Answered step by step

Verified Expert Solution

Question

1 Approved Answer

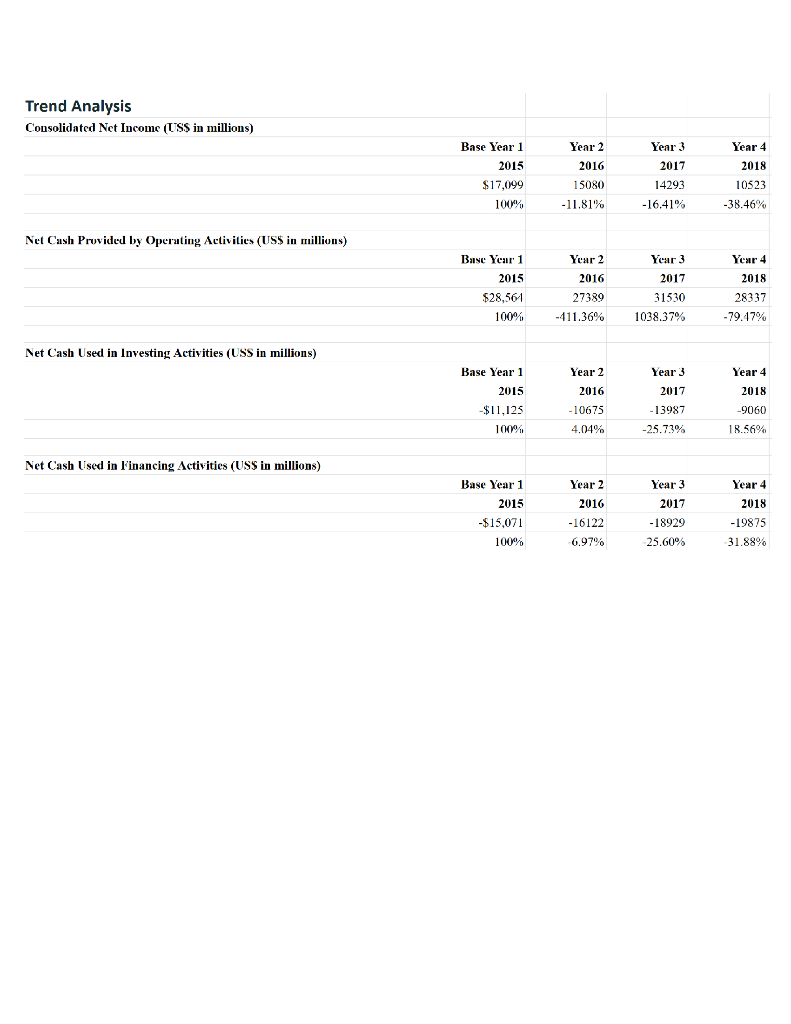

Walmart Inc. Compare trends in cash flow from operations with the trends in net income. What conclusions can you draw from this? Do trends in

Walmart Inc.

Compare trends in cash flow from operations with the trends in net income. What conclusions can you draw from this? Do trends in cash flows from investing and financing activities provide any clues about companys strategy? Write a one-page report. Be specific.

Trend Analysis Consolidated Net Income (US$ in millions) Base Year 1 2015 $17,099 100% Year 2 2016 15080 -11.81% Year 3 2017 14293 -16.41% Year 4 2018 10523 -38.46% Nel Cush Provided by Operating Activities (USS in millions) Base Year 1 2015 $28,561 100% Year 2 2016 27389 -411.36% Year 3 2017 31530 1038.37% 2018 2 8337 -79.47% Net Cash Used in Investing Activities (USS in millions) Base Year 1 2015 $11,125 100% Year 2 2016 -10675 4.04% Year 3 2017 - 13987 -25.73% Year 4 2018 -9060 18.56% Net Cash Used in Financing Activities (USS in millions) Base Year 1 2015 -$15,071 100% Year 2 2016 -16122 6.97% Year 3 2017 - 18929 25.60% Year 4 2018 -19875 31.88% Trend Analysis Consolidated Net Income (US$ in millions) Base Year 1 2015 $17,099 100% Year 2 2016 15080 -11.81% Year 3 2017 14293 -16.41% Year 4 2018 10523 -38.46% Nel Cush Provided by Operating Activities (USS in millions) Base Year 1 2015 $28,561 100% Year 2 2016 27389 -411.36% Year 3 2017 31530 1038.37% 2018 2 8337 -79.47% Net Cash Used in Investing Activities (USS in millions) Base Year 1 2015 $11,125 100% Year 2 2016 -10675 4.04% Year 3 2017 - 13987 -25.73% Year 4 2018 -9060 18.56% Net Cash Used in Financing Activities (USS in millions) Base Year 1 2015 -$15,071 100% Year 2 2016 -16122 6.97% Year 3 2017 - 18929 25.60% Year 4 2018 -19875 31.88%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started