Question

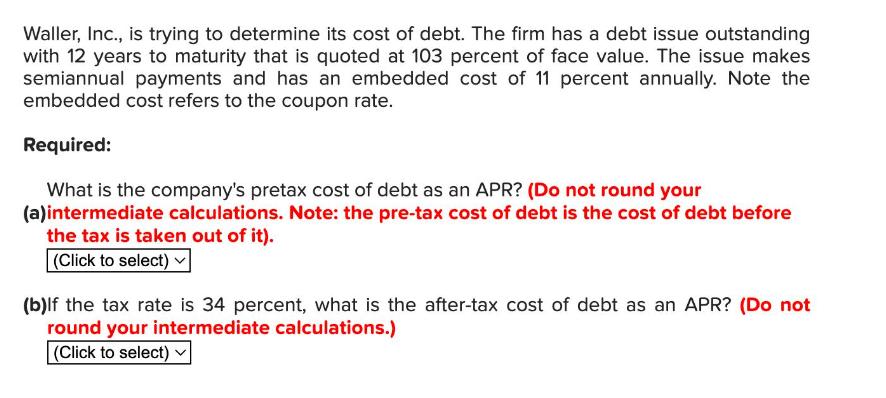

Waller, Inc., is trying to determine its cost of debt. The firm has a debt issue outstanding with 12 years to maturity that is

Waller, Inc., is trying to determine its cost of debt. The firm has a debt issue outstanding with 12 years to maturity that is quoted at 103 percent of face value. The issue makes semiannual payments and has an embedded cost of 11 percent annually. Note the embedded cost refers to the coupon rate. Required: What is the company's pretax cost of debt as an APR? (Do not round your (a)intermediate calculations. Note: the pre-tax cost of debt is the cost of debt before the tax is taken out of it). (Click to select) (b) If the tax rate is 34 percent, what is the after-tax cost of debt as an APR? (Do not round your intermediate calculations.) (Click to select):

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Solution a To calculate the pretax cost of debt we need to first determine the effective annual inte...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of corporate finance

Authors: Stephen Ross, Randolph Westerfield, Bradford Jordan

9th edition

978-0077459451, 77459458, 978-1259027628, 1259027627, 978-0073382395

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App