Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Walmart ROIC Tree Outside Assignment Step One: Use Walmart's financial statements to fill in the 2018 data. To calculate the tax rate for 2018, divide

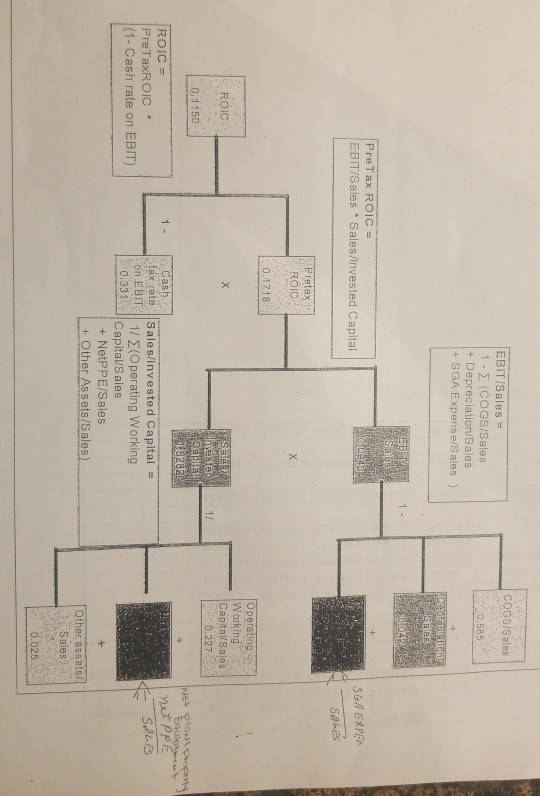

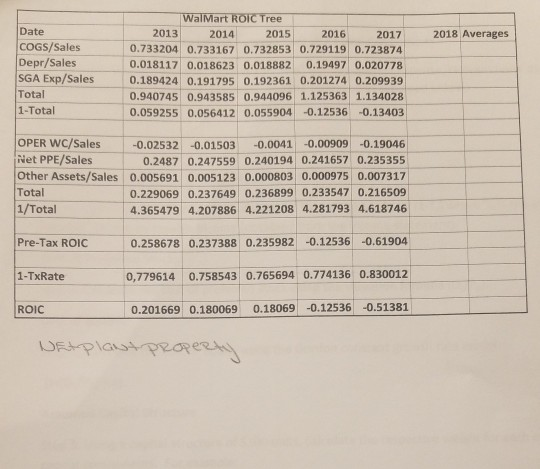

Walmart ROIC Tree Outside Assignment Step One: Use Walmart's financial statements to fill in the 2018 data. To calculate the tax rate for 2018, divide the income taxes paid for that year by that year's net income. Step Two: Calculate the averages for the years 2013 - 2018. Step Three: Use the attached template format to fill in the average data. EBIT/Sales = 1 - (COGS/Sales + Depreciation/Sales + SGA Expense/Sales) COGS/Sales 0.585 Pre Tax ROIC = EBIT/Sales Sales/invested Capital SGA EXPEA SALE Pretax ROIC -0.1718 ROIC Operating Working Capital Sales 0.227 e 0,1150 JBL NE plan property Buloh net ppt ROIC = Pre TaxROIC (1-Cash rate on EBIT) SALES Cash tax rate Sales/Invested Capital = on EBIT11 (Operating Working 01831 Capital/Sales + NetPPE/Sales + Other Assets/Sales) Other assets/ Sales 0.025 2018 Averages Date COGS/Sales Depr/Sales SGA Exp/Sales Total 1-Total WalMart ROIC Tree 2013 2014 2015 2016 2017 0.733204 0.733167 0.732853 0.729119 0.723874 0.018117 0.018623 0.018882 0.19497 0.020778 0.189424 0.191795 0.192361 0.201274 0.209939 0.940745 0.943585 0.944096 1.125363 1.134028 0.059255 0.056412 0.055904 0.12536 0.13403 OPER WC/Sales -0.02532 -0.01503 -0.0041 -0.00909 -0.19046 Net PPE/Sales 0.2487 0.247559 0.240194 0.241657 0.235355 Other Assets/Sales 0.005691 0.005123 0.000803 0.000975 0.007317 Total 0.229069 0.237649 0.236899 0.233547 0.216509 1/Total 4.365479 4.207886 4.221208 4.281793 4.618746 Pre-Tax ROIC 0.258678 0.237388 0.235982 -0.12536 -0.61904 1-TxRate 0,779614 0.758543 0.765694 0.774136 0.830012 ROIC 0.201669 0.180069 0.18069 -0.12536 -0.51381 Netplaut PROPERty. Walmart ROIC Tree Outside Assignment Step One: Use Walmart's financial statements to fill in the 2018 data. To calculate the tax rate for 2018, divide the income taxes paid for that year by that year's net income. Step Two: Calculate the averages for the years 2013 - 2018. Step Three: Use the attached template format to fill in the average data. EBIT/Sales = 1 - (COGS/Sales + Depreciation/Sales + SGA Expense/Sales) COGS/Sales 0.585 Pre Tax ROIC = EBIT/Sales Sales/invested Capital SGA EXPEA SALE Pretax ROIC -0.1718 ROIC Operating Working Capital Sales 0.227 e 0,1150 JBL NE plan property Buloh net ppt ROIC = Pre TaxROIC (1-Cash rate on EBIT) SALES Cash tax rate Sales/Invested Capital = on EBIT11 (Operating Working 01831 Capital/Sales + NetPPE/Sales + Other Assets/Sales) Other assets/ Sales 0.025 2018 Averages Date COGS/Sales Depr/Sales SGA Exp/Sales Total 1-Total WalMart ROIC Tree 2013 2014 2015 2016 2017 0.733204 0.733167 0.732853 0.729119 0.723874 0.018117 0.018623 0.018882 0.19497 0.020778 0.189424 0.191795 0.192361 0.201274 0.209939 0.940745 0.943585 0.944096 1.125363 1.134028 0.059255 0.056412 0.055904 0.12536 0.13403 OPER WC/Sales -0.02532 -0.01503 -0.0041 -0.00909 -0.19046 Net PPE/Sales 0.2487 0.247559 0.240194 0.241657 0.235355 Other Assets/Sales 0.005691 0.005123 0.000803 0.000975 0.007317 Total 0.229069 0.237649 0.236899 0.233547 0.216509 1/Total 4.365479 4.207886 4.221208 4.281793 4.618746 Pre-Tax ROIC 0.258678 0.237388 0.235982 -0.12536 -0.61904 1-TxRate 0,779614 0.758543 0.765694 0.774136 0.830012 ROIC 0.201669 0.180069 0.18069 -0.12536 -0.51381 Netplaut PROPERty

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started