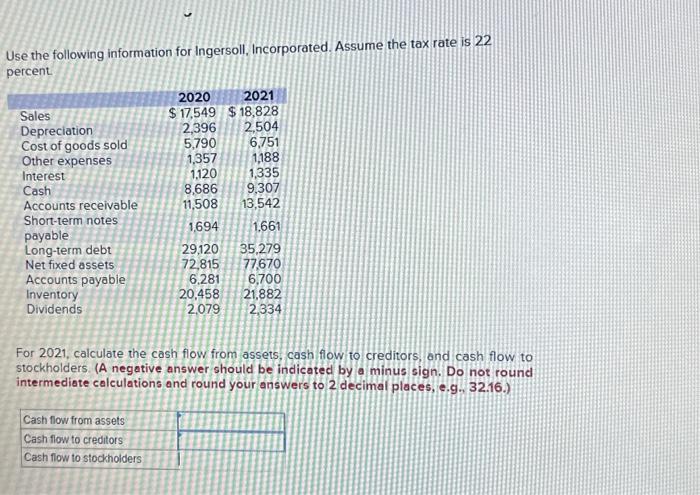

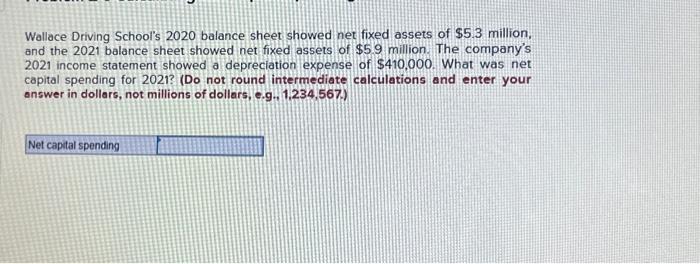

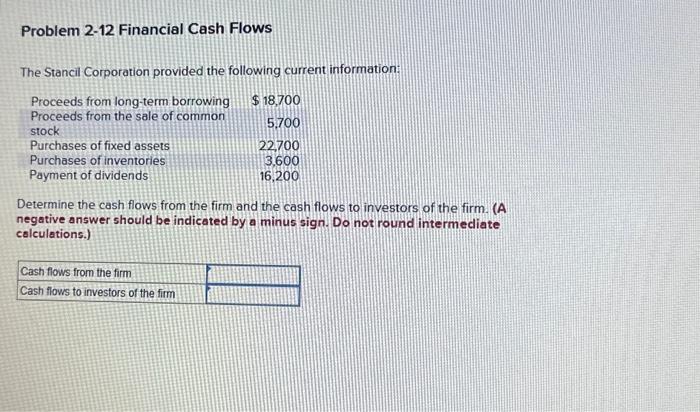

Wallace Driving School's 2020 balance sheet showed net fixed assets of $5.3 million, and the 2021 balance sheet showed net fixed assets of $5.9 million. The company's 2021 income statement showed a depreciation expense of $410,000. What was net capital spending for 2021? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, e.9., 1,234,567.) Prepare an income statement for this company for 2020 and 2021 (Enter all answers as positive values. Do not round intermediate calculations and round your answers to 2 decimal places, e.9., 32.16.) Use the following information for Ingersoll, Incorporated. Assume the tax rate is 22 percent. For 2021, calculate the cash flow from assets, cash flow to creditors, and cash flow to stockholders. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places, e.g. 32.16.) Use the following information for Ingersoll, Incorporated. Assume the tax rate is 24 percent Prepare a balance sheet for this company for 2020 and 2021 (Do not round intermediate calculations.) Problem 2-12 Financial Cash Flows The Stancil Corporation provided the following current information: Determine the cash flows from the firm and the cash flows to investors of the firm. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations.) Nightwish Corporation shows the following information on its 2021 income statement: Sales =$196,000; Costs =$105,000; Other expenses =$7,900; Depreciation expense = $14,700; Interest expense =$13,900; Taxes =$19,075; Dividends =$11,000. In addition, you're told that the firm issued $5,400 in new equity during 2021 and redeemed $3,900 in outstanding long-term debt (Do not round intermediate calculations.) a. What is the 2021 operating cash flow? b. What is the 2021 cash flow to creditors? c. What is the 2021 cash flow to stockhoiders? d. If net fixed assets increased by $25,000 during the year, what was the addition to net working capital (NWC)? Wallace Driving School's 2020 balance sheet showed net fixed assets of $5.3 million, and the 2021 balance sheet showed net fixed assets of $5.9 million. The company's 2021 income statement showed a depreciation expense of $410,000. What was net capital spending for 2021? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, e.9., 1,234,567.) Prepare an income statement for this company for 2020 and 2021 (Enter all answers as positive values. Do not round intermediate calculations and round your answers to 2 decimal places, e.9., 32.16.) Use the following information for Ingersoll, Incorporated. Assume the tax rate is 22 percent. For 2021, calculate the cash flow from assets, cash flow to creditors, and cash flow to stockholders. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places, e.g. 32.16.) Use the following information for Ingersoll, Incorporated. Assume the tax rate is 24 percent Prepare a balance sheet for this company for 2020 and 2021 (Do not round intermediate calculations.) Problem 2-12 Financial Cash Flows The Stancil Corporation provided the following current information: Determine the cash flows from the firm and the cash flows to investors of the firm. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations.) Nightwish Corporation shows the following information on its 2021 income statement: Sales =$196,000; Costs =$105,000; Other expenses =$7,900; Depreciation expense = $14,700; Interest expense =$13,900; Taxes =$19,075; Dividends =$11,000. In addition, you're told that the firm issued $5,400 in new equity during 2021 and redeemed $3,900 in outstanding long-term debt (Do not round intermediate calculations.) a. What is the 2021 operating cash flow? b. What is the 2021 cash flow to creditors? c. What is the 2021 cash flow to stockhoiders? d. If net fixed assets increased by $25,000 during the year, what was the addition to net working capital (NWC)