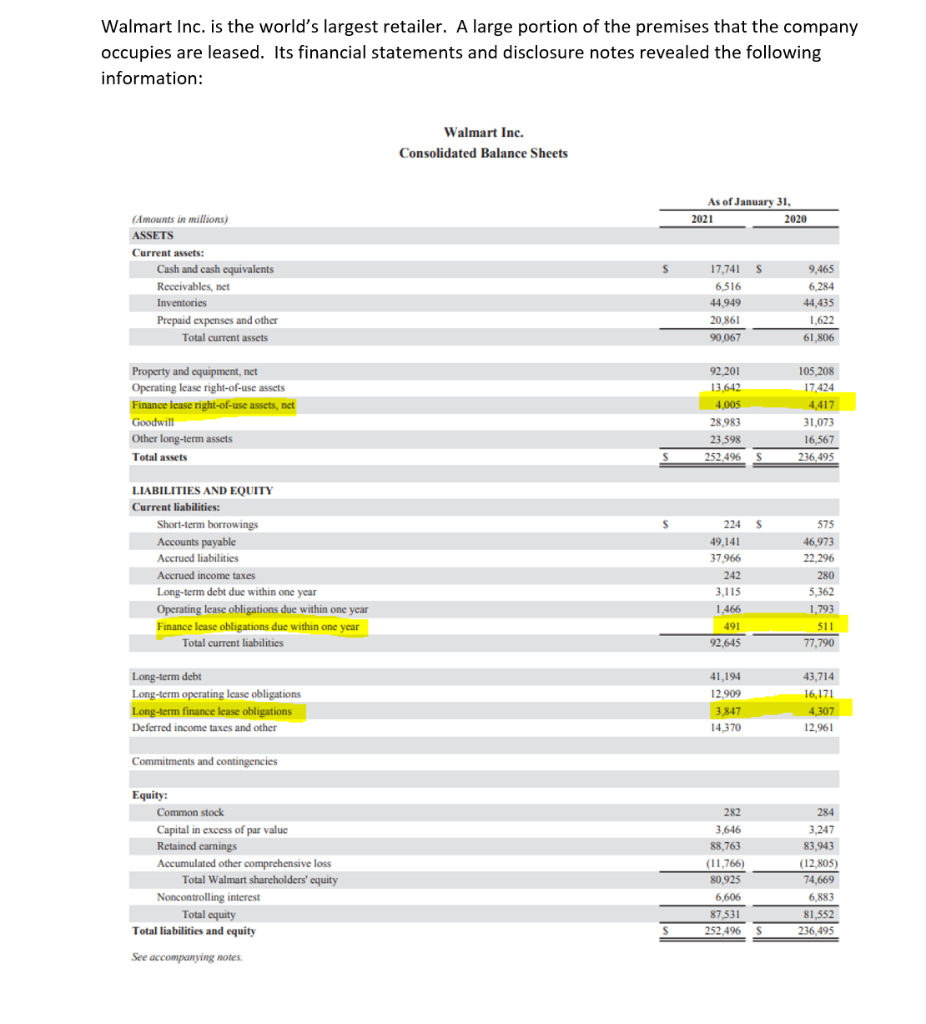

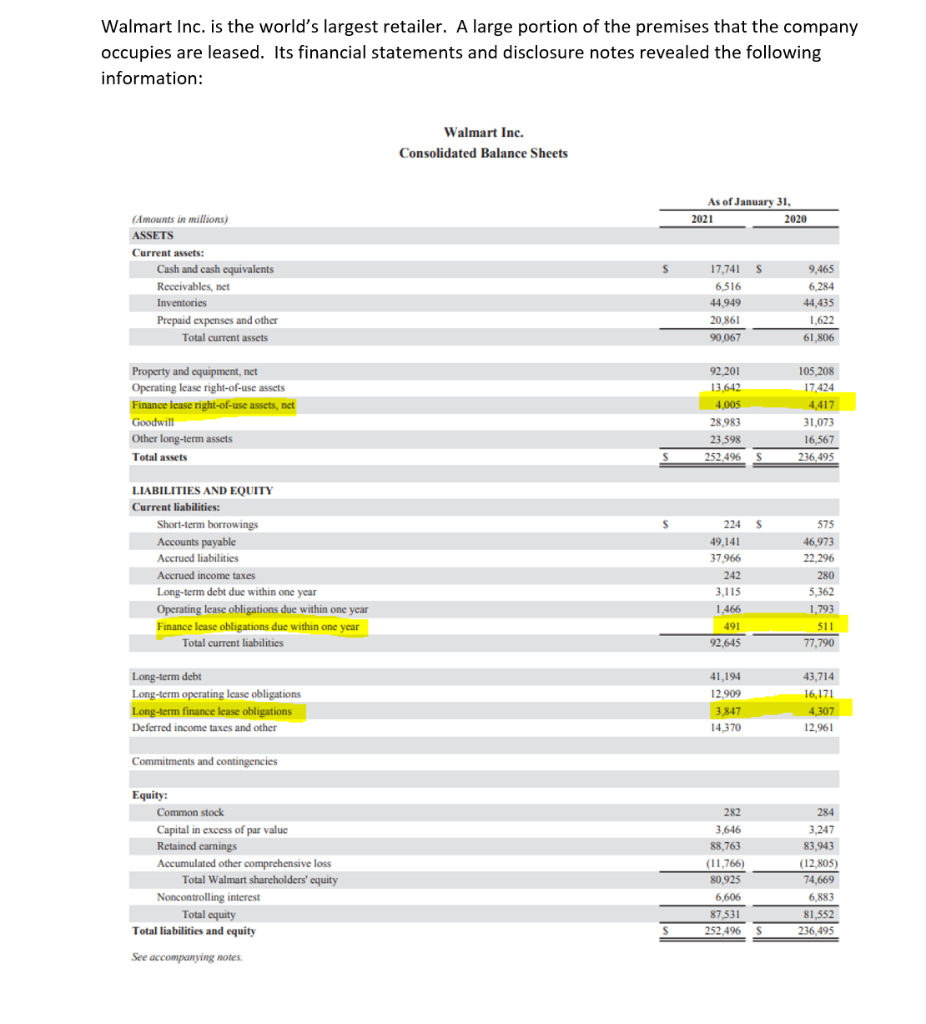

Walmart Inc. is the world's largest retailer. A large portion of the premises that the company occupies are leased. Its financial statements and disclosure notes revealed the following information: Walmart Inc. Consolidated Balance Sheets As of January 31, 2021 2020 S (Amounts in millions) ASSETS Current assets: Cash and cash equivalents Receivables, net Inventories Prepaid expenses and other Total current assets 17,741 $ 6,516 44,949 20,861 90,067 9,465 6,284 44,435 1,622 61,806 Property and equipment, net Operating lease right-of-use assets Finance lease right-of-use assets, net Goodwill Other long-term assets Total assets 92.201 13.642 4.005 28,983 23.598 252,496 105,208 17,424 4,417 31,073 16,567 236,495 S LIABILITIES AND EQUITY Current liabilities: Short-term borrowings Accounts payable Accrued liabilities Accrued income taxes Long-term debt due within one year Operating lease obligations due within one year Finance lease obligations due within one year Total current liabilities 2245 49,141 37.966 242 3,115 1,466 491 92,645 575 46,973 22,296 280 5,362 1,793 511 77,790 41,194 Long-term debt Long-term operating lease obligations Long-term finance lease obligations Deferred income taxes and other 12,909 3.847 14,370 43,714 16,171 4,307 12.961 Commitments and contingencies Equity: Common stock Capital in excess of par value Retained earnings Accumulated other comprehensive loss Total Walmart shareholders' equity Noncontrolling interest Total equity Total liabilities and equity See accompanying notes , 282 3,646 88,763 (11,766) 80.925 6606 87,531 252,496 S 284 3,247 83,943 (12.805) 74,669 6,883 81,552 236,495 S Required: 1. A) The net asset property under finance lease obligations has a balance of $4,005 million in 2021. The total lease liabilities are $4,338million (491 current + 3,847 long- term). Why do the assets and liability amounts associated with leases differ? B) Prepare the 2021 summary entry to record Walmart's lease payments, assuming lease payments during the year are $950 million. C) What is the approximate interest rate on Walmart's leases? (Hint: use interest expense calculated in requirement 2 to assist you in determining an approximately interest rate) D) Discuss some possible reasons why Walmart leases