Question

a) What is the difference between a stock and a strip hedge? b) How do Beta and hedge ratio relate to each other? c) Determine

a) What is the difference between a stock and a strip hedge?

b) How do Beta and hedge ratio relate to each other?

c) Determine the hedge ratio for a stock portfolio that has a beta of 0.80 relative to the S&P 500. The S&P 500 is currently at 3800 and pays a 2.5% dividend yield. The hedge will be for six months (1/2 year) and the current annual risk-free rate is 1.00%.

d) Using the information from above, if the S&P 500 Futures contract is trading at 3800 (contract value = $50 x current price) and the portfolio holds $60,000,000 in stocks what would be the number of S&P 500 Futures contracts sold to hedge the portfolio?

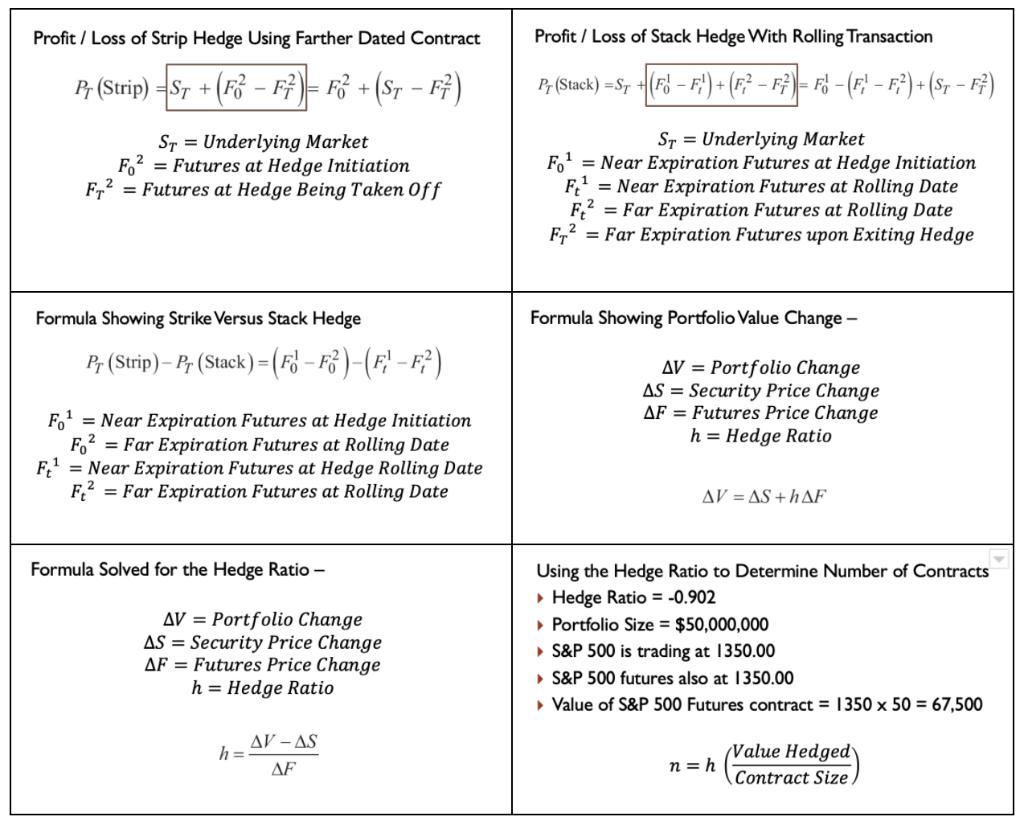

PROVIDED FORMULAS:

Profit / Loss of Strip Hedge Using Farther Dated Contract P (Strip) = ST + (F - F7 )= F2 + (St F7 ) ST= Underlying Market F = Futures at Hedge Initiation F = Futures at Hedge Being Taken off Formula Showing Strike Versus Stack Hedge Pr (Strip) - Pr (Stack) = (F - F2)-(F) F?) Fo = Near Expiration Futures at Hedge Initiation Fo = Far Expiration Futures at Rolling Date F = Near Expiration Futures at Hedge Rolling Date F = Far Expiration Futures at Rolling Date Formula Solved for the Hedge Ratio - AV Portfolio Change AS Security Price Change AF Futures Price Change h = Hedge Ratio h= AV - AS AF Profit/ Loss of Stack Hedge With Rolling Transaction P (Stack) = ST +(F - F') + (F? F7 ) = F (F} F) + (S, F7) ST Underlying Market 1 Fo = Near Expiration Futures at Hedge Initiation F = Near Expiration Futures at Rolling Date Far Expiration Futures at Rolling Date Fr = Far Expiration Futures upon Exiting Hedge Ft Formula Showing Portfolio Value Change - AV = Portfolio Change AS Security Price Change AF = Futures Price Change h = Hedge Ratio AV=AS+hAF Using the Hedge Ratio to Determine Number of Contracts Hedge Ratio = -0.902 Portfolio Size = $50,000,000 S&P 500 is trading at 1350.00 S&P 500 futures also at 1350.00 Value of S&P 500 Futures contract = 1350 x 50 = 67,500 n = h Value Hedged Contract Size

Step by Step Solution

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

a A stock hedge is created when an investor buys or sells a security in order to offs...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started