Answered step by step

Verified Expert Solution

Question

1 Approved Answer

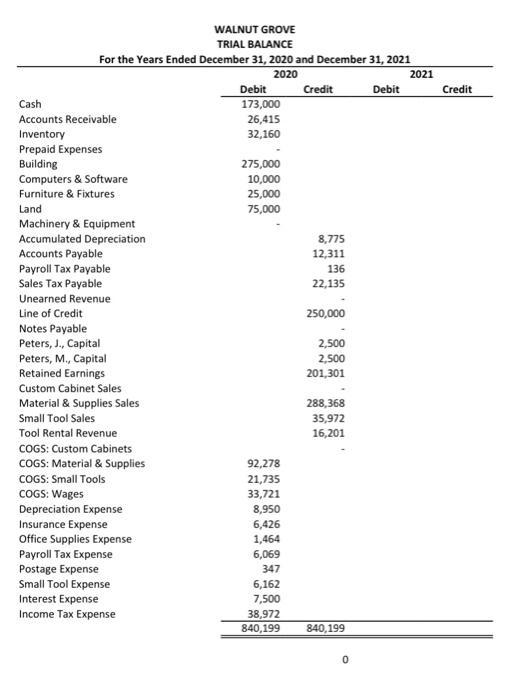

WALNUT GROVE TRIAL BALANCE For the Years Ended December 31, 2020 and December 31, 2021 2020 2021 Debit Credit Debit 173,000 26,415 32,160 275,000

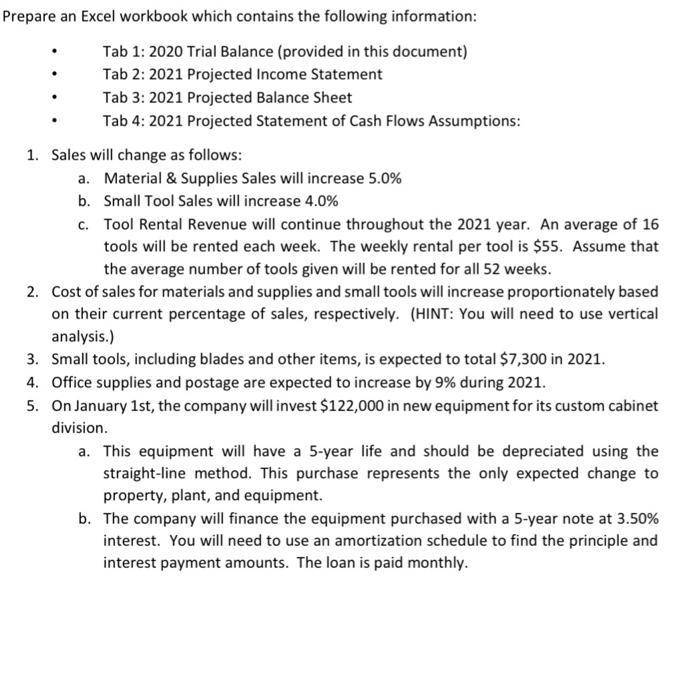

WALNUT GROVE TRIAL BALANCE For the Years Ended December 31, 2020 and December 31, 2021 2020 2021 Debit Credit Debit 173,000 26,415 32,160 275,000 10,000 25,000 75,000 Cash Accounts Receivable Inventory Prepaid Expenses Building Computers & Software Furniture & Fixtures Land Machinery & Equipment Accumulated Depreciation Accounts Payable Payroll Tax Payable Sales Tax Payable Unearned Revenue Line of Credit Notes Payable Peters, J., Capital Peters, M., Capital Retained Earnings Custom Cabinet Sales Material & Supplies Sales Small Tool Sales Tool Rental Revenue COGS: Custom Cabinets COGS: Material & Supplies COGS: Small Tools COGS: Wages Depreciation Expense Insurance Expense Office Supplies Expense Payroll Tax Expense Postage Expense Small Tool Expense Interest Expense Income Tax Expense 92,278 21,735 33,721 8,950 6,426 1,464 6,069 347 6,162 7,500 38,972 840,199 8,775 12,311 136 22,135 250,000 2,500 2,500 201,301 288,368 35,972 16,201 840,199 0 Credit Prepare an Excel workbook which contains the following information: Tab 1: 2020 Trial Balance (provided in this document) Tab 2: 2021 Projected Income Statement Tab 3: 2021 Projected Balance Sheet Tab 4: 2021 Projected Statement of Cash Flows Assumptions: 1. Sales will change as follows: a. Material & Supplies Sales will increase 5.0% b. Small Tool Sales will increase 4.0% c. Tool Rental Revenue will continue throughout the 2021 year. An average of 16 tools will be rented each week. The weekly rental per tool is $55. Assume that the average number of tools given will be rented for all 52 weeks. 2. Cost of sales for materials and supplies and small tools will increase proportionately based on their current percentage of sales, respectively. (HINT: You will need to use vertical analysis.) 3. Small tools, including blades and other items, is expected to total $7,300 in 2021. 4. Office supplies and postage are expected to increase by 9% during 2021. 5. On January 1st, the company will invest $122,000 in new equipment for its custom cabinet division. a. This equipment will have a 5-year life and should be depreciated using the straight-line method. This purchase represents the only expected change to property, plant, and equipment. b. The company will finance the equipment purchased with a 5-year note at 3.50% interest. You will need to use an amortization schedule to find the principle and interest payment amounts. The loan is paid monthly.

Step by Step Solution

★★★★★

3.49 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

2021 Project income statement 2021 Custom cabinet O sale...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started