rather than purchases most of its premises? Walmart Inc. is the world's largest retailer. A large portion of the premises that the company occupies are leased. Its financial statements and disclosure notes revealed the following information: Walmart Inc. Consolidated Balance Sheets As of January 31, 2021 2020 S (Amounts in millions) ASSETS Current assets: Cash and cash equivalents Receivables, net Inventories Prepaid expenses and other Total current assets 17,741 $ 6,516 44,949 20,861 90,067 9,465 6,284 44,435 1,622 61,806 Property and equipment, net Operating lease right-of-use assets Finance lease right-of-use assets, net Goodwill Other long-term assets Total assets 92.201 13.642 4.005 28,983 23.598 252,496 105,208 17,424 4,417 31,073 16,567 236,495 S LIABILITIES AND EQUITY Current liabilities: Short-term borrowings Accounts payable Accrued liabilities Accrued income taxes Long-term debt due within one year Operating lease obligations due within one year Finance lease obligations due within one year Total current liabilities 2245 49,141 37.966 242 3,115 1,466 491 92,645 575 46,973 22,296 280 5,362 1,793 511 77,790 41,194 Long-term debt Long-term operating lease obligations Long-term finance lease obligations Deferred income taxes and other 12,909 3.847 14,370 43,714 16,171 4,307 12.961 Commitments and contingencies Equity: Common stock Capital in excess of par value Retained earnings Accumulated other comprehensive loss Total Walmart shareholders' equity Noncontrolling interest Total equity Total liabilities and equity See accompanying notes , 282 3,646 88,763 (11,766) 80.925 6606 87,531 252,496 S 284 3,247 83,943 (12.805) 74,669 6,883 81,552 236,495 S Required: 1. A) The net asset property under finance lease obligations has a balance of $4,005 million in 2021. The total lease liabilities are $4,338million (491 current + 3,847 long- term). Why do the assets and liability amounts associated with leases differ? B) Prepare the 2021 summary entry to record Walmart's lease payments, assuming lease payments during the year are $950 million. C) What is the approximate interest rate on Walmart's leases? (Hint: use interest expense calculated in requirement 2 to assist you in determining an approximately interest rate) D) Discuss some possible reasons why Walmart leases rather than purchases most of its premises